Question

Part 1 (50%) Earth's General Store (EGS) is at a crossroads and must make a decision that will determine the future direction of the company.

Part 1 (50%)

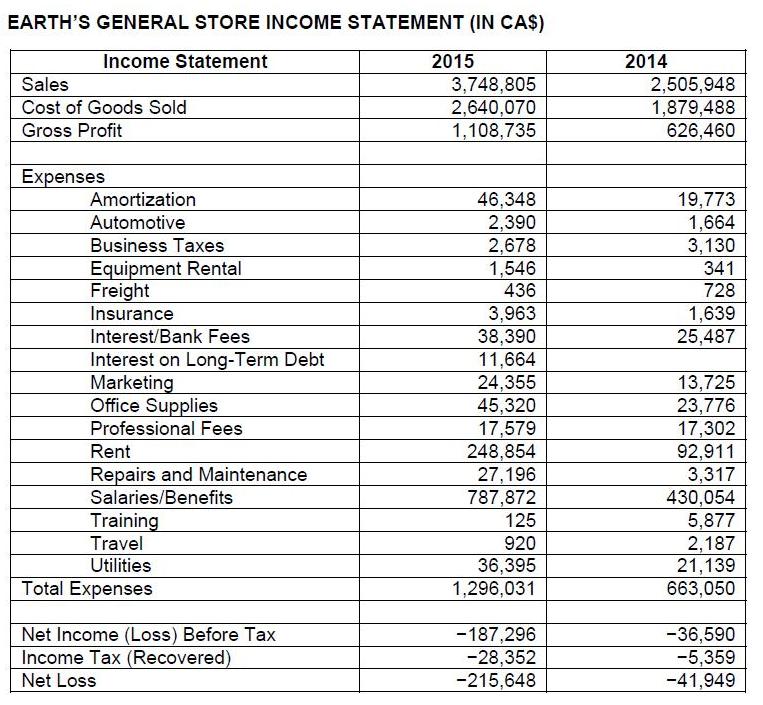

Earth's General Store (EGS) is at a crossroads and must make a decision that will determine the future direction of the company. There are multiple options. The case provides two years of Income Statements. You are to advise the company which direction you feel it should pursue.

Perform a financial analysis with the limited financial information that you have available. Use the analytical tools that you feel are most relevant. Identify the events or reasons that you feel led to the changes from 2014 to the 2015 Income Statements. (30%)

Identify what you feel are the different options that are available. Be specific! Identify the pros and cons of each option. Your analysis should include both quantitative and qualitative factors for each option. (10%)

Based on your analysis, select what you feel is the best option to recommend to EGS. List the reasons supporting your recommendation. Use point form (bullet points) throughout your analysis. (10%)

Part 2 (50%)

The Balanced Scorecard has been called a strategic performance measurement system. Considering the option you recommended in Part 1 and the factors that are key for EGS's future success, prepare a Balanced Scorecard and a Strategy Map for the company. The Balanced Scorecard must identify objectives and measures that relate to critical success factors from the case information. You should identify at least two objectives for each Balanced Scorecard perspective. You should also provide one performance measure for each objective. The Strategy Map must show specific cause-and-effect relationships among the objectives.

EARTH'S GENERAL STORE INCOME STATEMENT (IN CA$) Income Statement Sales Cost of Goods Sold Gross Profit Expenses Amortization Automotive Business Taxes Equipment Rental Freight Insurance Interest/Bank Fees Interest on Long-Term Debt Marketing Office Supplies Professional Fees Rent Repairs and Maintenance Salaries/Benefits Training Travel Utilities Total Expenses Net Income (Loss) Before Tax Income Tax (Recovered) Net Loss 2015 3,748,805 2,640,070 1,108,735 46,348 2,390 2,678 1,546 436 3,963 38,390 11,664 24,355 45,320 17,579 248,854 27,196 787,872 125 920 36,395 1,296,031 -187,296 -28,352 -215,648 2014 2,505,948 1,879,488 626,460 19,773 1,664 3,130 341 728 1,639 25,487 13,725 23,776 17,302 92,911 3,317 430,054 5,877 2,187 21,139 663,050 -36,590 -5,359 -41,949

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

on which Advise the company direction you feel they ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started