Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Earnings would be higher (lower) each year by $ million. (Round to two decimal places, and use a negative number for a decline.) f.

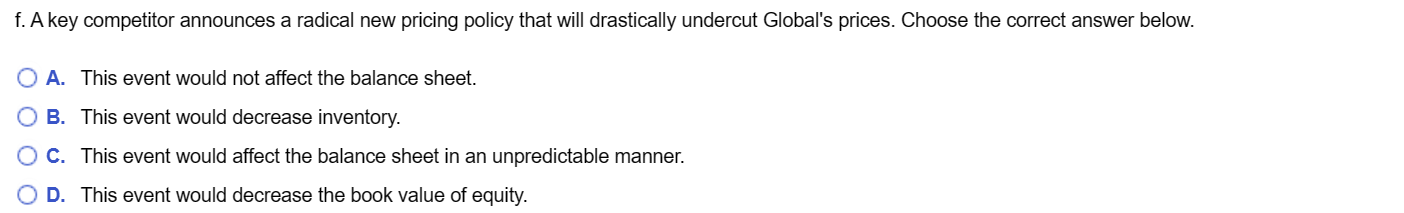

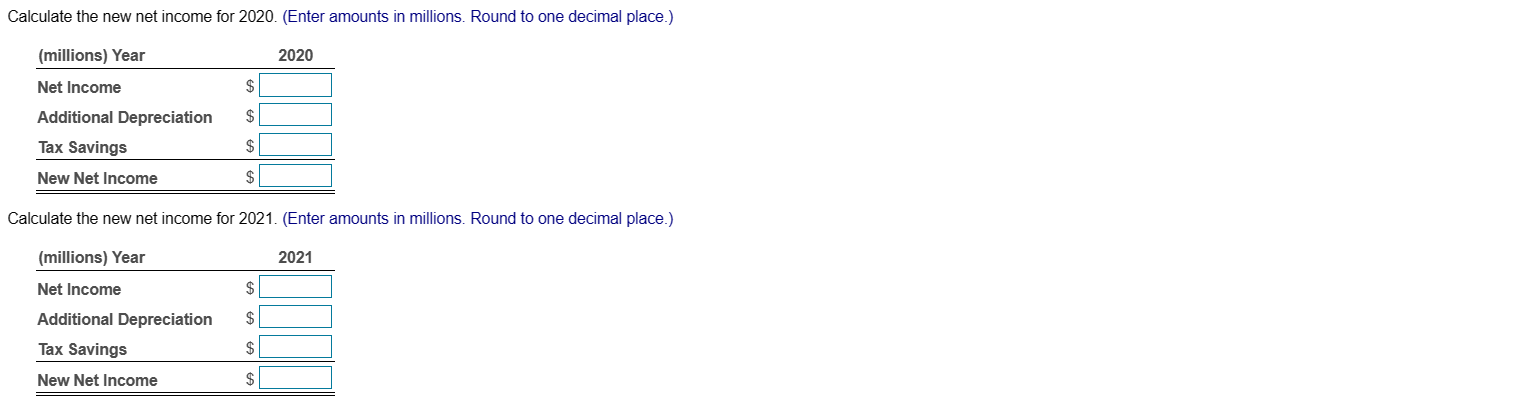

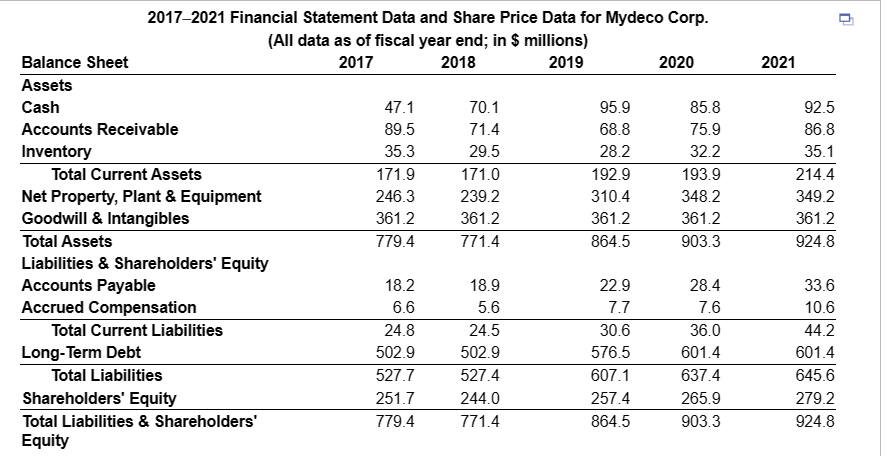

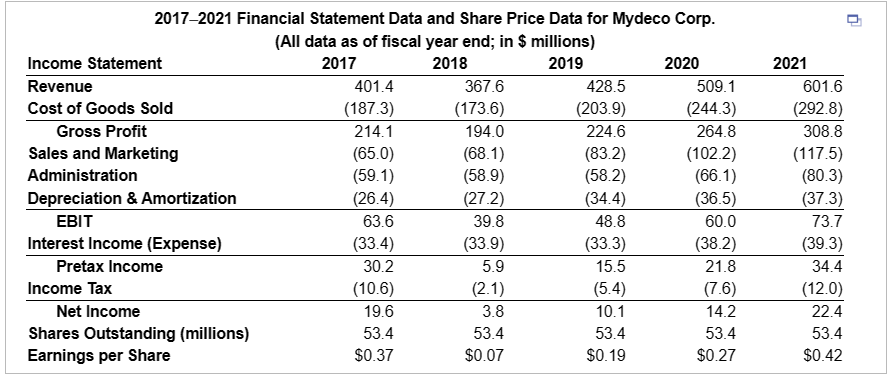

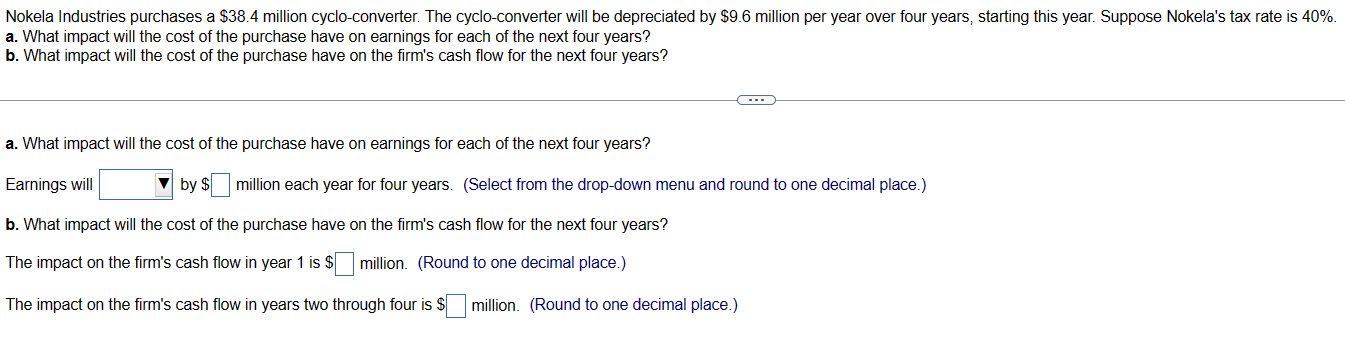

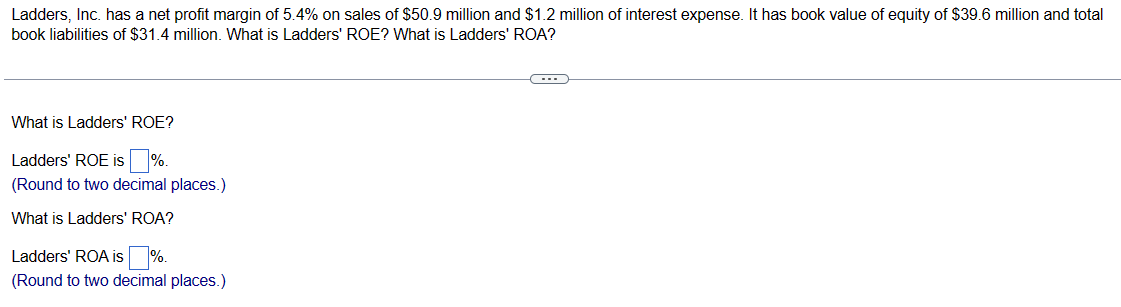

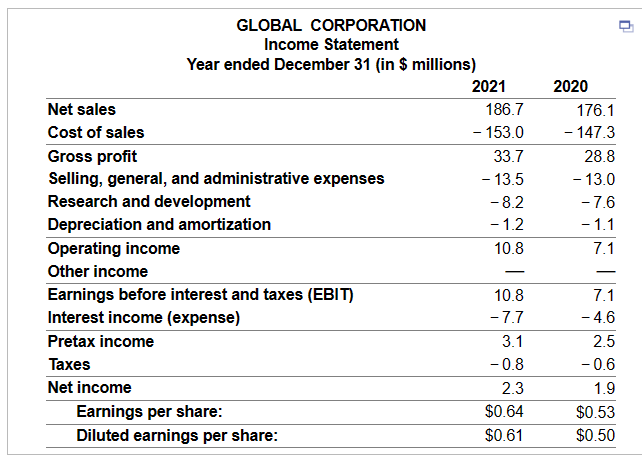

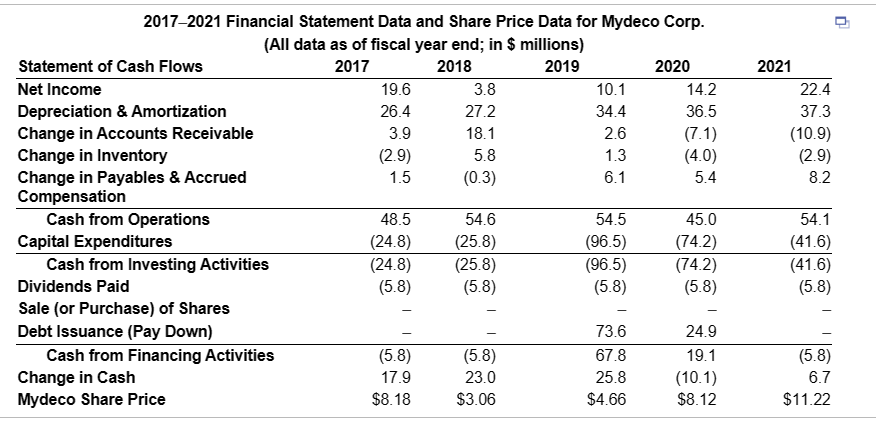

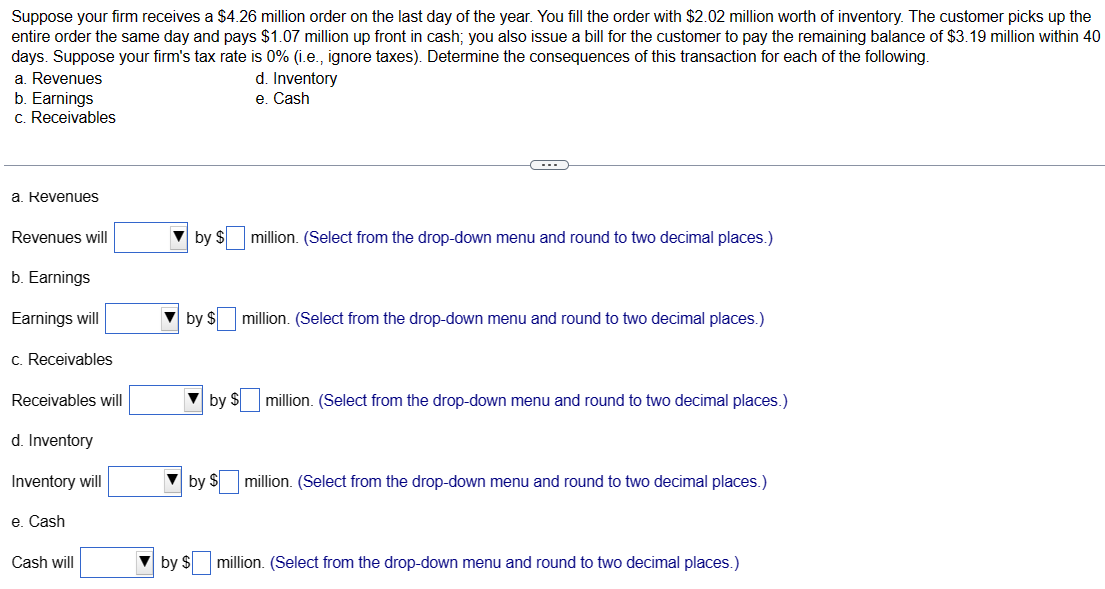

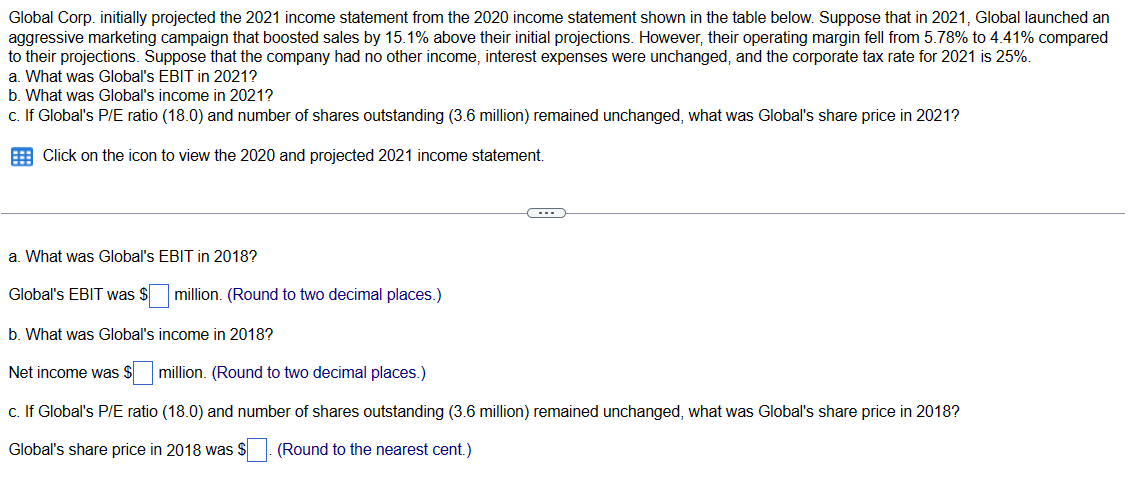

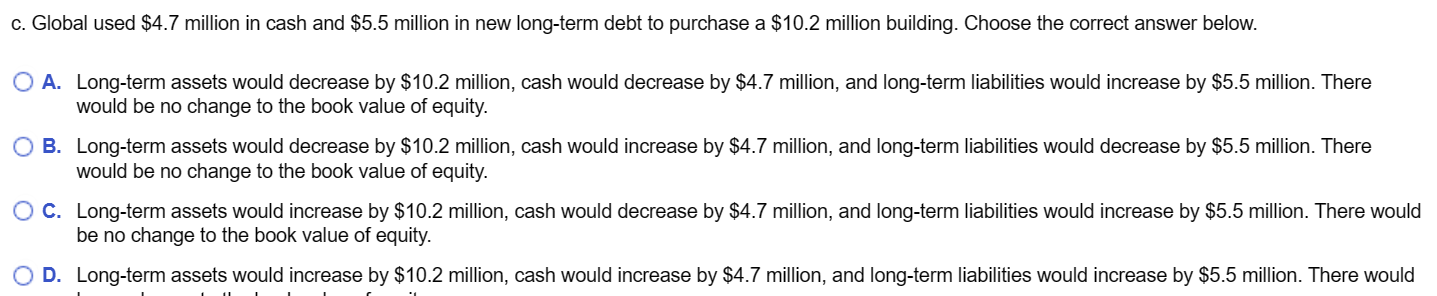

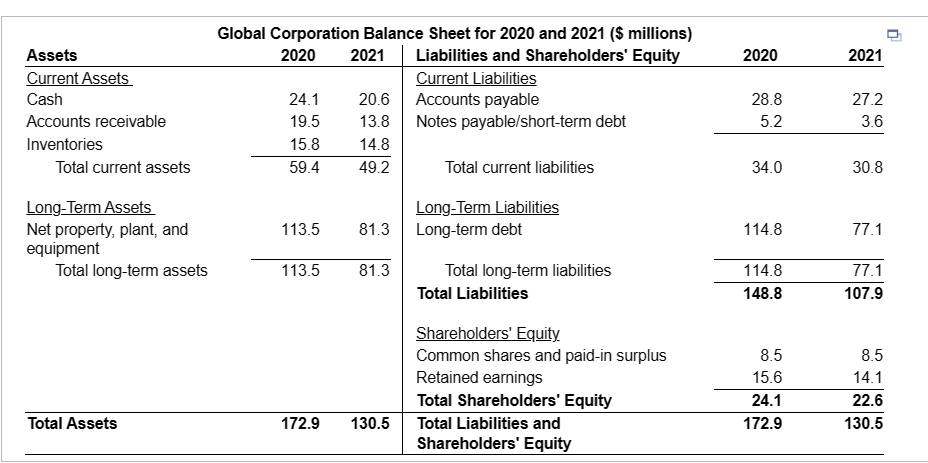

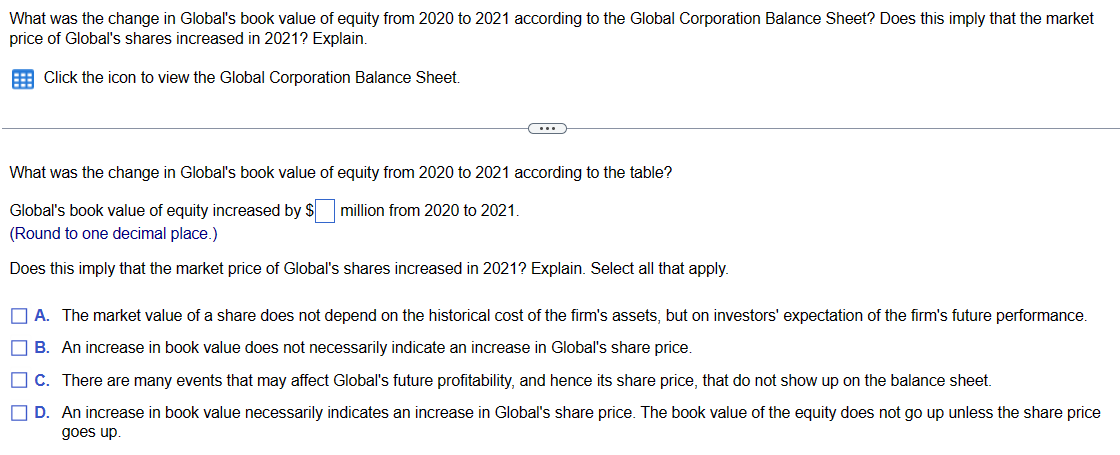

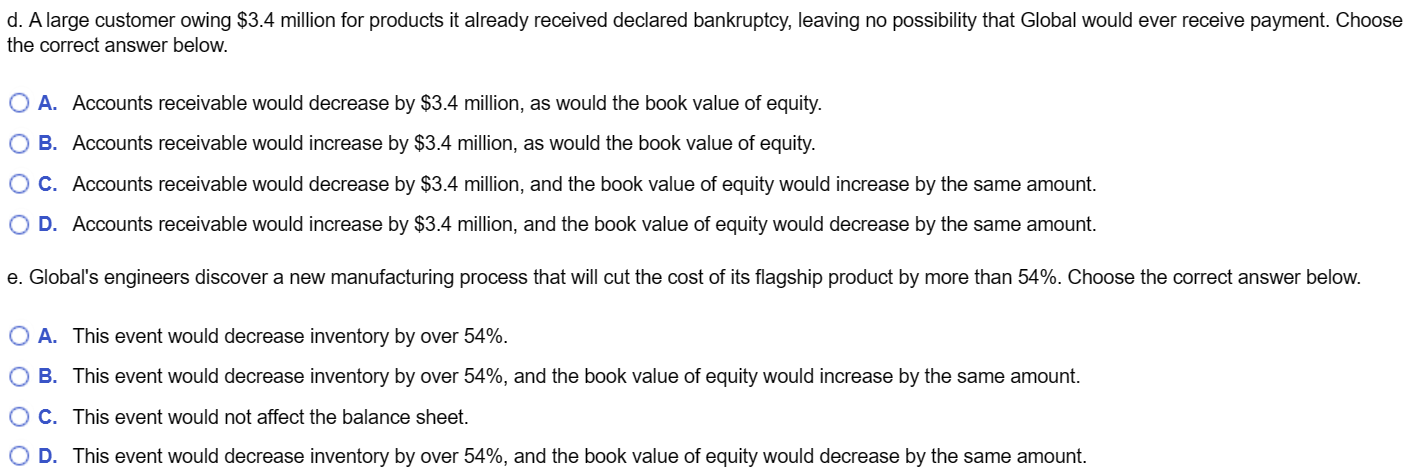

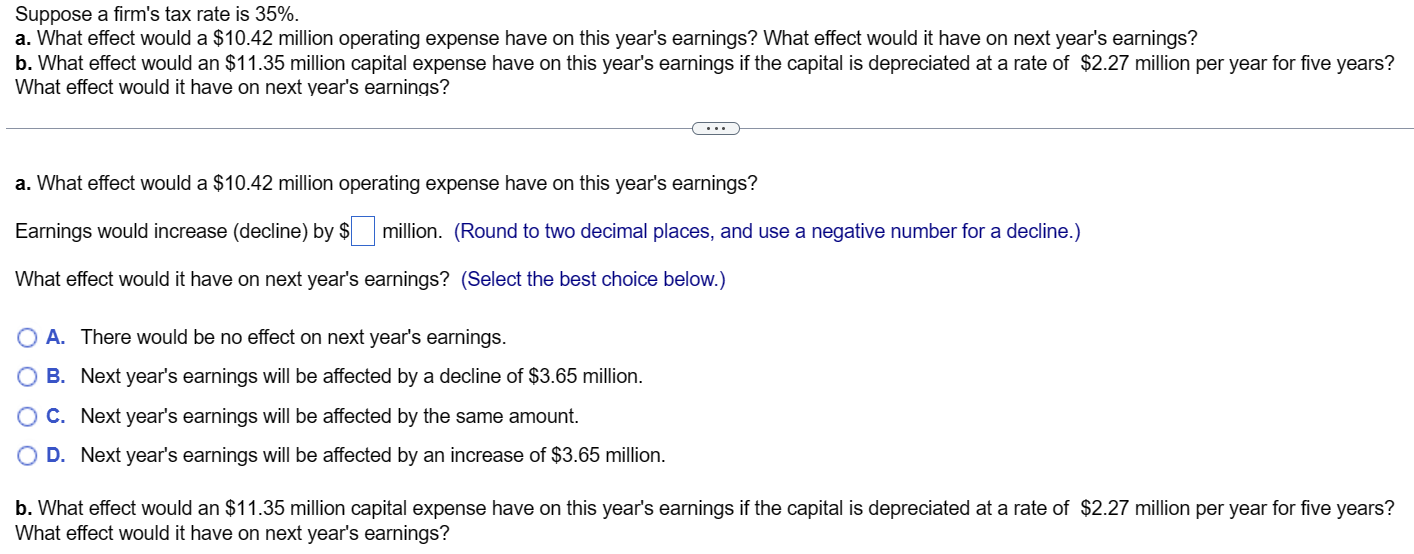

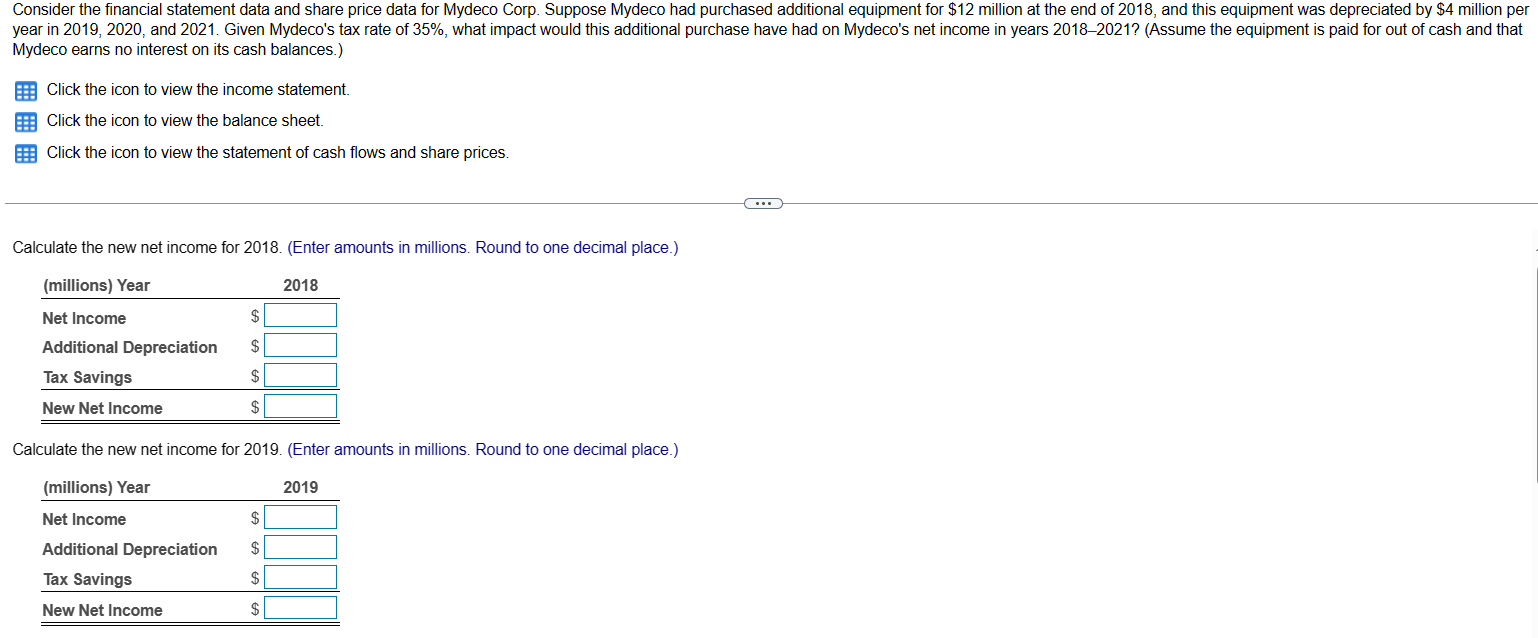

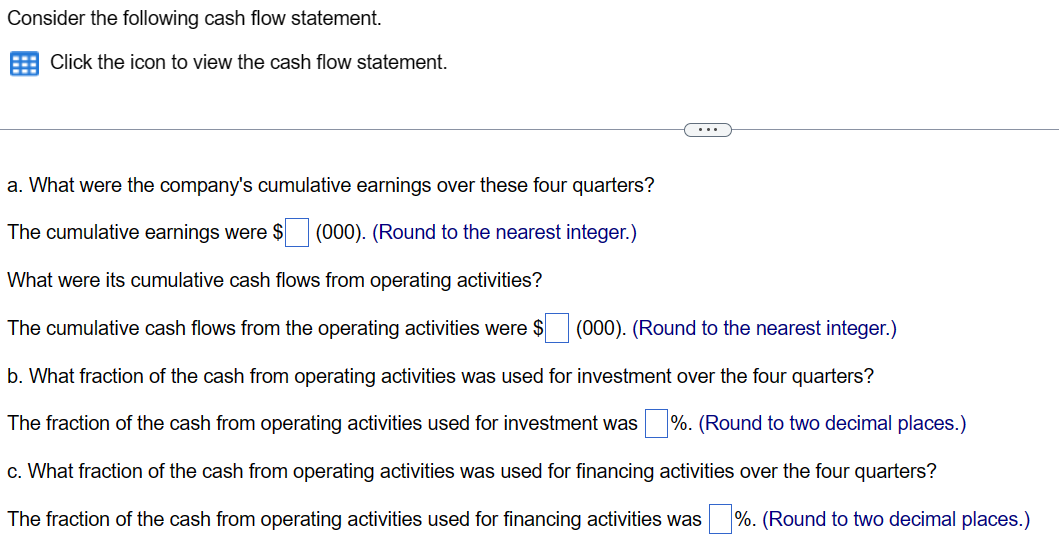

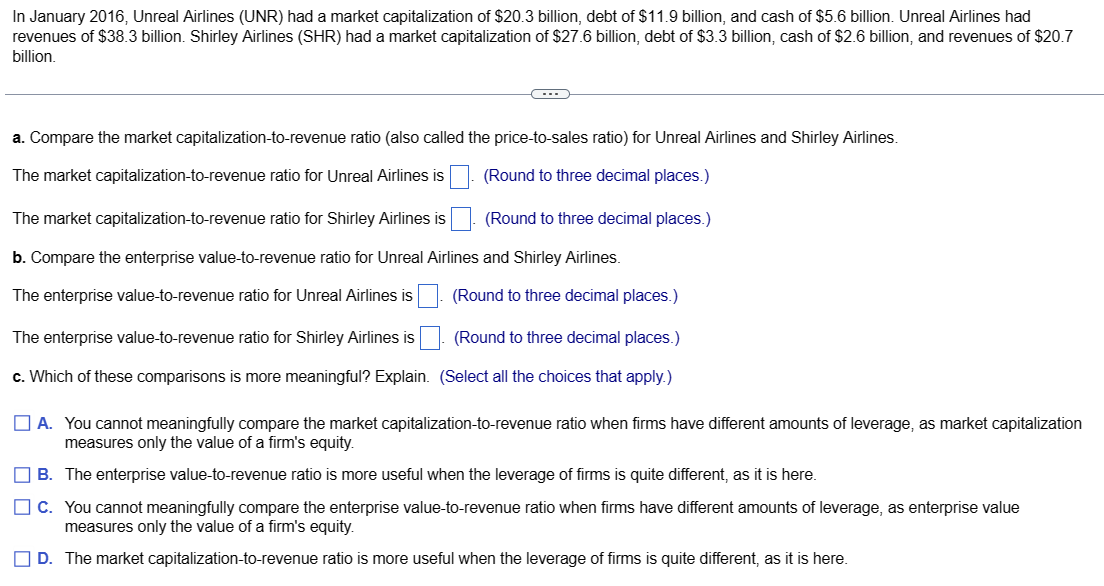

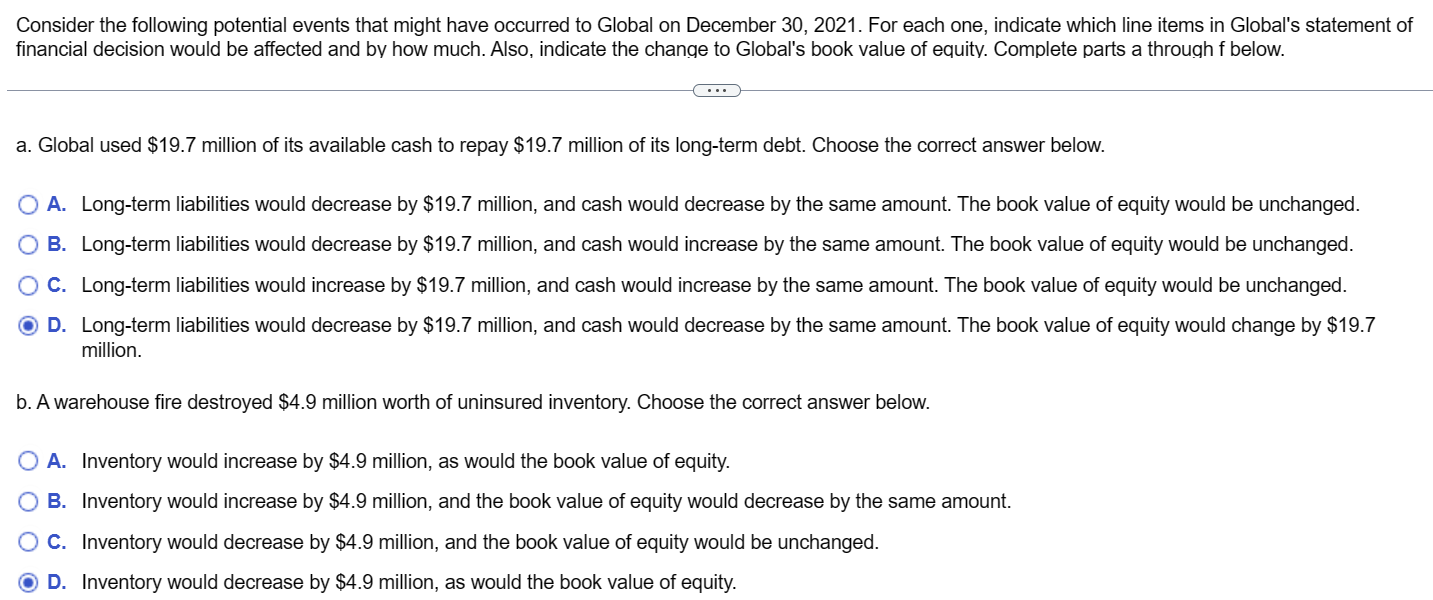

Earnings would be higher (lower) each year by $ million. (Round to two decimal places, and use a negative number for a decline.) f. A key competitor announces a radical new pricing policy that will drastically undercut Global's prices. Choose the correct answer below. O O O A. This event would not affect the balance sheet. OB. This event would decrease inventory. OC. This event would affect the balance sheet in an unpredictable manner. O D. This event would decrease the book value of equity. Calculate the new net income for 2020. (Enter amounts in millions. Round to one decimal place.) (millions) Year Net Income Additional Depreciation Tax Savings New Net Income $ $ Tax Savings New Net Income $ $ Calculate the new net income for 2021. (Enter amounts in millions. Round to one decimal place.) (millions) Year 2021 Net Income Additional Depreciation 2020 $ $ $ $ Balance Sheet Assets Cash 2017-2021 Financial Statement Data and Share Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) 2017 2018 2019 Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equipment Goodwill & Intangibles Total Assets Liabilities & Shareholders' Equity Accounts Payable Accrued Compensation Total Current Liabilities Long-Term Debt Total Liabilities Shareholders' Equity Total Liabilities & Shareholders' Equity 