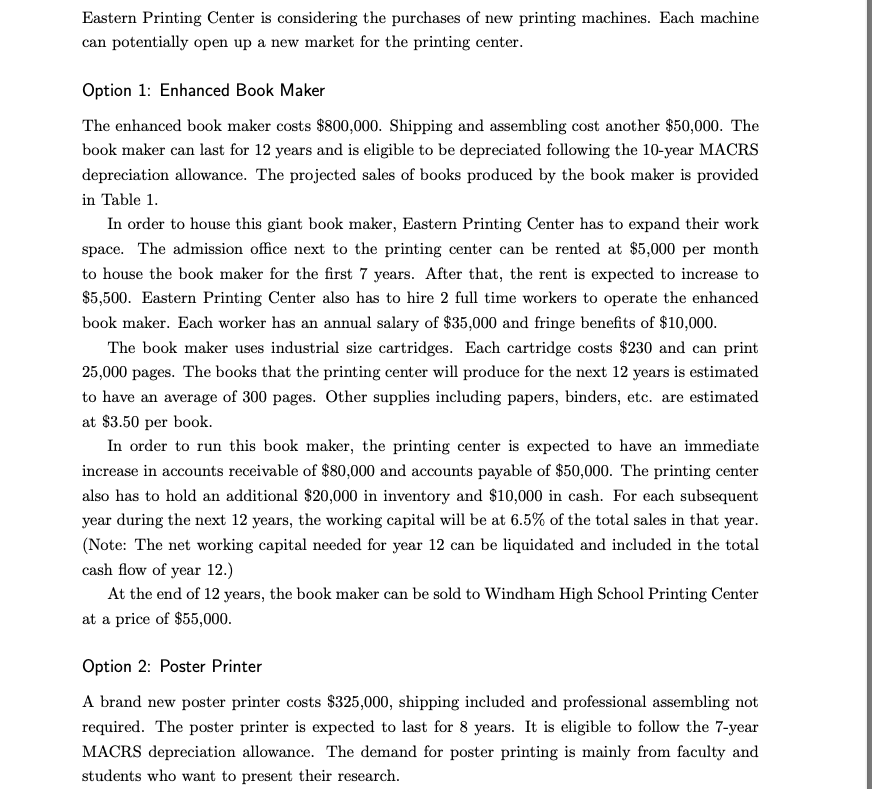

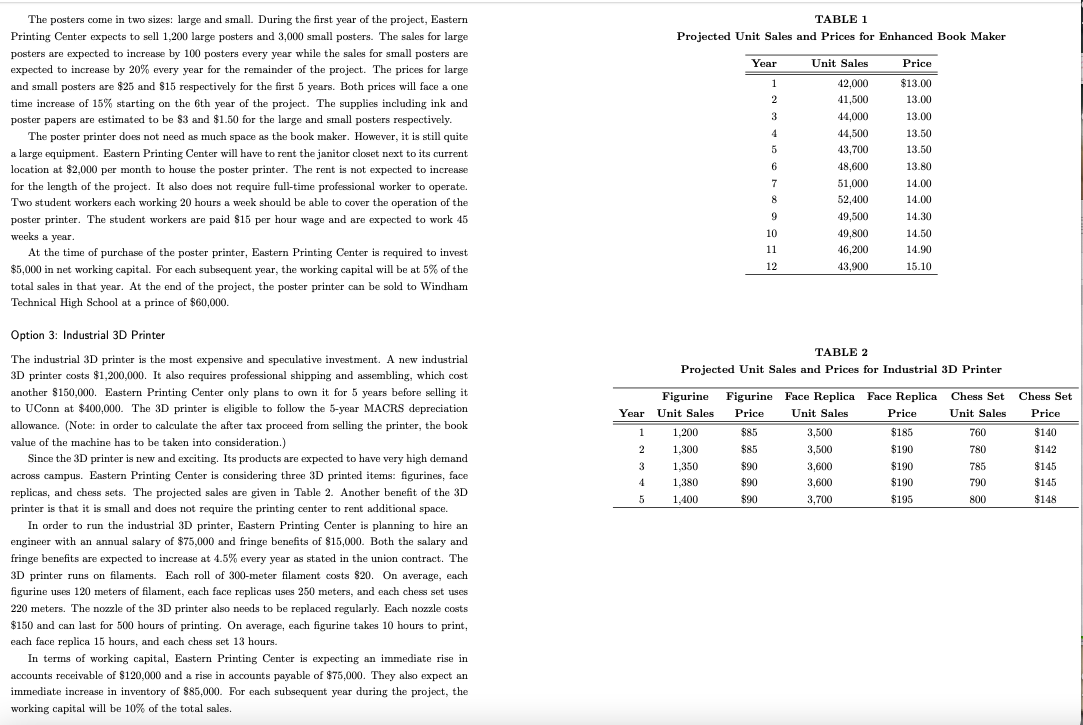

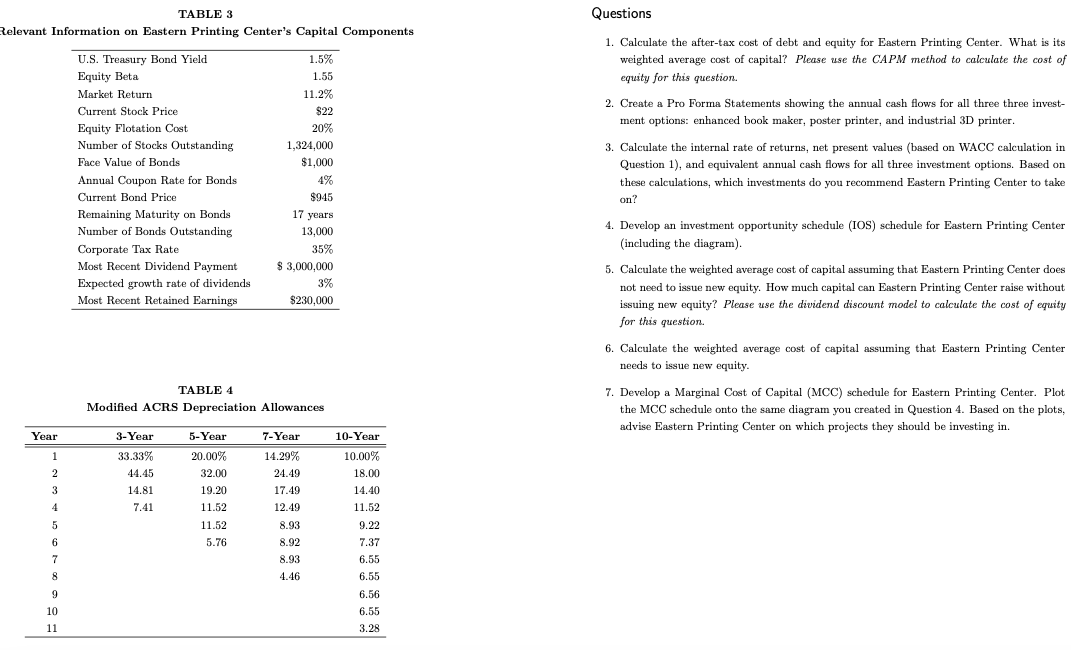

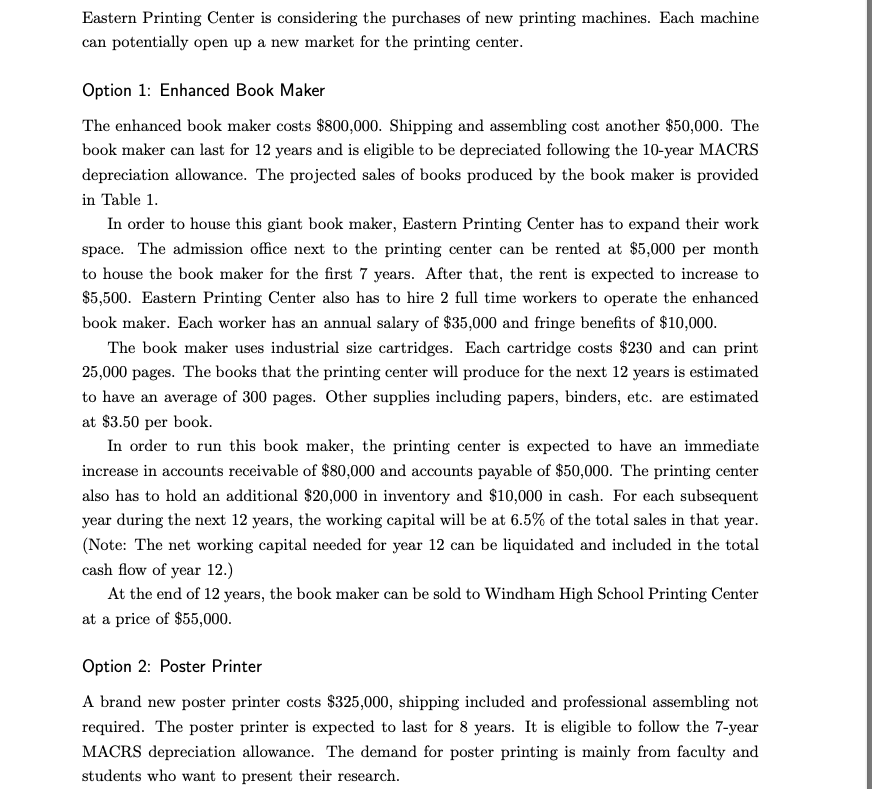

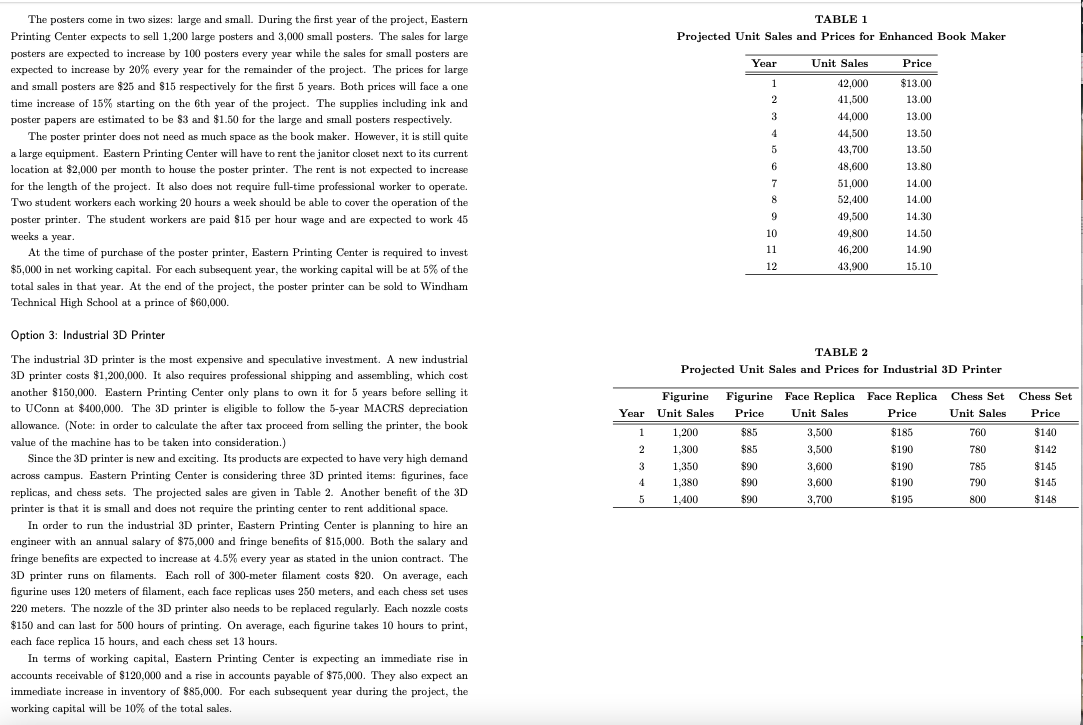

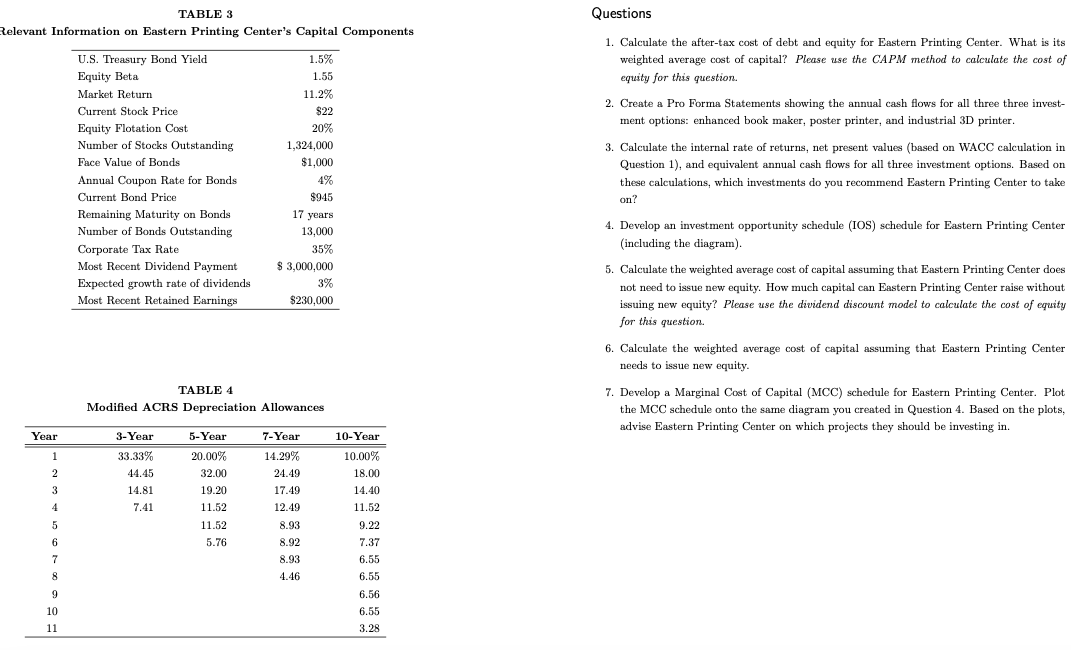

Eastern Printing Center is considering the purchases of new printing machines. Each machine can potentially open up a new market for the printing center. Option 1: Enhanced Book Maker The enhanced book maker costs $800,000. Shipping and assembling cost another $50,000. The book maker can last for 12 years and is eligible to be depreciated following the 10-year MACRS depreciation allowance. The projected sales of books produced by the book maker is provided in Table 1. In order to house this giant book maker, Eastern Printing Center has to expand their work space. The admission office next to the printing center can be rented at $5,000 per month to house the book maker for the first 7 years. After that, the rent is expected to increase to $5,500. Eastern Printing Center also has to hire 2 full time workers to operate the enhanced book maker. Each worker has an annual salary of $35,000 and fringe benefits of $10,000. The book maker uses industrial size cartridges. Each cartridge costs $230 and can print 25,000 pages. The books that the printing center will produce for the next 12 years is estimated to have an average of 300 pages. Other supplies including papers, binders, etc. are estimated at $3.50 per book. In order to run this book maker, the printing center is expected to have an immediate increase in accounts receivable of $80,000 and accounts payable of $50,000. The printing center also has to hold an additional $20,000 in inventory and $10,000 in cash. For each subsequent year during the next 12 years, the working capital will be at 6.5% of the total sales in that year. (Note: The net working capital needed for year 12 can be liquidated and included in the total cash flow of year 12.) At the end of 12 years, the book maker can be sold to Windham High School Printing Center at a price of $55,000. Option 2: Poster Printer A brand new poster printer costs $325,000, shipping included and professional assembling not required. The poster printer is expected to last for 8 years. It is eligible to follow the 7-year MACRS depreciation allowance. The demand for poster printing is mainly from faculty and students who want to present their research. TABLE 1 Projected Unit Sales and Prices for Enhanced Book