Answered step by step

Verified Expert Solution

Question

1 Approved Answer

East Hill Home Healthcare Services was organized on January 1, 2022 by four friends. Each organizer invested $10,000 in the company and, in turn,

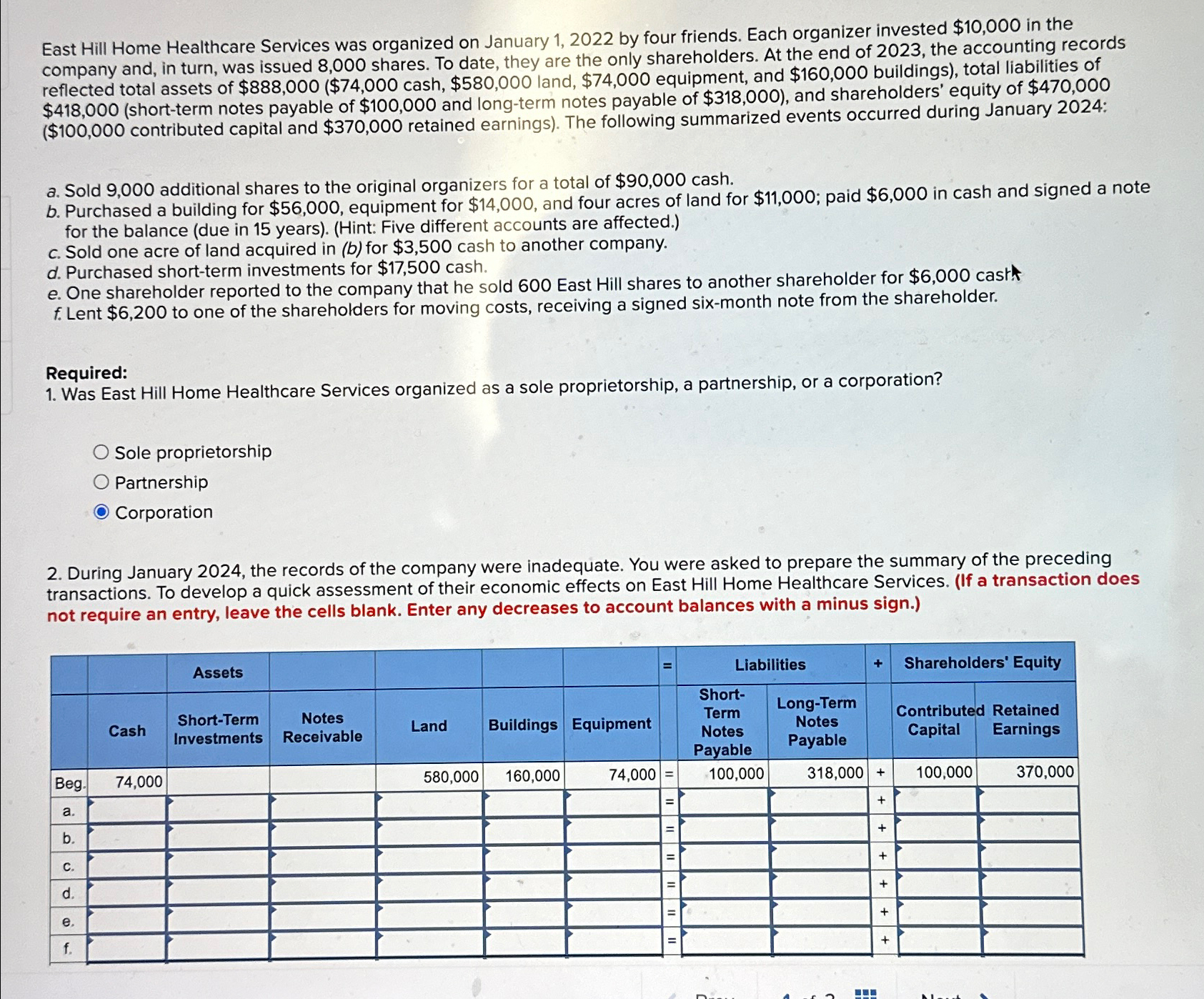

East Hill Home Healthcare Services was organized on January 1, 2022 by four friends. Each organizer invested $10,000 in the company and, in turn, was issued 8,000 shares. To date, they are the only shareholders. At the end of 2023, the accounting records reflected total assets of $888,000 ($74,000 cash, $580,000 land, $74,000 equipment, and $160,000 buildings), total liabilities of $418,000 (short-term notes payable of $100,000 and long-term notes payable of $318,000), and shareholders' equity of $470,000 ($100,000 contributed capital and $370,000 retained earnings). The following summarized events occurred during January 2024: a. Sold 9,000 additional shares to the original organizers for a total of $90,000 cash. b. Purchased a building for $56,000, equipment for $14,000, and four acres of land for $11,000; paid $6,000 in cash and signed a note for the balance (due in 15 years). (Hint: Five different accounts are affected.) c. Sold one acre of land acquired in (b) for $3,500 cash to another company. d. Purchased short-term investments for $17,500 cash. e. One shareholder reported to the company that he sold 600 East Hill shares to another shareholder for $6,000 cash f. Lent $6,200 to one of the shareholders for moving costs, receiving a signed six-month note from the shareholder. Required: 1. Was East Hill Home Healthcare Services organized as a sole proprietorship, a partnership, or a corporation? Sole proprietorship O Partnership Corporation 2. During January 2024, the records of the company were inadequate. You were asked to prepare the summary of the preceding transactions. To develop a quick assessment of their economic effects on East Hill Home Healthcare Services. (If a transaction does not require an entry, leave the cells blank. Enter any decreases to account balances with a minus sign.) Assets + Shareholders' Equity Contributed Retained Capital Earnings Liabilities Short- Long-Term Cash Short-Term Notes Investments Receivable Land Buildings Equipment Term Notes Payable Notes Payable Beg. 74,000 580,000 160,000 74,000 = 100,000 318,000+ 100,000 370,000 + a. b. C. d. e. f. + + + + +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started