47.1 89.5 35.3 171.9 246.3 361.2 779.4 18.2 6.6 24.8 502.9 527.7 251.7 779.4 70.1 71.4 29.5 171.0 239.2 361.2 771.4 18.9 5.6 24.5 502.9 527.4 244.0 771.4 95.9 68.8 28.2 192.9 310.4 361.2 864.5 22.9 7.7 30.6 576.5 607.1 257.4 864.5 2020 85.8 75.9 32.2 193.9 348.2 361.2 903.3 28.4 7.6 36.0 601.4 637.4 265.9 903.3 2021 92.5 86.8 35.1 214.4 349.2 361.2 924.8 33.6 10.6 44.2 601.4 645.6 279.2 924.8 2017-2021 Financial Statement Data and Share Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) 2017 2018 2019 Income Statement Revenue Cost of Goods Sold Gross Profit Sales and Marketing Administration Depreciation & Amortization EBIT Interest Income (Expense) Pretax Income Income Tax Net Income Shares Outstanding (millions) Earnings per Share 401.4 (187.3) 214.1 (65.0) (59.1) (26.4) 63.6 (33.4) 30.2 (10.6) 19.6 53.4 $0.37 367.6 (173.6) 194.0 (68.1) (58.9) (27.2) 39.8 (33.9) 5.9 (2.1) 3.8 53.4 $0.07 428.5 (203.9) 224.6 (83.2) (58.2) (34.4) 48.8 (33.3) 15.5 (5.4) 10.1 53.4 $0.19 2020 509.1 (244.3) 264.8 (102.2) (66.1) (36.5) 60.0 (38.2) 21.8 (7.6) 14.2 53.4 $0.27 2021 601.6 (292.8) 308.8 (117.5) (80.3) (37.3) 73.7 (39.3) 34.4 (12.0) 22.4 53.4 $0.42 0 Nokela Industries purchases a $38.4 million cyclo-converter. The cyclo-converter will be depreciated by $9.6 million per year over four years, starting this year. Suppose Nokela's tax rate is 40%. a. What impact will the cost of the purchase have on earnings for each of the next four years? b. What impact will the cost of the purchase have on the firm's cash flow for the next four years? a. What impact will the cost of the purchase have on earnings for each of the next four years? Earnings will by $ b. What impact will the cost of the purchase have on the firm's cash flow for the next four years? The impact on the firm's cash flow in year 1 is $ million. (Round to one decimal place.) The impact on the firm's cash flow in years two through four is $ million each year for four years. (Select from the drop-down menu and round to one decimal place.) million. (Round to one decimal place.) Ladders, Inc. has a net profit margin of 5.4% on sales of $50.9 million and $1.2 million of interest expense. It has book value of equity of $39.6 million and total book liabilities of $31.4 million. What is Ladders' ROE? What