Maker Year Price 1 2 3 4 5 The posters come in two sizes: large and small. During the first year of the project, Eastern Printing Center expects to sell 1,200 large posters and 3,000 small posters. The sales for large posters are expected to increase by 100 posters every year while the sales for small posters are expected to increase by 20% every year for the remainder of the project. The prices for large and small posters are $25 and $15 respectively for the first 5 years. Both prices will face a one time increase of 15% starting on the 6th year of the project. The supplies including ink and poster papers are estimated to be $3 and $1.50 for the large and small posters respectively. The poster printer does not need as much space as the book maker. However, it is still quite a large equipment. Eastern Printing Center will have to rent the janitor closet next to its current location at $2,000 per month to house the poster printer. The rent is not expected to increase for the length of the project. It also does not require full-time professional worker to operate. Two student workers each working 20 hours a week should be able to cover the operation of of the poster printer. The student workers are paid $15 per hour wage and are expected to work 45 weeks a year At the time of purchase of the poster printer, Eastern Printing Center is required to invest $5,000 in net working capital. For each subsequent year, the working capital will be at 5% of the total sales in that year. At the end of the project, the poster printer can be sold to Windham Technical High School at a prince of $60,000. 6 Unit Sales 42,000 41,500 44,000 44,500 43,700 48,600 51,000 52,400 49,500 49,800 46,200 43,900 $13.00 13.00 13.00 13.50 13.50 13.80 14.00 14.00 14.30 14.50 14.90 15.10 7 8 9 10 11 12 TABLE 2 Projected Unit Sales and Prices for Industrial 3D Printer Chess Set Price $140 Figurine Figurine Face Replica Face Replica Chess Set Year Unit Sales Price Unit Sales Price Unit Sales 1 1,200 $85 $ 3,500 $185 760 2 1,300 $85 3,500 $190 780 3 1.350 $90 3,600 $190 785 4 1,380 $90 3,600 $190 790 5 1,400 $90 3,700 $195 800 $142 $145 $145 $148 Option 3: Industrial 3D Printer The industrial 3D printer is the most expensive and speculative investment. A new industrial 3D printer costs $1,200,000. It also requires professional shipping and assembling, which cost another $150,000. Eastern Printing Center only plans to own it for 5 years before selling it to UConn at $400,000. The 3D printer