Answered step by step

Verified Expert Solution

Question

1 Approved Answer

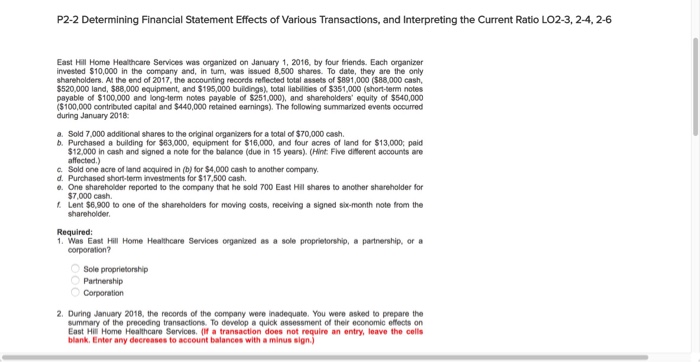

East Hill Home Healthcare Services was organized on January 1, 2016, by four friends. Each organizer invested $10,000 in the company and, in turn, was

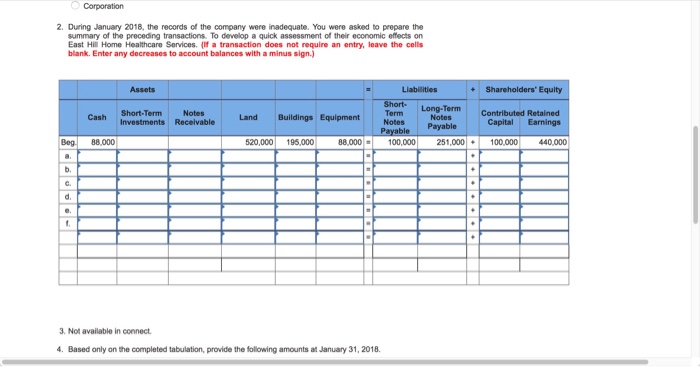

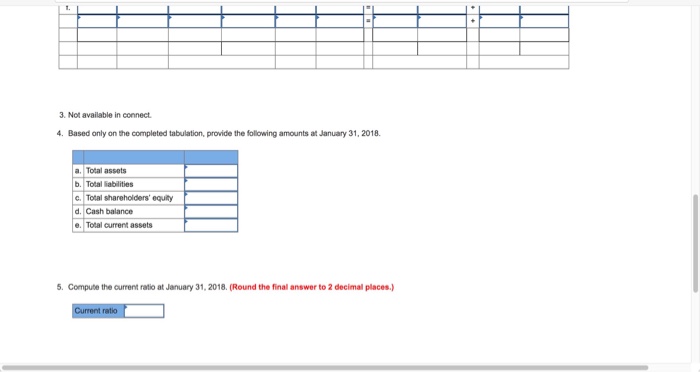

East Hill Home Healthcare Services was organized on January 1, 2016, by four friends. Each organizer invested $10,000 in the company and, in turn, was issued 8,500 shares. To date, they are the only shareholders. At the end of 2017, the accounting records reflected total assets of $891,000 ($88,000 cash, $520,000 land, $88,000 equipment, and $195,000 buildings), total liabilities of $351,000 (short-term notes payable of $100,000 and long-term notes payable of $251,000), and shareholders equity of $540,000 ($100,000 contributed capital and $440,000 retained earnings). The following summarized events occurred during January 2018:

a.

Sold 7,000 additional shares to the original organizers for a total of $70,000 cash.

b.

Purchased a building for $63,000, equipment for $16,000, and four acres of land for $13,000; paid $12,000 in cash and signed a note for the balance (due in 15 years). (Hint: Five different accounts are affected.)

c.

Sold one acre of land acquired in (b) for $4,000 cash to another company.

d. Purchased short-term investments for $17,500 cash.

e.

One shareholder reported to the company that he sold 700 East Hill shares to another shareholder for $7,000 cash.

f.

Lent $6,900 to one of the shareholders for moving costs, receiving a signed six-month note from the shareholder.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started