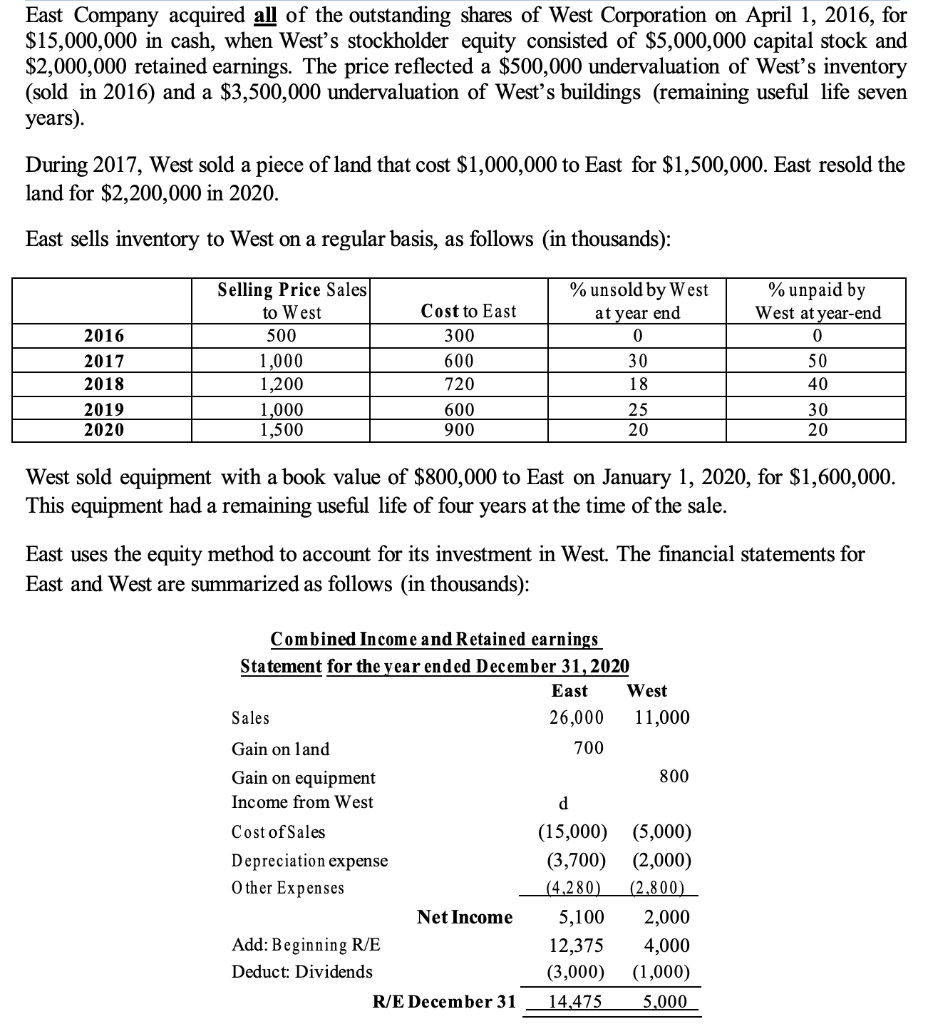

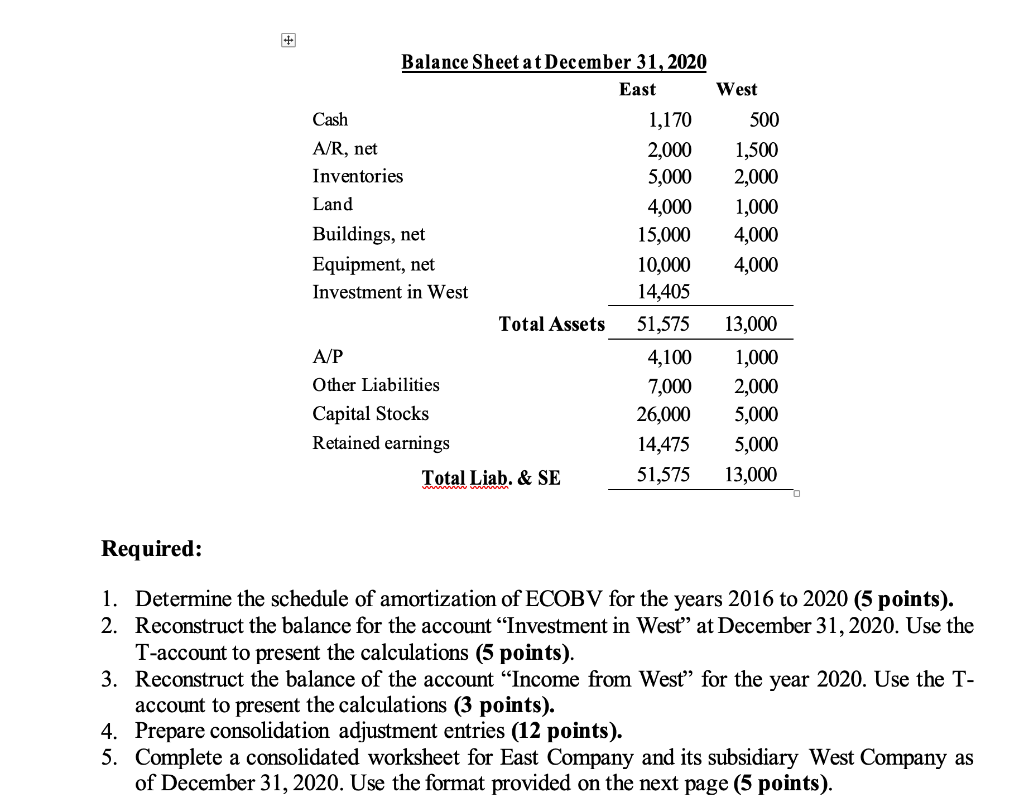

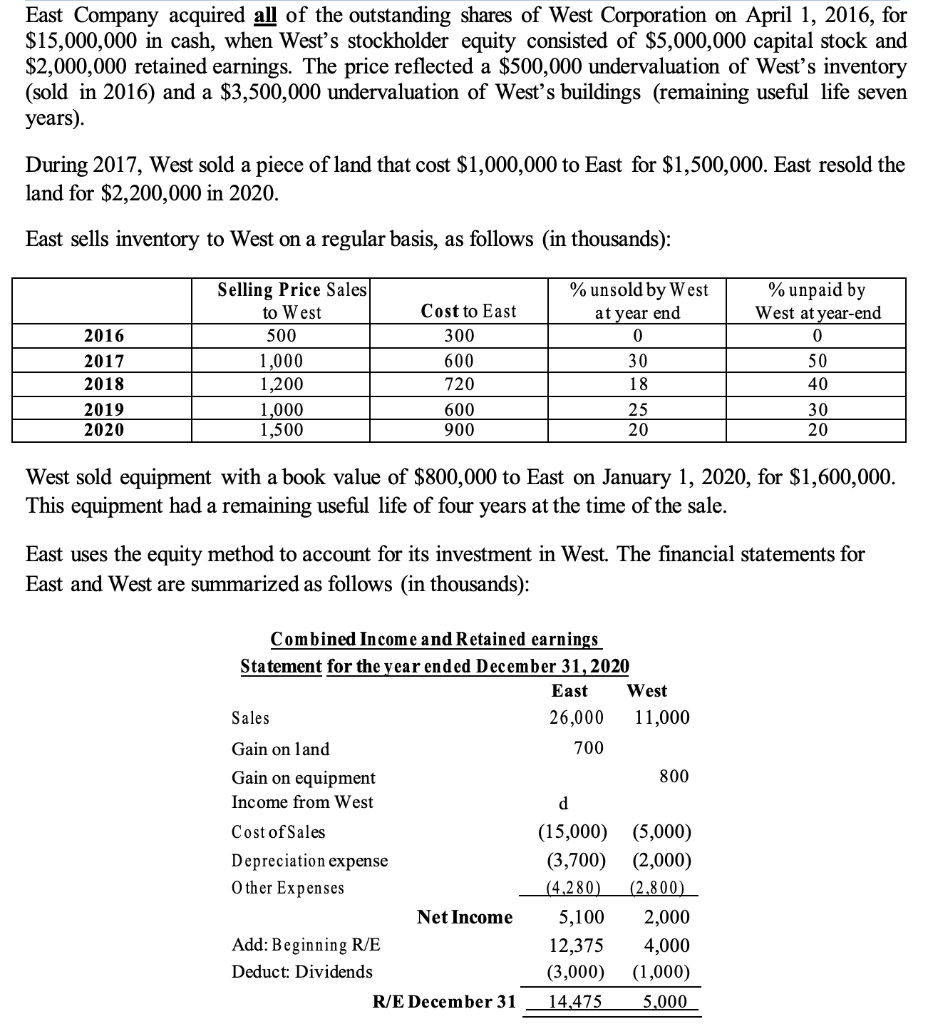

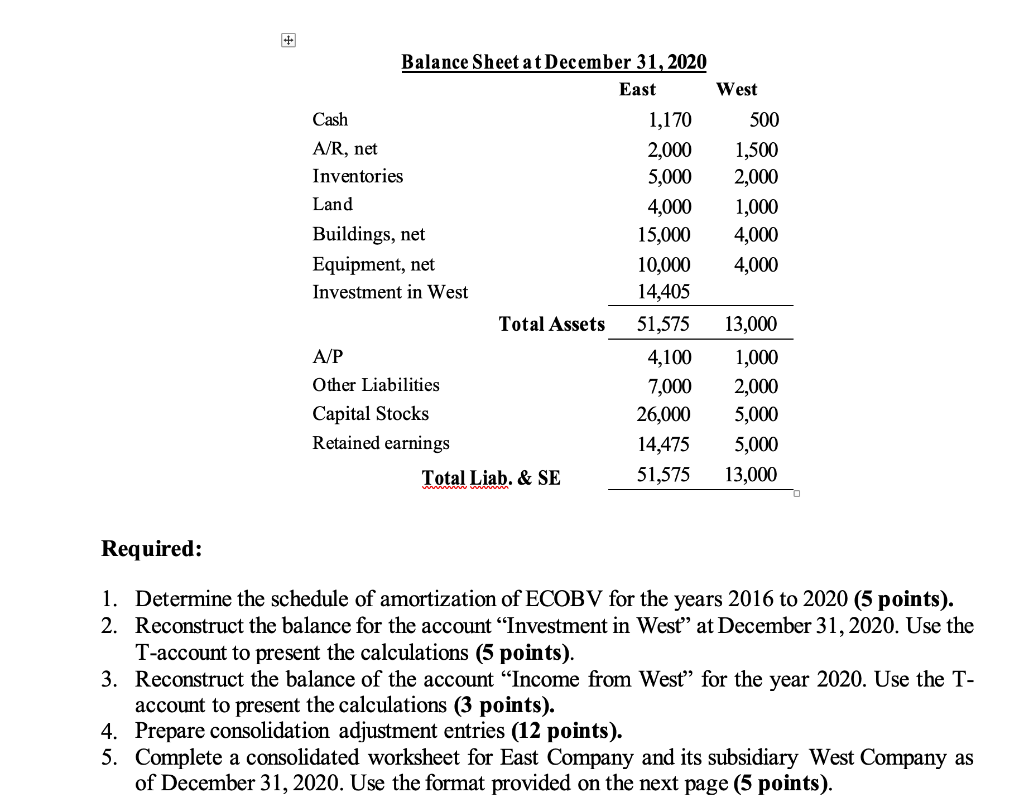

East Company acquired all of the outstanding shares of West Corporation on April 1, 2016, for $15,000,000 in cash, when West's stockholder equity consisted of $5,000,000 capital stock and $2,000,000 retained earnings. The price reflected a $500,000 undervaluation of West's inventory (sold in 2016) and a $3,500,000 undervaluation of West's buildings (remaining useful life seven years). During 2017, West sold a piece of land that cost $1,000,000 to East for $1,500,000. East resold the land for $2,200,000 in 2020. East sells inventory to West on a regular basis, as follows (in thousands): Cost to East 300 % unpaid by West at year-end 0 Selling Price Sales to West 500 1,000 1,200 1,000 1,500 % unsold by West at year end 0 30 18 2016 2017 2018 2019 2020 600 50 40 720 600 900 25 20 30 20 West sold equipment with a book value of $800,000 to East on January 1, 2020, for $1,600,000. This equipment had a remaining useful life of four years at the time of the sale. East uses the equity method to account for its investment in West. The financial statements for East and West are summarized as follows (in