Question

Eastern Broom Company manufactures, amongst other broom products, corn brooms. To make a corn broom, a worker begins the manufacturing process by selecting a bundle

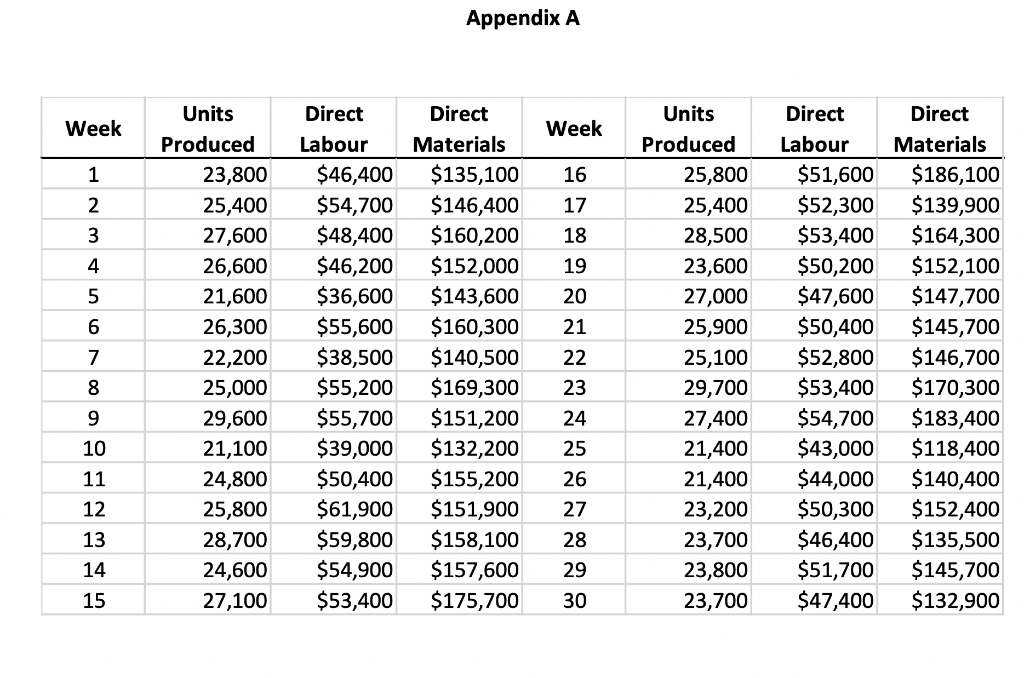

Eastern Broom Company manufactures, amongst other broom products, corn brooms. To make a corn broom, a worker begins the manufacturing process by selecting a bundle of straw, which is prepackaged by the supplier, and a broom handle. The worker puts both items into a machine and presses a button. The machine then binds the bundle of straw and the broom handle to complete production. A production worker, who is paid $40 per hour, can make 20 corn brooms each hour. Total production is limited by the number of labour hours available, which is 1,500. Eastern Broom Company sells its corn brooms for $28 each and is currently operating at capacity. Annual fixed costs assigned to the corn broom operation is $540,000. The production supervisor has provided data, which appears in Appendix A, summarizing production volume, materials cost, and labour costs for the most recent 30 weeks of operations.

A group of students from a local university has undertaken a statistical cost study for Eastern Broom Company. The students believe that a reasonable estimate of the labour cost per unit of production is $2.00 and the cost of materials per unit of production is $6.00. The product manager has advised you to use these cost estimates for materials and labour when answering the questions that follow.