is Ladders' ROA? What is Ladders' ROE? Ladders' ROE is% (Round to two decimal places.) What is Ladders' ROA? Ladders' ROA is%. (Round to two decimal places.) C GLOBAL CORPORATION Income Statement Year ended December 31 (in $ millions) Net sales Cost of sales Gross profit Selling, general, and administrative expenses Research and development Depreciation and amortization Operating income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net income Earnings per share: Diluted earnings per share: 2021 186.7 - 153.0 33.7 - 13.5 -8.2 - 1.2 10.8 10.8 -7.7 3.1 -0.8 2.3 $0.64 $0.61 2020 176.1 - 147.3 28.8 - 13.0 - 7.6 - 1.1 7.1 - 7.1 -4.6 2.5 -0.6 1.9 $0.53 $0.50 n 2017-2021 Financial Statement Data and Share Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) 2017 2018 2019 Statement of Cash Flows Net Income Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Payables & Accrued Compensation Cash from Operations Capital Expenditures Cash from Investing Activities Dividends Paid Sale (or Purchase) of Shares Debt Issuance (Pay Down) Cash from Financing Activities Change in Cash Mydeco Share Price 19.6 26.4 3.9 (2.9) 1.5 3.8 27.2 18.1 5.8 (0.3) 48.5 54.6 (24.8) (25.8) (24.8) (25.8) (5.8) (5.8) (5.8) 17.9 $8.18 (5.8) 23.0 $3.06 10.1 34.4 2.6 1.3 6.1 54.5 (96.5) (96.5) (5.8) - 73.6 67.8 25.8 $4.66 2020 14.2 36.5 (7.1) (4.0) 5.4 45.0 (74.2) (74.2) (5.8) 24.9 19.1 (10.1) $8.12 2021 22.4 37.3 (10.9) (2.9) 8.2 54.1 (41.6) (41.6) (5.8) (5.8) 6.7 $11.22 0 Suppose your firm receives a $4.26 million order on the last day of the year. You fill the order with $2.02 million worth of inventory. The customer picks up the entire order the same day and pays $1.07 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $3.19 million within 40 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following. a. Revenues b. Earnings c. Receivables a. Revenues Revenues will b. Earnings Earnings will c. Receivables Receivables will d. Inventory Inventory will e. Cash Cash will by $ d. Inventory e. Cash by $ million. (Select from the drop-down menu and round to two decimal places.) by $ million. (Select from the drop-down menu and round to two decimal places.) million. (Select from the drop-down menu and round to two decimal places.) by $ million. (Select from the drop-down menu