Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Easy Accounting Question PLease Help!! Parent purchased 100% of Sub Co on 1/1/X3 for $200,000; at this time, the subs net asset value equaled fmv

Easy Accounting Question PLease Help!!

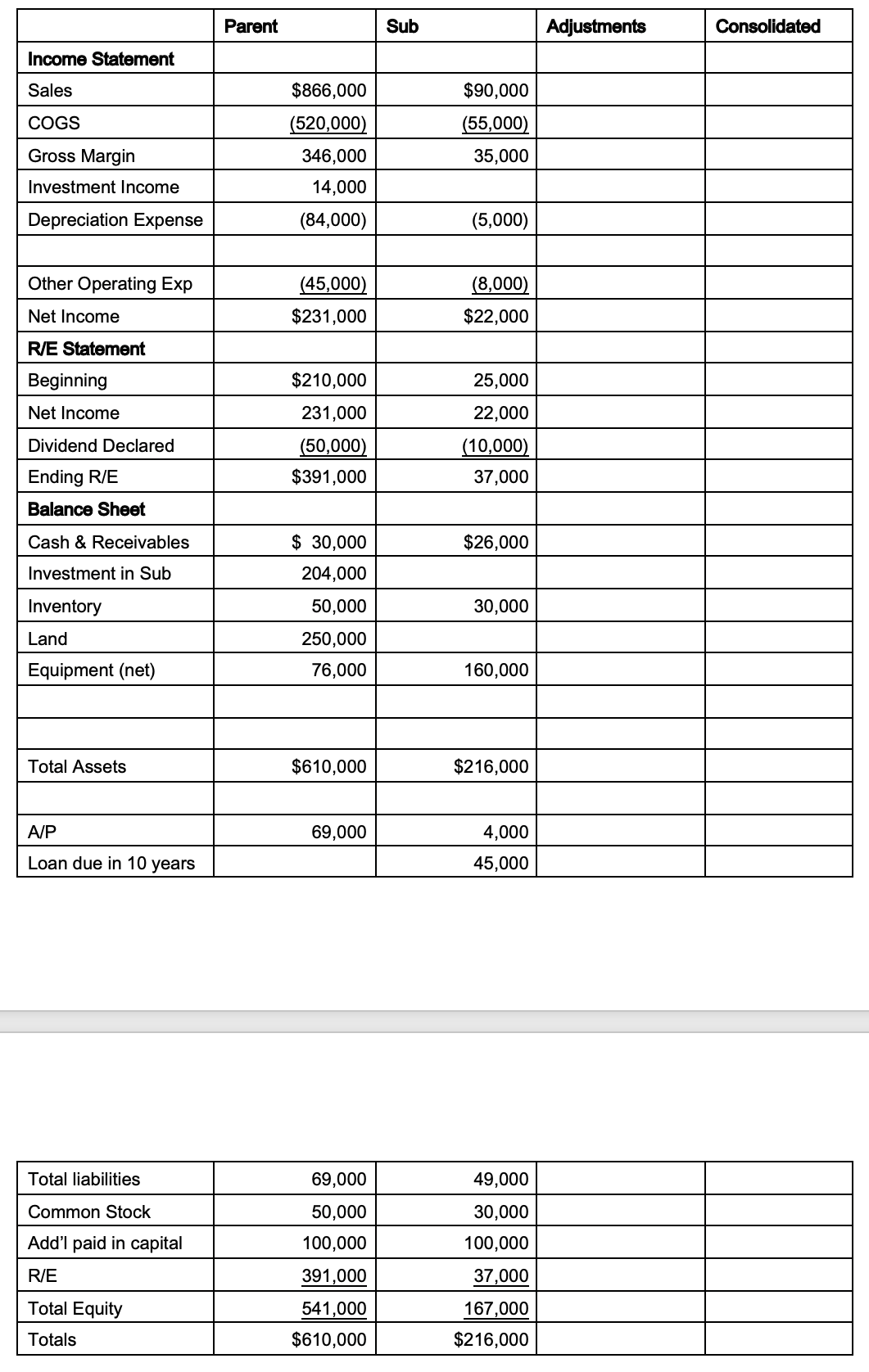

Parent purchased 100% of Sub Co on 1/1/X3 for $200,000; at this time, the subs net asset value equaled fmv except for inventory (+5,000), customer list (10,000, 5 yr life) and equipment (+10,000, 10 year life).

