Answered step by step

Verified Expert Solution

Question

1 Approved Answer

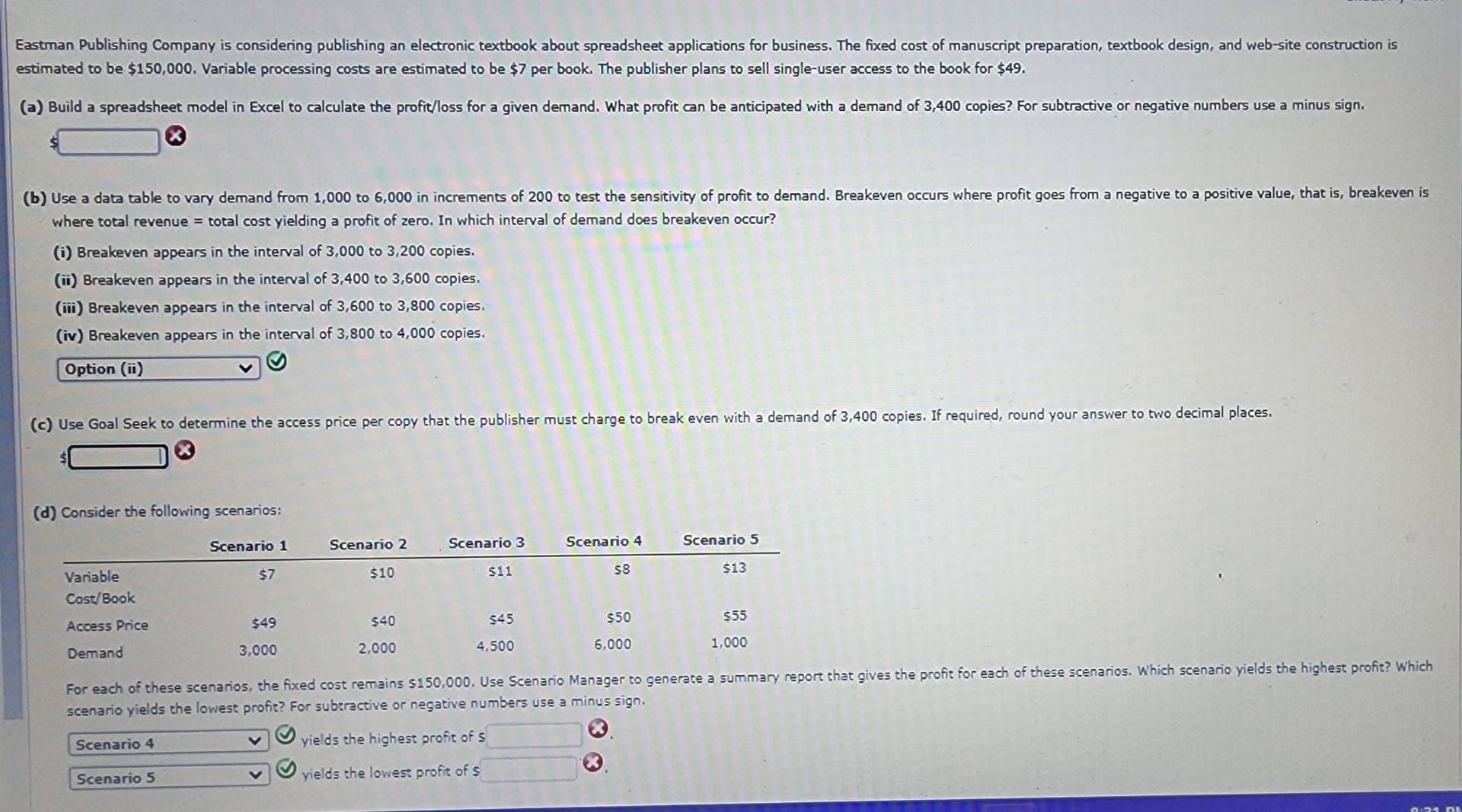

Eastman Publishing Company is considering publishing an electronic textbook about spreadsheet applications for business. The fixed cost of manuscript preparation, textbook design, and web -

Eastman Publishing Company is considering publishing an electronic textbook about spreadsheet applications for business. The fixed cost of manuscript preparation, textbook design, and website construction is estimated to be $ Variable processing costs are estimated to be $ per book. The publisher plans to sell singleuser access to the book for $

a Build a spreadsheet model in Excel to calculate the profitloss for a given demand. What profit can be anticipated with a demand of copies? For subtractive or negative numbers use a minus sign.

b Use a data table to vary demand from to in increments of to test the sensitivity of profit to demand. Breakeven occurs where profit goes from a negative to a positive value, that is breakeven is where total revenue total cost yielding a profit of zero. In which interval of demand does breakeven occur?

i Breakeven appears in the interval of to copies.

ii Breakeven appears in the interval of to copies.

iii Breakeven appears in the interval of to copies.

iv Breakeven appears in the interval of to copies.

c Use Goal Seek to determine the access price per copy that the publisher must charge to break even with a demand of copies. If required, round your answer to two decimal places.

$

d Consider the following scenarios:

tableScenario Scenario Scenario Scenario Scenario Variable$$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started