thousands): Combined Income and Retained earnings Statement for the year ended December 31, 2020 East West Sales 26,000 11,000 Gain on land 700 Gain on equipment 800 Income from West d Cost of Sales (15,000) (5,000) Depreciation expense (3,700) (2,000) Other Expenses (4,280) (2,800) Net Income 5,100 2,000 Add: Beginning R/E 12,375 4,000 Deduct: Dividends (3,000) (1,000) R/E December 31 14,475 5,000 Balance Sheet at December 31, 2020 East West Cash 1,170 500 A/R, net 2,000 1,500 Inventories 5,000 2,000 Land 4,000 1,000 Buildings, net 15,000 4,000 Equipment, net 10,000 4,000 Investment in West 14,405 Total Assets 51,575 13,000 A/P 4,100 1,000 Other Liabilities 7,000 2,000 Capital Stocks 26,000 5,000 Retained earnings 14,475 5,000 Total Liab. & SE 51,575 13,000 Required: 1. Determine the schedule of amortization of ECOBV for the years 2016 to 2020 (5 points). 2. Reconstruct the balance for the account "Investment in West at December 31, 2020. Use the T-account to present the calculations (5 points). 3. Reconstruct the balance of the account Income from West for the year 2020. Use the T- account to present the calculations (3 points). 4. Prepare consolidation adjustment entries (12 points). 