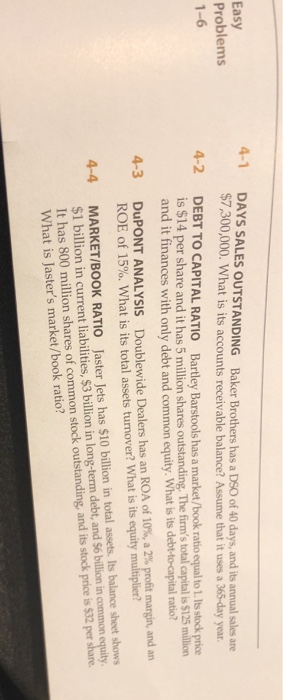

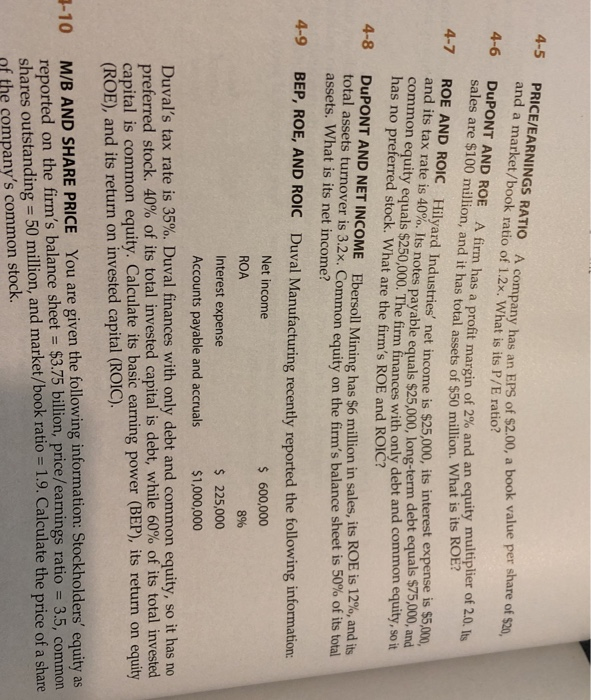

Easy Problems 1-6 4-1 DAYS SALES OUTSTANDING $7 300,000. What is its accounts receivable balance? Assume DEBT TO CAPITAL RATIO is $14 per share and it has 5 million shares outstanding, The firm's total capital is $125 million and it finances with only debt and common equity. What is its d DuPONT ANALYSIS ROE of 15%. What is its total assets turnover? what is its equity multiplier? Baker Brothers has a DSO of 40 days, and its annual sales are that it uses a 365-day year 4-2 Bartley Barstools has a market/book ratio equal to 1.Its stock ebt-to-capital ratio? 4-3 Doublewide Dealers has an ROA of 10%, a 2% profit margin, and an 4-4 Jaster Jets has $10 billion in total assets. Its balance sheet shows MARKET/BOOK RATIO $1 billion in current liabilities, $3 billion in long-term debt, and S6 billion in common equity It has 800 million shares of common stock outstanding, and its stock price is $32 per What is Jaster's market/book ratio? 4-5 PRICE/EARNINGS RATIO A company has an EPS of $2.00, a boo 4-6 DuPONT AND ROE A firm has a profit margin of 2% 4-7 ROE AND ROIC Hilyard Industries' net income is $25,000, its interest expense is s5.00 and a market/book ratio of 1.2x. What is its P/E ratio? value per share of $20, sales are $100 million, and it has total assets of $50 million. and an equity multiplier of 2.0. Its What is its ROE? and its tax rate is 40%. Its notes payable equals $25,000, long-term debt equal ,and common equity equals $250,000. The firm finances with only debt and common equity, so it has no preferred stock. What are the firm's ROE and ROIC? 4-8 total assets turnover is 3.2x. Common equity on the firm's balance sheet is assets. What is its net income? DuPONT AND NET INCOME Ebersoll Mining has $6 million in sales, its ROE is 12%, and its 50% of its total 4-9 BEP, ROE, AND ROIC Duval Manufacturin g recently reported the following information 600,000 Net income ROA Interest expense Accounts payable and accruals 8% 225,000 $1,000,000 Duval's tax rate is 35%. Duval finances with only debt and common equity, so it has no preferred stock, 40% of its total invested capital is debt, while 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC) uity as , common late the price of a share You are given the following information: Stockholders' eq M/B AND SHARE PRICE reported on the firm's balance sheet $3.75 billion, price/earnings ratio- 3.5 shares outstanding 50 million, and market/book ratio -1.9. Calcul nf the company's common stock. -10