and round to two decimal places.) by $ million. (Select from the drop-down menu and round to two decimal places.) Global Corp. initially projected the 2021 income statement from the 2020 income statement shown in the table below. Suppose that in 2021, Global launched an aggressive marketing campaign that boosted sales by 15.1% above their initial projections. However, their operating margin fell from 5.78% to 4.41% compared to their projections. Suppose that the company had no other income, interest expenses were unchanged, and the corporate tax rate for 2021 is 25%. a. What was Global's EBIT in 2021? b. What was Global's income in 2021? c. If Global's P/E ratio (18.0) and number of shares outstanding (3.6 million) remained unchanged, what was Global's share price in 2021? Click on the icon to view the 2020 and projected 2021 income statement. a. What was Global's EBIT in 2018? Global's EBIT was $ C--- million. (Round to two decimal places.) b. What was Global's income in 2018? Net income was $ million. (Round to two decimal places.) c. If Global's P/E ratio (18.0) and number of shares outstanding (3.6 million) remained unchanged, what was Global's share price in 2018? Global's share price in 2018 was $ (Round to the nearest cent.) c. Global used $4.7 million in cash and $5.5 million in new long-term debt to purchase a $10.2 million building. Choose the correct answer below. A. Long-term assets would decrease by $10.2 million, cash would decrease by $4.7 million, and long-term liabilities would increase by $5.5 million. There would be no change to the book value of equity. B. Long-term assets would decrease by $10.2 million, cash would increase by $4.7 million, and long-term liabilities would decrease by $5.5 million. There would be no change to the book value of equity. O C. Long-term assets would increase by $10.2 million, cash would decrease by $4.7 million, and long-term liabilities would increase by $5.5 million. There would be no change to the book value of equity. D. Long-term assets would increase by $10.2 million, cash would increase by $4.7 million, and long-term liabilities would increase by $5.5 million. There would Assets Current Assets Cash Accounts receivable Inventories Total current assets Long-Term Assets Net property, plant, and