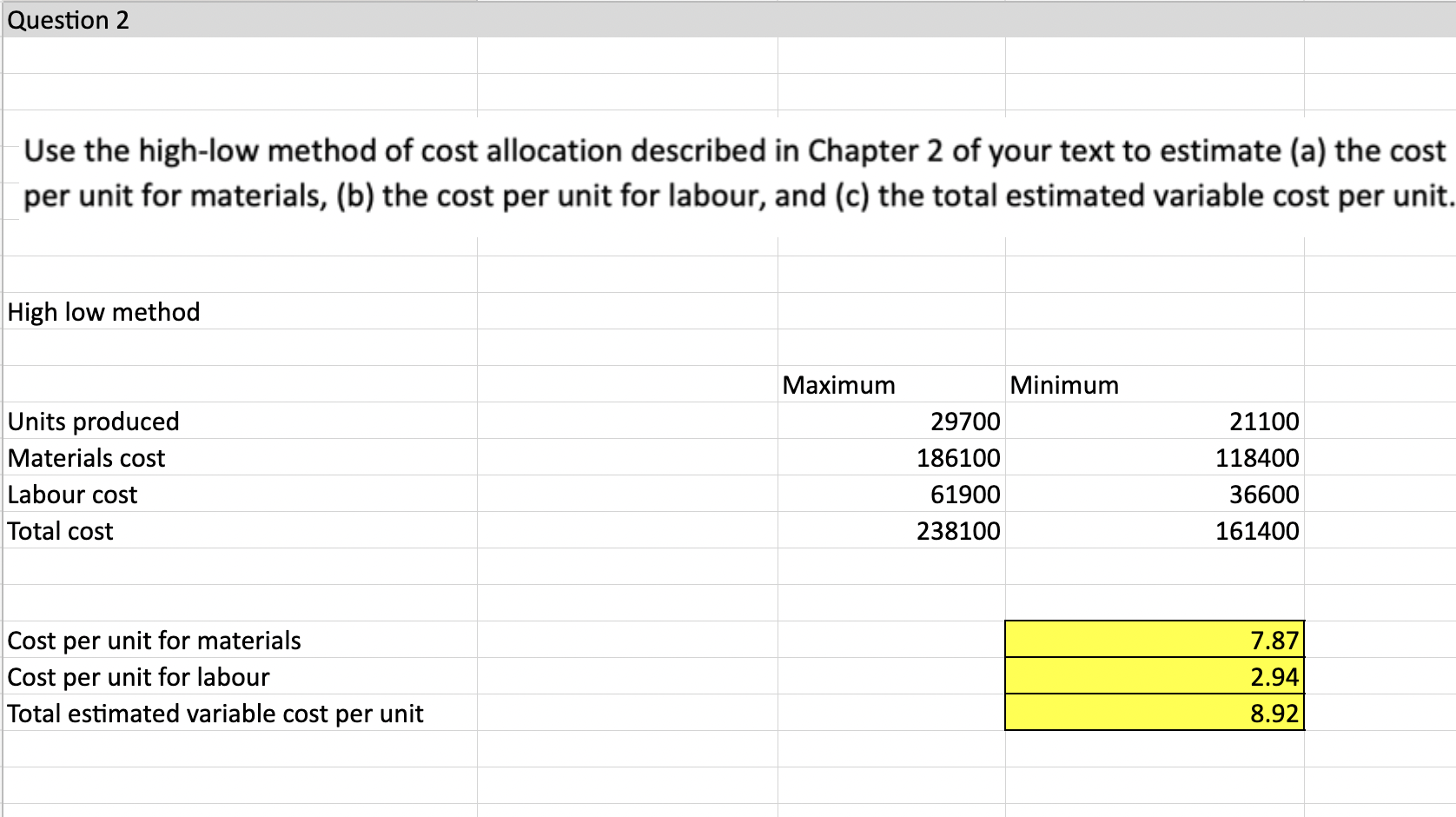

Question 4 (please answer question 4, question 2 is already answered and just used as a reference)

If we assume that the materials and labour cost per corn broom are best estimated by the costs estimated by the students, what would be the consequences of Eastern Corn Broom ignoring these estimates and using the estimates you developed in Question 2 instead. Identify 5 consequences and confine your response to this question to 50 or fewer words.

Question 2 estimates: labour cost of production is 2.94 and cost of material per unit productions is 7.87

Student estimates: labour cost of production is 2.00 and cost of material per unit productions is 6.00

Please answer question 4 and give me 3 more consequences. (I already have two which I will provide below)

Consequence 1. Higher breakeven point calculated (since our calculations are 92 cents higher per unit)

Consequence 2. Higher variable costs (lower contribution margin)

Question 2 Use the high-low method of cost allocation described in Chapter 2 of your text to estimate (a) the cost per unit for materials, (b) the cost per unit for labour, and (c) the total estimated variable cost per unit. High low method Maximum Units produced Materials cost Labour cost Total cost Minimum 29700 186100 61900 238100 21100 118400 36600 161400 Cost per unit for materials Cost per unit for labour Total estimated variable cost per unit 7.87 2.94 8.92 Appendix A Week Week 16 17 18 19 ham tin ON OSA 12 Units Produced 23,800 25,400 27,600 26,600 21,600 26,300 22,200 25,000 29,600 21,100 24,800 25,800 28,700 24,600 27,100 Direct Labour $46,400 $54,700 $48,400 $46,200 $36,600 $55,600 $38,500 $55,200 $55,700 $39,000 $50,400 $61,900 $59,800 $54,900 $53,400 Direct Materials $135,100 $146,400 $160,200 $152,000 $143,600 $160,300 $140,500 $169,300 $ 151,200 $132,200 $155,200 $151,900 $ 158,100 $157,600 $175,700 20 21 22 23 Units Produced 25,800 25,400 28,500 23,600 27,000 25,900 25,100 29,700 27,400 21,400 21,400 23,200 23,700 23,800 23,700 Direct Labour $51,600 $52,300 $53,400 $50,200 $47,600 $50,400 $52,800 $53,400 $54,700 $43,000 $44,000 $50,300 $46,400 $51,700 $47,400 Direct Materials $186,100 $139,900 $164,300 $152,100 $147,700 $145,700 $146,700 $170,300 $183,400 $118,400 $140,400 $152,400 $135,500 $145,700 $132,900 24 10 25 26 11 12 13 14 27 28 29 15 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started