Question

East Coast Yachts is a small manufacturer of costumed yachts on the east coast. East Coast Yachts recently hired Dan Erwin to assist the company

East Coast Yachts is a small manufacturer of costumed yachts on the east coast. East Coast Yachts recently hired Dan Erwin to assist the company with short-term financial planning and also to evaluate the company's financial performance. Dan graduated from college five years ago with a finance degree, and he has been employed in the treasury department of a Fortune 500 company since then.

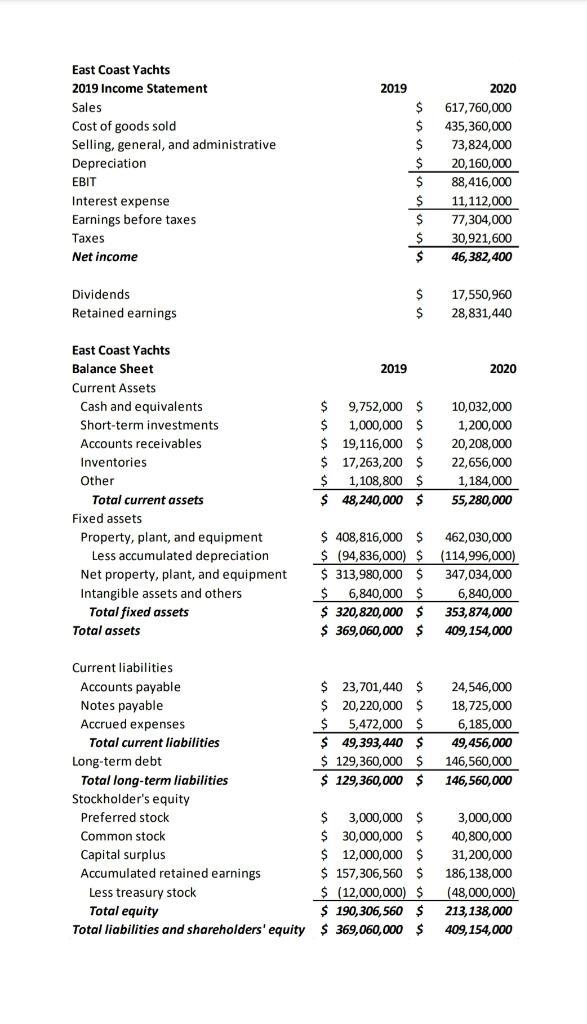

The company's past growth has been somewhat hectic, in part due to poor planning. Larissa, the company's president, has asked Dan to analyze the company's cash flows. An outside auditor prepares the company's financial statements. You will find the most recent income statement and the balance sheets for the last two years on the next page (See PDF file). Larissa has also provided the following information: During the year, the company raised $40 million in new long-term debt and retired $22.8 million in long-term debt. The company also sold $30 million in new stock and repurchased $36 million. The company purchased $60 million in fixed assets and sold $6,786,000 in fixed assets.

Larissa has asked Dan to prepare the Statement of Cash Flows and calculate the free cash flow, including the NOPAT and the Net Investment. Provide a brief analysis of the company's performance for the year under analysis.

East Coast Yachts 2019 Income Statement 2019 2020 617,760,000 $ Sales Cost of goods sold 435,360,000 Selling, general, and administrative $ 73,824,000 Depreciation 20,160,000 EBIT 88,416,000 Interest expense 11,112,000 Earnings before taxes es $ 77,304,000 Taxes 30,921,600 Net income 46,382,400 Dividends $ 17,550,960 Retained earnings 28,831,440 East Coast Yachts Balance Sheet 2019 2020 Current Assets Cash and equivalents $ 9,752,000 $ 10,032,000 $ 1,000,000 $ $ 19,116,000 $ $ 17,263,200 $ $ 1,108,800 $ $ 48,240,000 $ Short-term investments 1,200,000 Accounts receivables 20,208,000 Inventories 22,656,000 Other 1,184,000 Total current assets 55,280,000 Fixed assets $ 408,816,000 $ $ (94,836,000) $ (114,996,000) $ 313,980,000 $ $ 6,840,000 $ $ 320,820,000 $ $ 369,060,000$ Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment 462,030,000 347,034,000 Intangible assets and others 6,840,000 Total fixed assets 353,874,000 Total assets 409,154,000 Current liabilities $ 23,701,440 $ $ 20,220,000 $ 5,472,000 $ $ 49,393,440 $ $ 129,360,000 S $ 129,360,000 $ Accounts payable 24,546,000 Notes payable 18,725,000 Accrued expenses 6,185,000 Total current liabilities 49,456,000 Long-term debt Total long-term liabilities Stockholder's equity 146,560,000 146,560,000 $ 3,000,000 $ $ 30,000,000 $ $ 12,000,000 $ $ 157,306,560 $ $ (12,000,000) $ $ 190,306,560 $ 213,138,000 Preferred stock 3,000,000 Common stock 40,800,000 Capital surplus Accumulated retained earnings 31,200,000 186,138,000 Less treasury stock (48,000,000) Total equity Total liabilities and shareholders' equity $ 369,060,000 $ 409,154,000

Step by Step Solution

3.27 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

year 2020 11112000 Tanes East coast yachts cash flow stedement for the Au cash flow from operating a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started