equipment Total long-term assets Total Assets Global Corporation Balance Sheet for 2020 and 2021 ($ millions) 2020 2021 Liabilities and Shareholders' Equity 24.1 19.5 15.8 59.4 113.5 113.5 172.9 20.6 13.8 14.8 49.2 81.3 81.3 130.5 Current Liabilities Accounts payable Notes payable/short-term debt Total current liabilities Long-Term Liabilities Long-term debt Total long-term liabilities Total Liabilities Shareholders' Equity Common shares and paid-in surplus Retained earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 2020 28.8 5.2 34.0 114.8 114.8 148.8 8.5 15.6 24.1 172.9 2021 27.2 3.6 30.8 77.1 77.1 107.9 8.5 14.1 22.6 130.5 n What was the change in Global's book value of equity from 2020 to 2021 according to the Global Corporation Balance Sheet? Does this imply that the market price of Global's shares increased in 2021? Explain. Click the icon to view the Global Corporation Balance Sheet. (... What was the change in Global's book value of equity from 2020 to 2021 according to the table? Global's book value of equity increased by $ million from 2020 to 2021. (Round to one decimal place.) Does this imply that the market price of Global's shares increased in 2021? Explain. Select all that apply. A. The market value of a share does not depend on the historical cost of the firm's assets, but on investors' expectation of the firm's future performance. B. An increase in book value does not necessarily indicate an increase in Global's share price. C. There are many events that may affect Global's future profitability, and hence its share price, that do not show up on the balance sheet. D. An increase in book value necessarily indicates an increase in Global's share price. The book value of the equity does not go up unless the share price goes up. d. A large customer owing $3.4 million for products it already received declared bankruptcy, leaving no possibility that Global would ever receive payment. Choose the correct answer below. O A. Accounts receivable would decrease by $3.4 million, as would the book value of equity. O B. Accounts receivable would increase by $3.4 million, as would the book value of equity. O C. Accounts receivable would decrease by $3.4 million, and the book value of equity would increase by the same amount. O D. Accounts