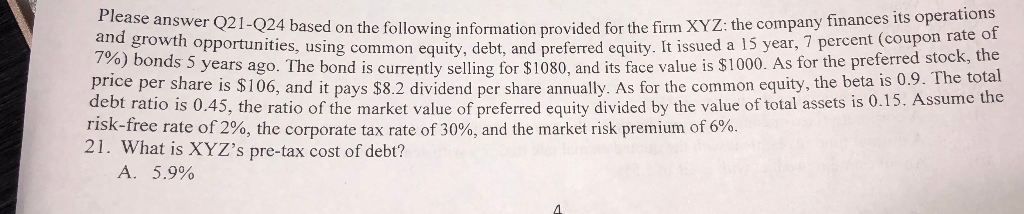

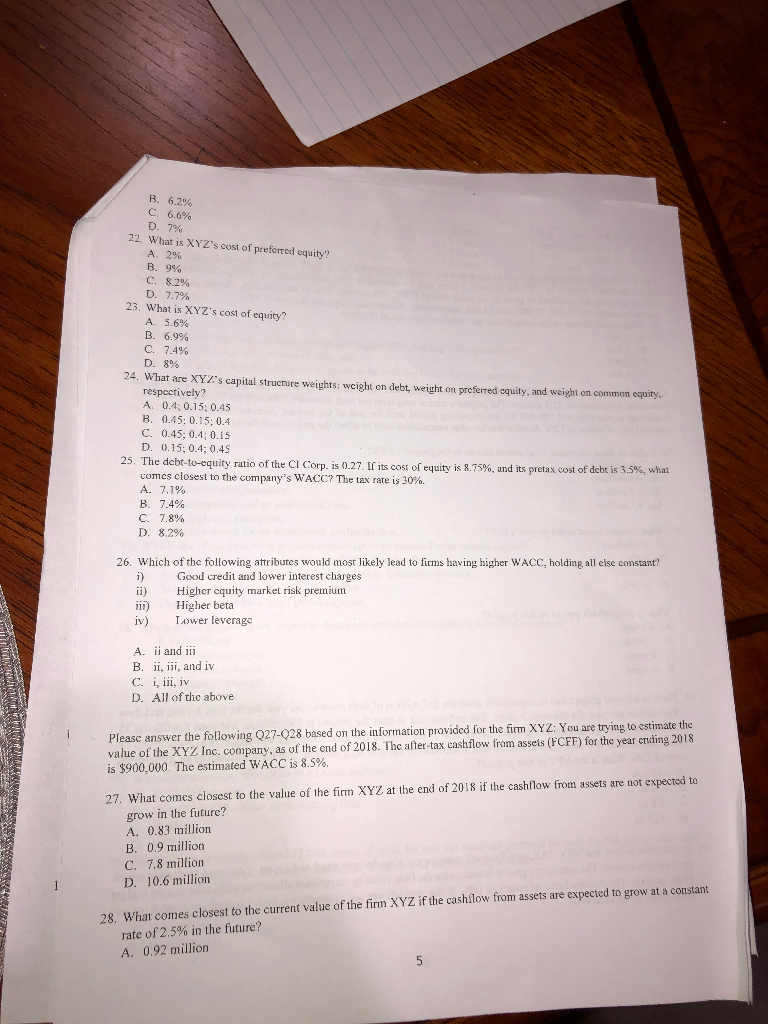

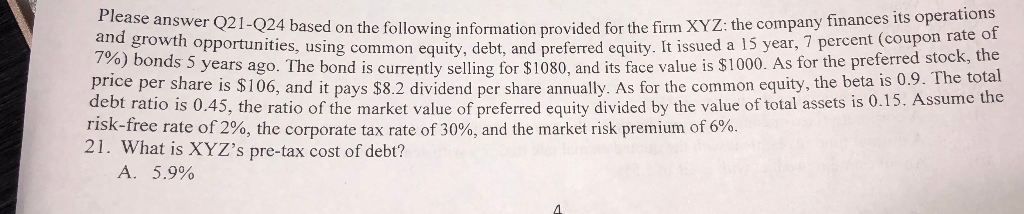

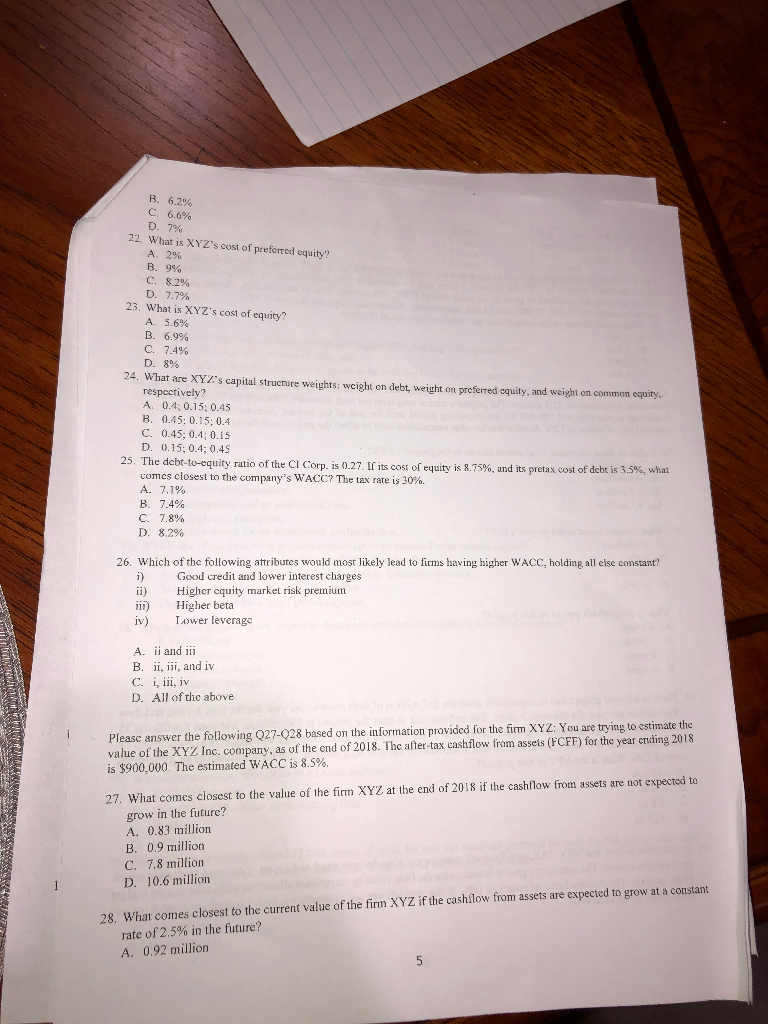

ease answer Q21-Q24 based on the following in formation provided for the firm XYZ: the company finances its operati rred equity. It issued a 15 year, 7 percent (coupon rate of the preferred stock, the and growth opportunities, using common equity, debt, and prefe /%) bonds 5 years ago. The bond is currently selling for $1080, and it face value 1s $1000 As for price per share is $106, and it pavs $8.2 dividend per share annually. As for the common equity, the beta is 0.9.he o debt ratio is 0.45, the ratio of the market value of preferred equity divided by the value of total assets is 0.15. Assume the risk-free rate of 2%, the corporate tax rate of 30% and the market risk premium of 6%. 21. What is XYZ's pre-tax cost of debt? A. 5.9% B. 6.2% C, 6.6% D.790 22, What is XYZ's cost of preferred equity? A.2% B. 9% C. 82% D. 23. What is XYZ's cost of equity? A. 5.6% B. 6.9% C. 7.4% D. 8% 24. What are XYZ:s capital structure weights: weight on debt, weight on preferred cquity, and weight on common equity, respectively? A. 0.4; 0.151 0.45 B. 0.45: 0.15; 0.4 C. 0.45; 0.4; 0.15 D. 0.15 0.4; 0.45 25, t to equity ratio of the Cl Corp. is 0.27. If its cost of equity is 8.75%, and its pretax cost of debt s 3.5%, what com cs closest to the company's WACC? The tax rate is 30%. B. 7.4% C. 7.8% D. 8.2% 26. Which of the following attributes would most likely lead to firms having higher WACC, holding all else constant? i Good credit and lower interest charges ii) iii) Higher beta iv) ower leverage Higher cquity market risk premium A. ii and ii B. ii, iii, and iv C. i, ii, iv D. All of the above trying to estimate the Pleasc answer the following 027-028 based on the information provided for the firm XYZ: You are value of the XYZ Inc. company, as of the end of 2018. The after-tax cashflow from asseis (FCFF) for the year ending 2018 is $900,000. The estimated WACC is 8.5%. 27. What comes closest to the value of the firm XYZ at the end of 2018 if the cashflow from assets are not expectod te grow in the future? A. 0.83 million B. 0.9 million C. 7.8 million D. 10.6 million 28. What comes closest to the current value of the firm XYZ if the cashilow from assets are expected to grow at a constant rate of2.5% in the future? A. 0.92 million