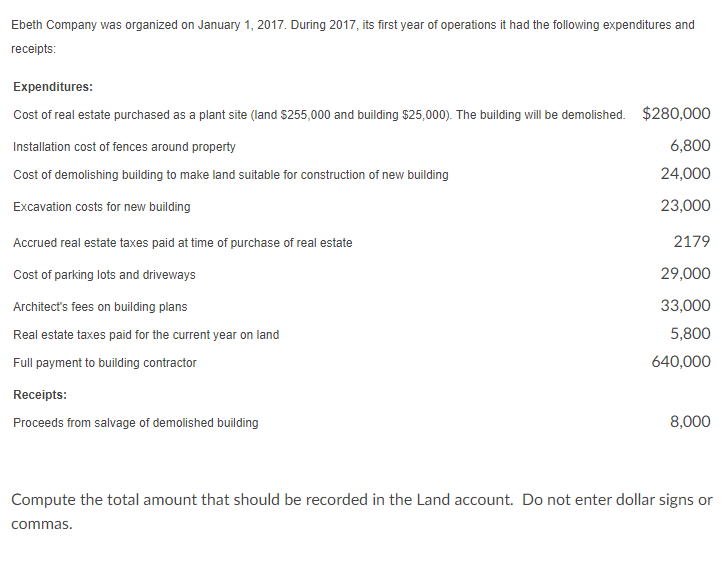

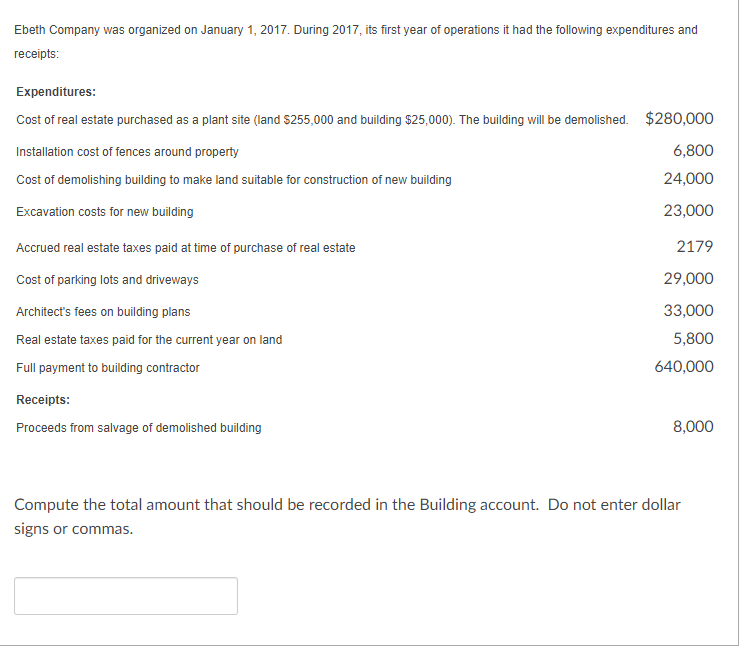

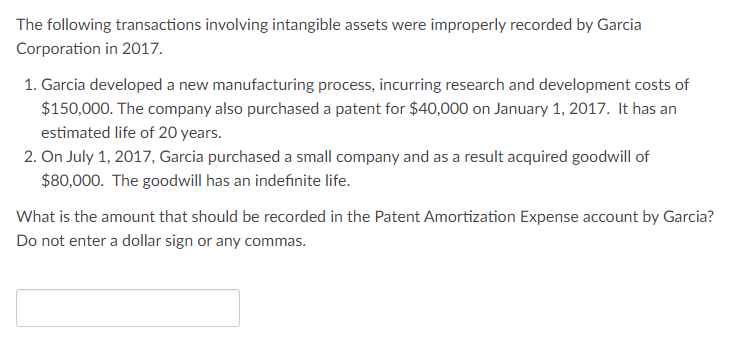

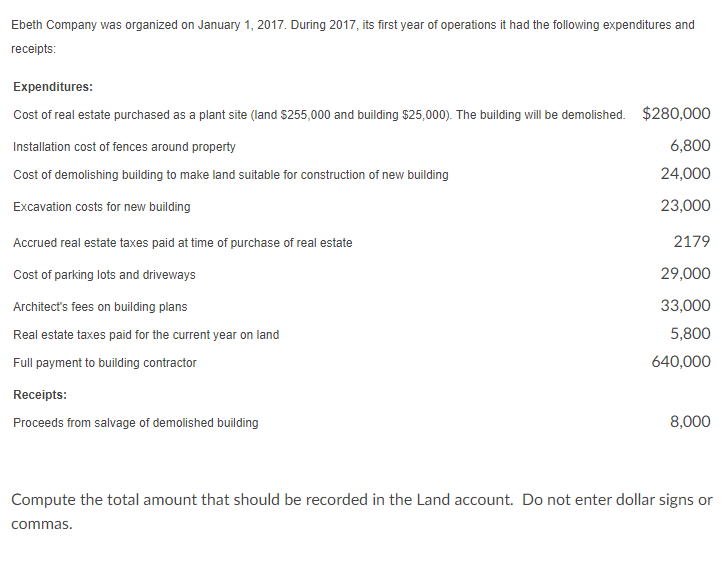

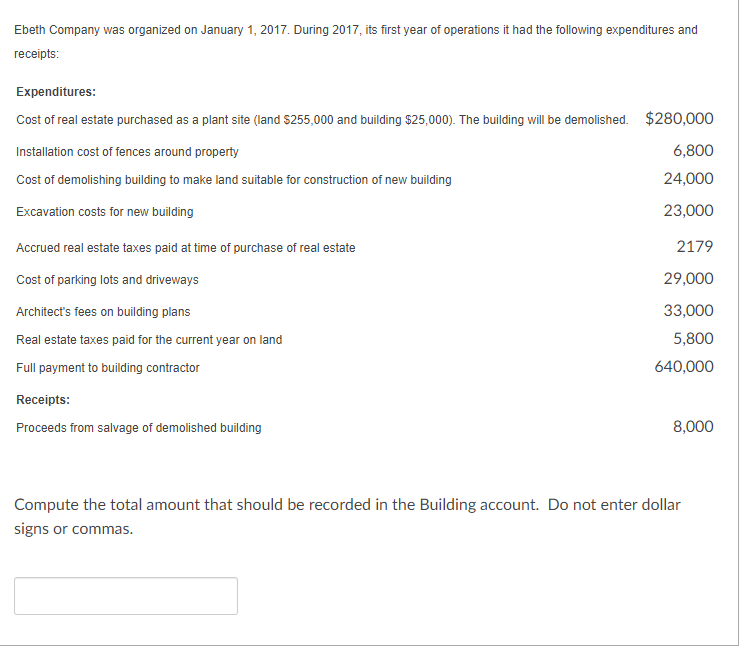

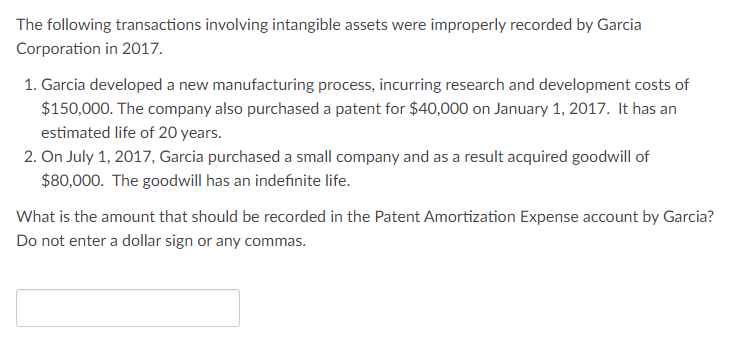

Ebeth Company was organized on January 1, 2017. During 2017, its first year of operations it had the following expenditures and receipts: Expenditures: Cost of real estate purchased as a plant site (land $255,000 and building $25,000). The building will be demolished. $280,000 Installation cost of fences around property Cost of demolishing building to make land suitable for construction of new building 6,800 24,000 Excavation costs for new building 23,000 Accrued real estate taxes paid at time of purchase of real estate 2179 29,000 Cost of parking lots and driveways Architect's fees on building plans Real estate taxes paid for the current year on land Full payment to building contractor 33,000 5,800 640,000 Receipts: Proceeds from salvage of demolished building 8,000 Compute the total amount that should be recorded in the Land account. Do not enter dollar signs or commas. Ebeth Company was organized on January 1, 2017. During 2017, its first year of operations it had the following expenditures and receipts: Expenditures: Cost of real estate purchased as a plant site (land $255,000 and building $25,000). The building will be demolished. $280,000 Installation cost of fences around property 6,800 Cost of demolishing building to make land suitable for construction of new building 24,000 Excavation costs for new building 23,000 Accrued real estate taxes paid at time of purchase of real estate 2179 Cost of parking lots and driveways Architect's fees on building plans Real estate taxes paid for the current year on land Full payment to building contractor 29,000 33,000 5,800 640,000 Receipts: Proceeds from salvage of demolished building 8,000 Compute the total amount that should be recorded in the Building account. Do not enter dollar signs or commas. The following transactions involving intangible assets were improperly recorded by Garcia Corporation in 2017. 1. Garcia developed a new manufacturing process, incurring research and development costs of $150,000. The company also purchased a patent for $40,000 on January 1, 2017. It has an estimated life of 20 years. 2. On July 1, 2017, Garcia purchased a small company and as a result acquired goodwill of $80,000. The goodwill has an indefinite life. What is the amount that should be recorded in the Patent Amortization Expense account by Garcia? Do not enter a dollar sign or any commas