The inventory was sold in the first year after the merger.

Below are the financial statements for the parent and sub on 12/31/x3. Prepare Full F/S (Income statement, statement of R/E, and B/S) for the consolidated company on Dec 31, 20X3.

\begin{tabular}{|c|c|c|c|c|} \hline & Parent & Sub & Adjustments & Consolidated \\ \hline \multicolumn{5}{|l|}{ Income Statement } \\ \hline Sales & $866,000 & $90,000 & & \\ \hline COGS & (520,000) & (55,000) & & \\ \hline Gross Margin & 346,000 & 35,000 & & \\ \hline Investment Income & 14,000 & & & \\ \hline Depreciation Expense & (84,000) & (5,000) & & \\ \hline Other Operating Exp & (45,000) & (8,000) & & \\ \hline Net Income & $231,000 & $22,000 & & \\ \hline \multicolumn{5}{|l|}{ R/E Statement } \\ \hline Beginning & $210,000 & 25,000 & & \\ \hline Net Income & 231,000 & 22,000 & & \\ \hline Dividend Declared & (50,000) & (10,000) & & \\ \hline Ending R/E & $391,000 & 37,000 & & \\ \hline \multicolumn{5}{|l|}{ Balance Sheet } \\ \hline Cash \& Receivables & $30,000 & $26,000 & & \\ \hline Investment in Sub & 204,000 & & & \\ \hline Inventory & 50,000 & 30,000 & & \\ \hline Land & 250,000 & & & \\ \hline Equipment (net) & 76,000 & 160,000 & & \\ \hline Total Assets & $610,000 & $216,000 & & \\ \hline A/P & 69,000 & 4,000 & & \\ \hline Loan due in 10 years & & 45,000 & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|l|l|} \hline Total liabilities & 69,000 & 49,000 & & \\ \hline Common Stock & 50,000 & 30,000 & & \\ \hline Add'l paid in capital & 100,000 & 100,000 & & \\ \hline R/E & 391,000 & 37,000 & & \\ \hline Total Equity & 541,000 & 167,000 & & \\ \hline Totals & $610,000 & $216,000 & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|} \hline & Parent & Sub & Adjustments & Consolidated \\ \hline \multicolumn{5}{|l|}{ Income Statement } \\ \hline Sales & $866,000 & $90,000 & & \\ \hline COGS & (520,000) & (55,000) & & \\ \hline Gross Margin & 346,000 & 35,000 & & \\ \hline Investment Income & 14,000 & & & \\ \hline Depreciation Expense & (84,000) & (5,000) & & \\ \hline Other Operating Exp & (45,000) & (8,000) & & \\ \hline Net Income & $231,000 & $22,000 & & \\ \hline \multicolumn{5}{|l|}{ R/E Statement } \\ \hline Beginning & $210,000 & 25,000 & & \\ \hline Net Income & 231,000 & 22,000 & & \\ \hline Dividend Declared & (50,000) & (10,000) & & \\ \hline Ending R/E & $391,000 & 37,000 & & \\ \hline \multicolumn{5}{|l|}{ Balance Sheet } \\ \hline Cash \& Receivables & $30,000 & $26,000 & & \\ \hline Investment in Sub & 204,000 & & & \\ \hline Inventory & 50,000 & 30,000 & & \\ \hline Land & 250,000 & & & \\ \hline Equipment (net) & 76,000 & 160,000 & & \\ \hline Total Assets & $610,000 & $216,000 & & \\ \hline A/P & 69,000 & 4,000 & & \\ \hline Loan due in 10 years & & 45,000 & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|l|l|} \hline Total liabilities & 69,000 & 49,000 & & \\ \hline Common Stock & 50,000 & 30,000 & & \\ \hline Add'l paid in capital & 100,000 & 100,000 & & \\ \hline R/E & 391,000 & 37,000 & & \\ \hline Total Equity & 541,000 & 167,000 & & \\ \hline Totals & $610,000 & $216,000 & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started