receivable would increase by $3.4 million, and the book value of equity would decrease by the same amount. e. Global's engineers discover a new manufacturing process that will cut the cost of its flagship product by more than 54%. Choose the correct answer below. A. This event would decrease inventory by over 54%. B. This event would decrease inventory by over 54%, and the book value of equity would increase by the same amount. OC. This event would not affect the balance sheet. O D. This event would decrease inventory by over 54%, and the book value of equity would decrease by the same amount. Suppose a firm's tax rate is 35%. a. What effect would a $10.42 million operating expense have on this year's earnings? What effect would it have on next year's earnings? b. What effect would an $11.35 million capital expense have on this year's earnings if the capital is depreciated at a rate of $2.27 million per year for five years? What effect would it have on next year's earnings? a. What effect would a $10.42 million operating expense have on this year's earnings? Earnings would increase (decline) by $ What effect would it have on next year's earnings? (Select the best choice below.) million. (Round to two decimal places, and use a negative number for a decline.) OA. There would be no effect on next year's earnings. B. Next year's earnings will be affected by a decline of $3.65 million. C. Next year's earnings will be affected by the same amount. D. Next year's earnings will be affected by an increase of $3.65 million. b. What effect would an $11.35 million capital expense have on this year's earnings if the capital is depreciated at a rate of $2.27 million per year for five years? What effect would it have on next year's earnings? Consider the financial statement data and share price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $12 million at the end of 2018, and this equipment was depreciated by $4 million per year in 2019, 2020, and 2021. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydeco's net income in years 2018-2021? (Assume the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances.) Click the icon to view the income statement. Click the icon to view the balance sheet. Click the icon to view the statement of cash flows and share prices. Calculate the new net income for 2018. (Enter amounts in millions. Round to one decimal place.) (millions) Year Net Income Additional Depreciation Tax Savings New Net Income $ $ $ $ 2018 Calculate the new net income for 2019. (Enter amounts in millions. Round to one decimal place.) (millions) Year 2019 Net Income Additional Depreciation Tax Savings New Net Income $ $ $ $ (...) Consider the following cash flow statement. Click the icon to view the cash flow statement. ... a. What were the company's cumulative earnings over these four quarters? The cumulative earnings were $ (000). (Round to the nearest integer.) What were its cumulative cash flows from operating activities? The cumulative cash flows from the operating activities were $ (000). (Round to the nearest integer.) b. What fraction of the cash from operating activities was used for investment over the four quarters? The fraction of the cash from operating activities used for investment was %. (Round to two decimal places.) c. What fraction of the cash from operating activities was used for financing activities over the four quarters? The fraction of the cash from operating activities used for financing activities was%. (Round to two decimal places.) In January 2016, Unreal Airlines (UNR) had a market capitalization of $20.3 billion, debt of $11.9 billion, and cash of $5.6 billion. Unreal Airlines had revenues of $38.3 billion. Shirley Airlines (SHR) had a market capitalization of $27.6 billion, debt of $3.3 billion, cash of $2.6 billion, and revenues of $20.7 billion. a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for Unreal Airlines and Shirley Airlines. The market capitalization-to-revenue ratio for Unreal Airlines is (Round to three decimal places.) (Round to three decimal places.) The market capitalization-to-revenue ratio for Shirley Airlines is b. Compare the enterprise value-to-revenue ratio for Unreal Airlines and Shirley Airlines. The enterprise value-to-revenue ratio for Unreal Airlines is (Round to three decimal places.) The enterprise value-to-revenue ratio for Shirley Airlines is (Round to three decimal places.) c. Which of these comparisons is more meaningful? Explain. (Select all the choices that apply.) A. You cannot meaningfully compare the market