5. Complete a consolidated worksheet for East Company and its subsidiary West Company as of December 31, 2020. Use the format provided on the next page (5 points). East Company acquired all of the outstanding shares of West Corporation on April 1, 2016, for $15,000,000 in cash, when West's stockholder equity consisted of $5,000,000 capital stock and $2,000,000 retained earnings. The price reflected a $500,000 undervaluation of West's inventory (sold in 2016) and a $3,500,000 undervaluation of West's buildings (remaining useful life seven years). During 2017, West sold a piece of land that cost $1,000,000 to East for $1,500,000. East resold the land for $2,200,000 in 2020. East sells inventory to West on a regular basis, as follows (in thousands): Cost to East 300 % unpaid by West at year-end 0 Selling Price Sales to West 500 1,000 1,200 1,000 1,500 % unsold by West at year end 0 30 18 2016 2017 2018 2019 2020 600 50 40 720 600 900 25 20 30 20 West sold equipment with a book value of $800,000 to East on January 1, 2020, for $1,600,000. This equipment had a remaining useful life of four years at the time of the sale. East uses the equity method to account for its investment in West. The financial statements for East and West are summarized as follows (in thousands): Combined Income and Retained earnings Statement for the year ended December 31, 2020 East West Sales 26,000 11,000 Gain on land 700 Gain on equipment 800 Income from West d Cost of Sales (15,000) (5,000) Depreciation expense (3,700) (2,000) Other Expenses (4,280) (2,800) Net Income 5,100 2,000 Add: Beginning R/E 12,375 4,000 Deduct: Dividends (3,000) (1,000) R/E December 31 14,475 5,000 Balance Sheet at December 31, 2020 East West Cash 1,170 500 A/R, net 2,000 1,500 Inventories 5,000 2,000 Land 4,000 1,000 Buildings, net 15,000 4,000 Equipment, net 10,000 4,000 Investment in West 14,405 Total Assets 51,575 13,000 A/P 4,100 1,000 Other Liabilities 7,000 2,000 Capital Stocks 26,000 5,000 Retained earnings 14,475 5,000 Total Liab. & SE 51,575 13,000 Required: 1. Determine the schedule of amortization of ECOBV for the years 2016 to 2020 (5 points). 2. Reconstruct the balance for the account "Investment in West at December 31, 2020. Use the T-account to present the calculations (5 points). 3. Reconstruct the balance of the account Income from West for the year 2020. Use the T- account to present the calculations (3 points). 4. Prepare consolidation adjustment entries (12 points). 5. Complete a consolidated worksheet for East Company and its subsidiary West Company as of December 31, 2020. Use the format provided on the next page (5 points)