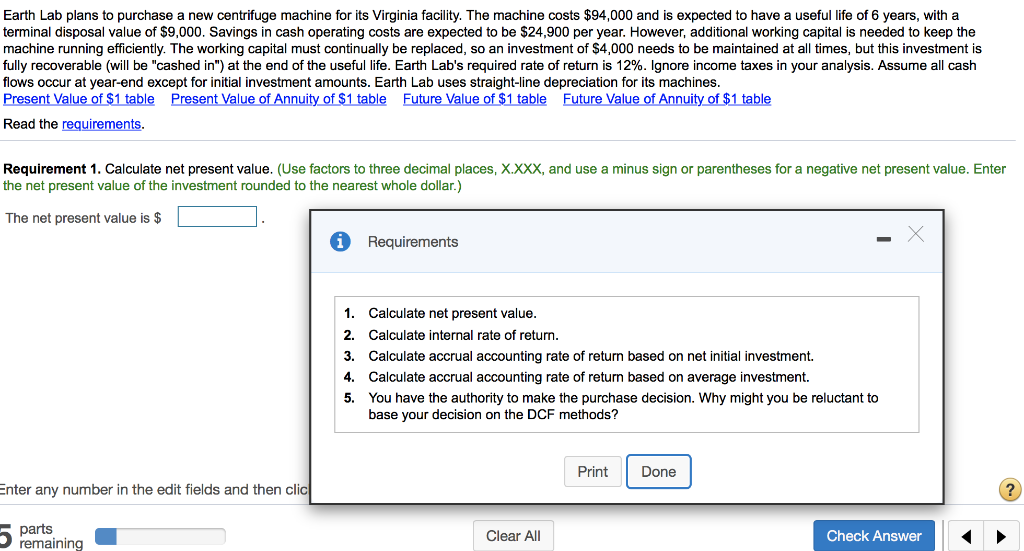

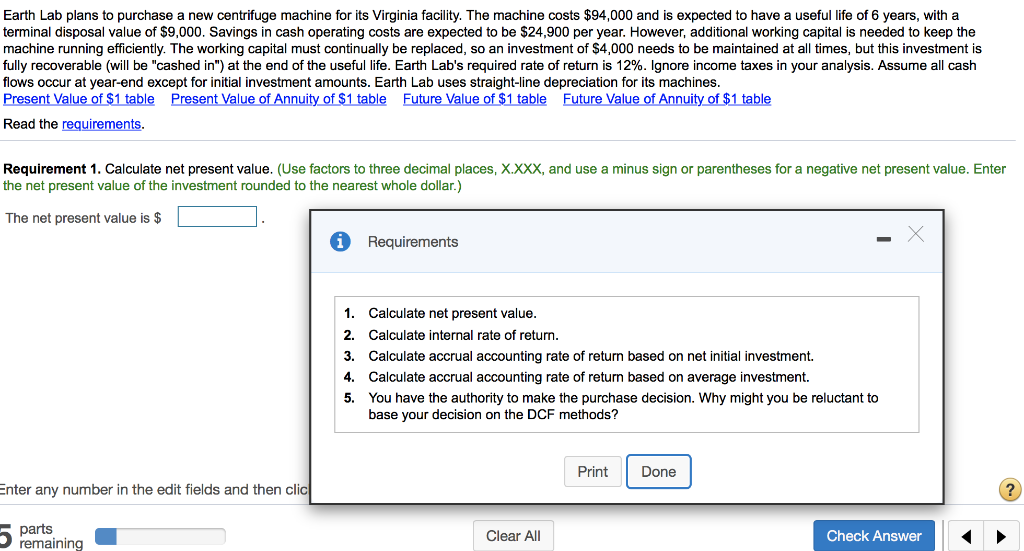

Earth Lab plans to purchase a new centrifuge machine for its Virginia facility. The machine costs $94,000 and is expected to have a useful life of 6 years, with a terminal disposal value of $9,000. Savings in cash operating costs are expected to be $24,900 per year. However, additional working capital is needed to keep the machine running efficiently. The working capital must continuall d so iovestment of SA 000 needs to be maintained at all times, but this investment is so an investment ol be rep e fully recoverable (will be "cashed in") at the end of the useful life. Earth Lab's required rate of return is 12%. Ignore income taxes in your analysis. Assume all cash flows occur at year-end except for initial investment amounts. Earth Lab uses straight-line depreciation for its machines. Present Value of $1 table Present Value of Annuity of $1 table Future Value of Annuity of $1 table Future Value of $1 table Read the requirements. Requirement 1. Calculate net present value. (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for the net present value of the investment rounded to the nearest whole dollar.) negative net present value. Enter The net present value is $ i Requirements 1 Calculate net present value. 2 Calculate internal rate of return. Calculate accrual accounting rate of return based on net initial investment 3 Calculate accrual accounting rate of return based on average investment. 4 5 You have the authority to make the purchase decision. Why might you be reluctant to base your decision on the DCF methods? Print Done Enter any number in the edit fields and then clic parts remaining Clear All Check Answer Earth Lab plans to purchase a new centrifuge machine for its Virginia facility. The machine costs $94,000 and is expected to have a useful life of 6 years, with a terminal disposal value of $9,000. Savings in cash operating costs are expected to be $24,900 per year. However, additional working capital is needed to keep the machine running efficiently. The working capital must continuall d so iovestment of SA 000 needs to be maintained at all times, but this investment is so an investment ol be rep e fully recoverable (will be "cashed in") at the end of the useful life. Earth Lab's required rate of return is 12%. Ignore income taxes in your analysis. Assume all cash flows occur at year-end except for initial investment amounts. Earth Lab uses straight-line depreciation for its machines. Present Value of $1 table Present Value of Annuity of $1 table Future Value of Annuity of $1 table Future Value of $1 table Read the requirements. Requirement 1. Calculate net present value. (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for the net present value of the investment rounded to the nearest whole dollar.) negative net present value. Enter The net present value is $ i Requirements 1 Calculate net present value. 2 Calculate internal rate of return. Calculate accrual accounting rate of return based on net initial investment 3 Calculate accrual accounting rate of return based on average investment. 4 5 You have the authority to make the purchase decision. Why might you be reluctant to base your decision on the DCF methods? Print Done Enter any number in the edit fields and then clic parts remaining Clear All Check