capitalization-to-revenue ratio when firms have different amounts of leverage, as market capitalization measures only the value of a firm's equity. B. The enterprise value-to-revenue ratio is more useful when the leverage of firms is quite different, as it is here. C. You cannot meaningfully compare the enterprise value-to-revenue ratio when firms have different amounts of leverage, as enterprise value measures only the value of a firm's equity. D. The market capitalization-to-revenue ratio is more useful when the leverage of firms is quite different, as it is here. Consider the following potential events that might have occurred to Global on December 30, 2021. For each one, indicate which line items in Global's statement of financial decision would be affected and by how much. Also, indicate the change to Global's book value of equity. Complete parts a through f below. a. Global used $19.7 million of its available cash to repay $19.7 million of its long-term debt. Choose the correct answer below. O A. Long-term liabilities would decrease by $19.7 million, and cash would decrease by the same amount. The book value of equity would be unchanged. O B. Long-term liabilities would decrease by $19.7 million, and cash would increase by the same amount. The book value of equity would be unchanged. O C. Long-term liabilities would increase by $19.7 million, and cash would increase by the same amount. The book value of equity would be unchanged. Long-term liabilities would decrease by $19.7 million, and cash would decrease by the same amount. The book value of equity would change by $19.7 million. O D. b. A warehouse fire destroyed $4.9 million worth of uninsured inventory. Choose the correct answer below. O A. ory would increase $4.9 million, would the book value of equ B. Inventory would increase by $4.9 million, and the book value of equity would decrease by the same amount. O C. Inventory would decrease by $4.9 million, and the book value of equity would be unchanged. OD. Inventory would decrease by $4.9 million, as would the book value of equity.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

C This event would affect the balance sheet in an unpredictable manner When a key competitor announc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started