is eligible to follow the 5-year MACRS depreciation allowance. (Note: in order to calculate the after tax proceed from selling the printer, the book value of the machine has to be taken into consideration.) Since the 3D printer is new and exciting. Its products are expected to have very high demand across campus. Eastern Printing Center is considering three 3D printed items: figurines, face replicas, and chess sets. The projected sales are given in Table 2. Another benefit of the 3D printer is that it is small and does not require the printing center to rent additional space. In order to run the industrial 3D printer, Eastern Printing Center is planning to hire an engineer with an annual salary of $75,000 and fringe benefits of $15,000. Both the salary and fringe benefits are expected to increase at 4.5% every year as stated in the union contract. The 3D printer runs on filaments. Each roll of 300-meter filament costs $20. On average, each son figurine uses 120 meters of filament, each face replicas uses 250 meters, and each chess set uses 220 meters. The nozzle of the 3D printer also needs to be replaced regularly. Each nozzle costs $150 and can last for 500 hours of printing. On average, each figurine takes 10 hours to print, each face replica 15 hours, and each chess set 13 hours. In terms of working capital, Eastern Printing Center is expecting an immediate rise in accounts receivable of $120,000 and a rise in accounts payable of $75,000. They also expect an immediate increase in inventory of $85,000. For each subsequent year during the project, the working capital will be 10% of the total sales. Questions TABLE 3 Relevant Information on Eastern Printing Center's Capital Components 1. Calculate the after-tax cost of debt and equity for Eastern Printing Center. What is its weighted average cost of capital? Please use the CAPM method to calculate the cost of equity for this question. 2. Create a Pro Forma Statements showing the annual cash flows for all three three invest- ment options: enhanced book maker, poster printer, and industrial 3D printer. U.S. Treasury Bond Yield Equity Beta Market Return Current Stock Price Equity Flotation Cost Number of Stocks Outstanding Face Value of Bonds Annual Coupon Rate for Bonds Current Bond Price Remaining Maturity on Bonds Number of Bonds Outstanding Corporate Tax Rate Most Recent Dividend Payment Expected growth rate of dividends Most Recent Retained Earnings 1.5% 1.55 11.2% $22 20% 1,324,000 $1,000 4% 4 $945 17 years 13,000 35% $3,000,000 3% $230,000 3. Calculate the internal rate of returns, net present values (based on WACC calculation in Question 1), and equivalent annual cash flows for all three investment options. Based on these calculations, which investments do you recommend Eastern Printing Center to take on? 4. Develop an investment opportunity schedule (IOS) schedule for Eastern Printing Center (including the diagram). 5. Calculate the weighted average cost of capital assuming that Eastern Printing Center does not need to issue new equity. How much capital can Eastern Printing Center raise without issuing new equity? Please use the dividend discount model to calculate the cost of equity for this question. 6. Calculate the weighted average cost of capital assuming that Eastern Printing Center needs to issue new equity. TABLE4 Modified ACRS Depreciation Allowances 7. Develop a Marginal Cost of Capital (MCC) schedule for Eastern Printing Center. Plot the MCC schedule onto the same diagram you created in Question 4. Based on the plots, advise Eastern Printing Center on which projects they should be investing in Year 3-Year 5-Year 7-Year 33.33% 1 2 3 TTD 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 5.76 14.29% 24.49 17.49 12.49 8.93 8.92 4 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 5 6 6 7 8.93 4.46 8 9 10 6.56 6.55 3.28 11 Eastern Printing Center is considering the purchases of new printing machines. Each machine can potentially open up a new market for the printing center. Option 1: Enhanced Book Maker The enhanced book maker costs $800,000. Shipping and assembling cost another $50,000. The book maker can last for 12 years and is eligible to be depreciated following the 10-year MACRS depreciation allowance. The projected sales of books produced by the book maker is provided in Table 1. In order to house this giant book maker, Eastern Printing Center has to expand their work space. The admission office next to the printing center can be rented at $5,000 per month to house the book maker for the first 7 years. After that, the rent is expected to increase to $5,500. Eastern Printing Center also has to hire 2 full time workers to operate the enhanced book maker. Each worker has an annual salary of $35,000 and fringe benefits of $10,000. The book maker uses industrial size cartridges. Each cartridge costs $230 and can print 25,000 pages. The books that the printing center will produce for the next 12 years is estimated to have