Answered step by step

Verified Expert Solution

Question

1 Approved Answer

easy questions pleasse fastt please i give thumbs uppp Question 1 Stock price never reacts to the unanticipated changes in the dividend. As it has

easy questions pleasse fastt

please i give thumbs uppp

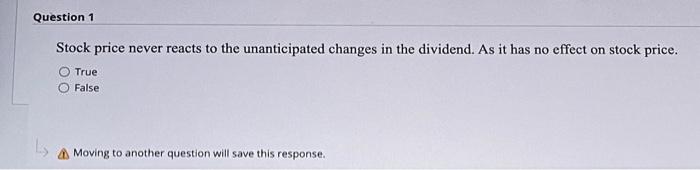

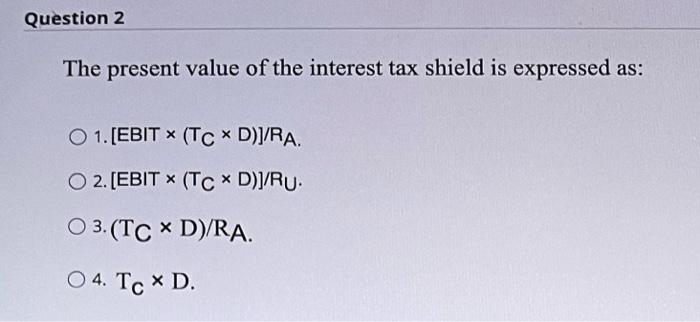

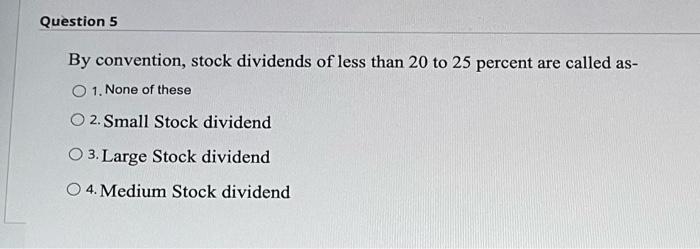

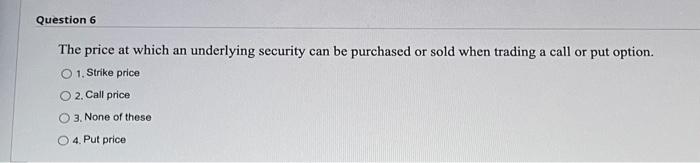

Question 1 Stock price never reacts to the unanticipated changes in the dividend. As it has no effect on stock price. True False Les Moving to another question will save this response. Question 2 The present value of the interest tax shield is expressed as: O1. [EBIT x (Tc x D)]/RA. O2. [EBIT * (TC * D)]/RU. O 3.(TC * D)/RA. O 4. Tc * D. Moving to another question will save this response Question 3 Investors have different perspective on dividend some prefer low whereas, some prefer high dividend pay-out, and this process is called as clientele efr True False Question 4 Stock splits and stock dividends are essentially the same concept but applied in different manner. True False Question 5 By convention, stock dividends of less than 20 to 25 percent are called as- O 1. None of these 2. Small Stock dividend 3. Large Stock dividend 4. Medium Stock dividend Question 6 The price at which an underlying security can be purchased or sold when trading a call or put option. 1. Strike price 2. Call price 3. None of these 4. Put price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started