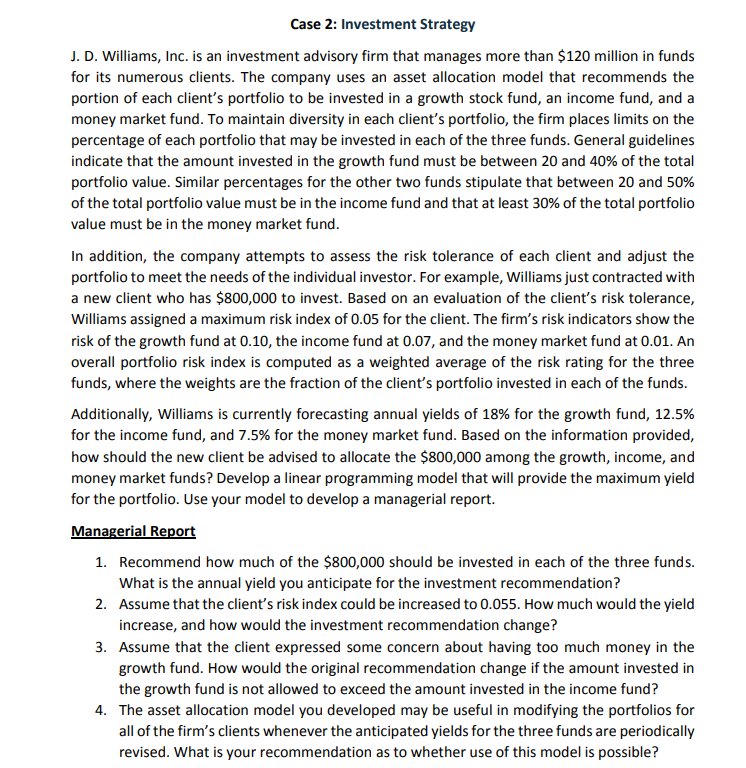

Ease 2: Investment Strategv .l. D. Williams, Inc. is an investment advisoriir firm that manages more than Sill] million in funds for its numerous clients. The companv uses an asset allocation model that recommends the portion of each client's portfolio to be invested in a growth stock fund, an income fund, and a monev market fund. To maintain diversitv in each client's portfolio, the firm places limits on the percentage of each portfolio that mav be invested in each of the three funds. General guidelines indicate that the amount invested in the growth fund must be between 2|] and 4cx of the total portfolio value. Similar percentages for the other two funds stipulate that between 2d and sox of the total portfolio value must be in the income fund and that at lea st aux of the total portfolio value must be in the monev market fund. In addition, the companv attempts to assess the risk tolerance of each client and adiust the portfolio to meet the needs of the individual investor. For example, Williamsjust contracted with a new client who has SSDIJJJDG to invest. Based on an evaluation of the client's risk tolerance, Williams assigned a maximum risk index of d.{i5 for the client. The firm's risk indicators show the risk of the growth fund at it), the income fund at cos, and the monev market fund at d.l]1. An overall portfolio risk index is computed as a weighted average of the risk rating for the three funds, where the weights are the fraction of the client's portfolio invested in each of the funds. Additionallv, Williams is currently forecasting annual vields of 13% for the growth fund, 12.5% for the income fund, and 15% for the monev market fund. Based on the information provided, how should the new client be advised to allocate the scoocco among the growth, income, and monevr market funds? Develop a linear programming model that will provide the maximum vield for the portfolio. Use vour model to develop a managerial report. MM 1. Recommend how much of the $EDDIJIJ should be invested in each of the three fund s. What is the annual vield vou anticipate for the investment recommendation? 2. Assume that the client' s risk index could be increased to MES. How much would the vield increase, and how would the investment recommendation change? 3. Assume that the client expressed some concern about having too much money in the growth fund. How would the original recommendation change if the amount invested in the growth fund is not allowed to exceed the amount invested in the income fund? 4. The asset allocation model vou developed mailr be useful in modifving the pcrtfolios for all of the firm's clients whenever the anticipated vields for the three funds are periodically revised. What is vour recommendation as to whether use of this model is possible