Answered step by step

Verified Expert Solution

Question

1 Approved Answer

< East Ferry Tool & Die, a manufacturer of parts for agricultural equipment, provides the following financial information for the most recent fiscal year

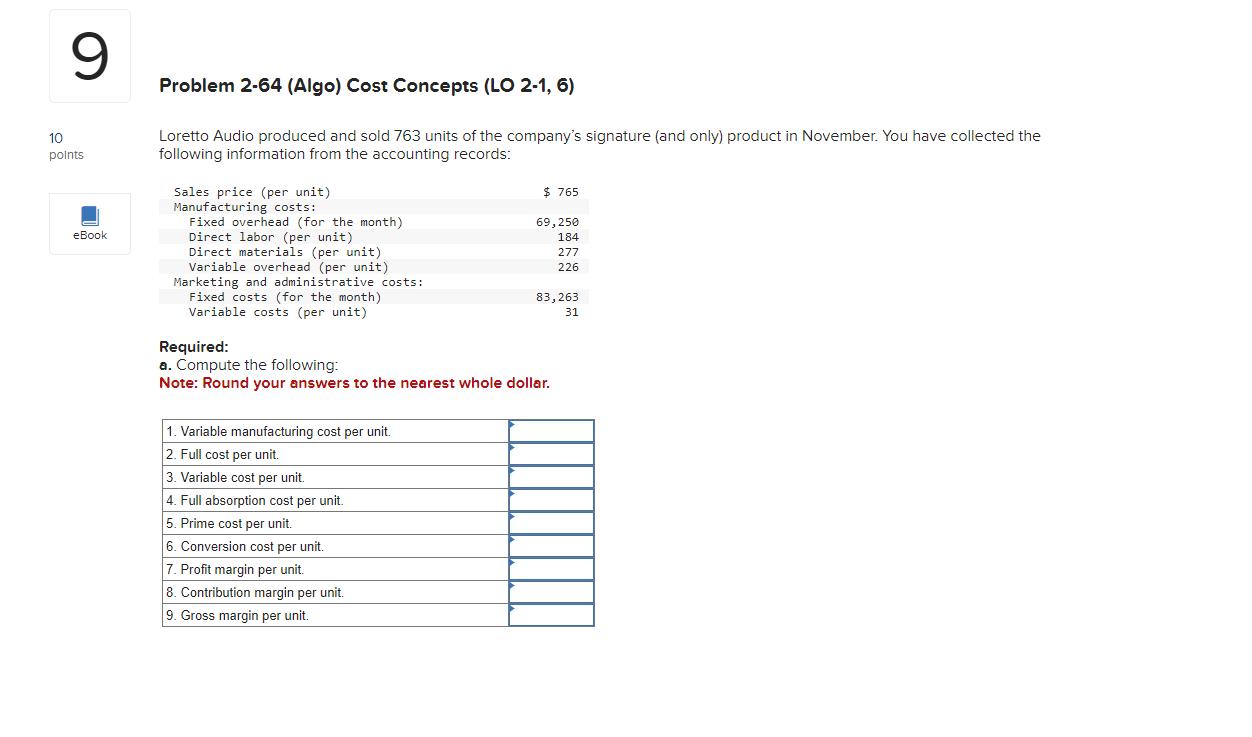

< East Ferry Tool & Die, a manufacturer of parts for agricultural equipment, provides the following financial information for the most recent fiscal year (all costs are in thousands of dollars): Inventories: As of January 1: Direct materials Work-in-process Finished goods As of December 31: Direct materials Work-in-process Finished goods Other amounts (for the year): Administrative costs. Direct labor Direct material purchases Indirect plant labor Indirect plant supplies Machine depreciation Marketing costs Plant depreciation Plant supervision Plant utilities Property taxes on plant and equipment Sales revenue Required: a. Prepare a cost of goods sold statement. b. Prepare an income statement. ($000) $ 87 96 664 $ 94 89 683 1,940 3,946 5,074 1,958 692 4,351 1,024 1,275 996 673 321 24,234 9 10 points eBook Problem 2-64 (Algo) Cost Concepts (LO 2-1, 6) Loretto Audio produced and sold 763 units of the company's signature (and only) product in November. You have collected the following information from the accounting records: Sales price (per unit) Manufacturing costs: Fixed overhead (for the month) Direct labor (per unit) Direct materials (per unit) Variable overhead (per unit) Marketing and administrative costs: Fixed costs (for the month) Variable costs (per unit) $ 765 1. Variable manufacturing cost per unit. 2. Full cost per unit. 3. Variable cost per unit. 4. Full absorption cost per unit. 5. Prime cost per unit. 6. Conversion cost per unit. 7. Profit margin per unit. 8. Contribution margin per unit. 9. Gross margin per unit. 69,250 184 277 226 83,263 31 Required: a. Compute the following: Note: Round your answers to the nearest whole dollar.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started