an average of 300 pages. Other supplies including papers, binders, etc. are estimated at $3.50 per book. In order to run this book maker, the printing center is expected to have an immediate increase in accounts receivable of $80,000 and accounts payable of $50,000. The printing center also has to hold an additional $20,000 in inventory and $10,000 in cash. For each subsequent year during the next 12 years, the working capital will be at 6.5% of the total sales in that year. (Note: The net working capital needed for year 12 can be liquidated and included in the total cash flow of year 12.) At the end of 12 years, the book maker can be sold to Windham High School Printing Center at a price of $55,000. Option 2: Poster Printer A brand new poster printer costs $325,000, shipping included and professional assembling not required. The poster printer is expected to last for 8 years. It is eligible to follow the 7-year MACRS depreciation allowance. The demand for poster printing is mainly from faculty and students who want to present their research. TABLE 1 Projected Unit Sales and Prices for Enhanced Book Maker Year Price 1 2 3 4 5 The posters come in two sizes: large and small. During the first year of the project, Eastern Printing Center expects to sell 1,200 large posters and 3,000 small posters. The sales for large posters are expected to increase by 100 posters every year while the sales for small posters are expected to increase by 20% every year for the remainder of the project. The prices for large and small posters are $25 and $15 respectively for the first 5 years. Both prices will face a one time increase of 15% starting on the 6th year of the project. The supplies including ink and poster papers are estimated to be $3 and $1.50 for the large and small posters respectively. The poster printer does not need as much space as the book maker. However, it is still quite a large equipment. Eastern Printing Center will have to rent the janitor closet next to its current location at $2,000 per month to house the poster printer. The rent is not expected to increase for the length of the project. It also does not require full-time professional worker to operate. Two student workers each working 20 hours a week should be able to cover the operation of of the poster printer. The student workers are paid $15 per hour wage and are expected to work 45 weeks a year At the time of purchase of the poster printer, Eastern Printing Center is required to invest $5,000 in net working capital. For each subsequent year, the working capital will be at 5% of the total sales in that year. At the end of the project, the poster printer can be sold to Windham Technical High School at a prince of $60,000. 