Answered step by step

Verified Expert Solution

Question

1 Approved Answer

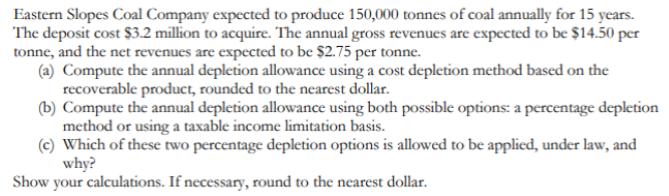

Eastern Slopes Coal Company expected to produce 150,000 tonnes of coal annually for 15 years. The deposit cost $3.2 million to acquire. The annual

Eastern Slopes Coal Company expected to produce 150,000 tonnes of coal annually for 15 years. The deposit cost $3.2 million to acquire. The annual gross revenues are expected to be $14.50 per tonne, and the net revenues are expected to be $2.75 per tonne. (a) Compute the annual depletion allowance using a cost depletion method based on the recoverable product, rounded to the nearest dollar. (b) Compute the annual depletion allowance using both possible options: a percentage depletion method or using a taxable income limitation basis. (c) Which of these two percentage depletion options is allowed to be applied, under law, and why? Show your calculations. If necessary, round to the nearest dollar.

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Solution C The method used to allocate the cost incurred while extracting the natural resources is k...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started