6 Unit Sales 42,000 41,500 44,000 44,500 43,700 48,600 51,000 52,400 49,500 49,800 46,200 43,900 $13.00 13.00 13.00 13.50 13.50 13.80 14.00 14.00 14.30 14.50 14.90 15.10 7 8 9 10 11 12 TABLE 2 Projected Unit Sales and Prices for Industrial 3D Printer Chess Set Price $140 Figurine Figurine Face Replica Face Replica Chess Set Year Unit Sales Price Unit Sales Price Unit Sales 1 1,200 $85 $ 3,500 $185 760 2 1,300 $85 3,500 $190 780 3 1.350 $90 3,600 $190 785 4 1,380 $90 3,600 $190 790 5 1,400 $90 3,700 $195 800 $142 $145 $145 $148 Option 3: Industrial 3D Printer The industrial 3D printer is the most expensive and speculative investment. A new industrial 3D printer costs $1,200,000. It also requires professional shipping and assembling, which cost another $150,000. Eastern Printing Center only plans to own it for 5 years before selling it to UConn at $400,000. The 3D printer is eligible to follow the 5-year MACRS depreciation allowance. (Note: in order to calculate the after tax proceed from selling the printer, the book value of the machine has to be taken into consideration.) Since the 3D printer is new and exciting. Its products are expected to have very high demand across campus. Eastern Printing Center is considering three 3D printed items: figurines, face replicas, and chess sets. The projected sales are given in Table 2. Another benefit of the 3D printer is that it is small and does not require the printing center to rent additional space. In order to run the industrial 3D printer, Eastern Printing Center is planning to hire an engineer with an annual salary of $75,000 and fringe benefits of $15,000. Both the salary and fringe benefits are expected to increase at 4.5% every year as stated in the union contract. The 3D printer runs on filaments. Each roll of 300-meter filament costs $20. On average, each son figurine uses 120 meters of filament, each face replicas uses 250 meters, and each chess set uses 220 meters. The nozzle of the 3D printer also needs to be replaced regularly. Each nozzle costs $150 and can last for 500 hours of printing. On average, each figurine takes 10 hours to print, each face replica 15 hours, and each chess set 13 hours. In terms of working capital, Eastern Printing Center is expecting an immediate rise in accounts receivable of $120,000 and a rise in accounts payable of $75,000. They also expect an immediate increase in inventory of $85,000. For each subsequent year during the project, the working capital will be 10% of the total sales. Questions TABLE 3 Relevant Information on Eastern Printing Center's Capital Components 1. Calculate the after-tax cost of debt and equity for Eastern Printing Center. What is its weighted average cost of capital? Please use the CAPM method to calculate the cost of equity for this question. 2. Create a Pro Forma Statements showing the annual cash flows for all three three invest- ment options: enhanced book maker, poster printer, and industrial 3D printer. U.S. Treasury Bond Yield Equity Beta Market Return Current Stock Price Equity Flotation Cost Number of Stocks Outstanding Face Value of Bonds Annual Coupon Rate for Bonds Current Bond Price Remaining Maturity on Bonds Number of Bonds Outstanding Corporate Tax Rate Most Recent Dividend Payment Expected growth rate of dividends Most Recent Retained Earnings 1.5% 1.55 11.2% $22 20% 1,324,000 $1,000 4% 4 $945 17 years 13,000 35% $3,000,000 3% $230,000 3. Calculate the internal rate of returns, net present values (based on WACC calculation in Question 1), and equivalent annual cash flows for all three investment options. Based on these calculations, which investments do you recommend Eastern Printing Center to take on? 4. Develop an investment opportunity schedule (IOS) schedule for Eastern Printing Center (including the diagram). 5. Calculate the weighted average cost of capital assuming that Eastern Printing Center does not need to issue new equity. How much capital can Eastern Printing Center raise without issuing new equity? Please use the dividend discount model to calculate the cost of equity for this question. 6. Calculate the weighted average cost of capital assuming that Eastern Printing Center needs to issue new equity. TABLE4 Modified ACRS Depreciation Allowances 7. Develop a Marginal Cost of Capital (MCC) schedule for Eastern Printing Center. Plot the MCC schedule onto the same diagram you created in Question 4. Based on the plots, advise Eastern Printing Center on which projects they should be investing in Year 3-Year 5-Year 7-Year 33.33% 1 2 3 TTD 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 5.76 14.29% 24.49 17.49 12.49 8.93 8.92 4 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 5 6 6 7 8.93 4.46 8 9 10 6.56 6.55 3.28 11