Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EBike, Inc. is considering opening a new product line for its Arlington factory to meet the demand for solar- charged e-bikes. The proposed project

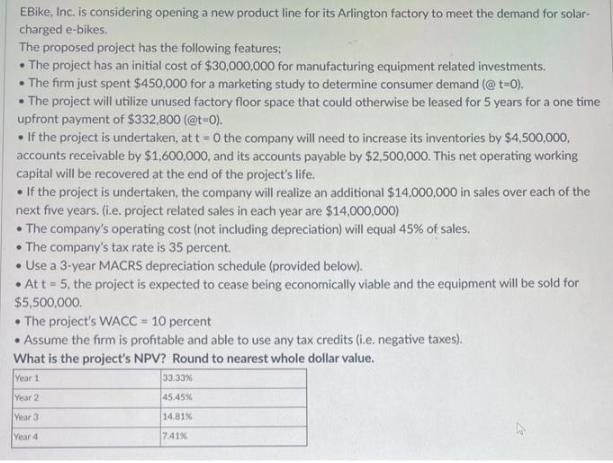

EBike, Inc. is considering opening a new product line for its Arlington factory to meet the demand for solar- charged e-bikes. The proposed project has the following features: The project has an initial cost of $30,000,000 for manufacturing equipment related investments. The firm just spent $450,000 for a marketing study to determine consumer demand (@t-0). The project will utilize unused factory floor space that could otherwise be leased for 5 years for a one time upfront payment of $332,800 (@t-0). If the project is undertaken, at t=0 the company will need to increase its inventories by $4,500,000, accounts receivable by $1,600,000, and its accounts payable by $2,500,000. This net operating working capital will be recovered at the end of the project's life. If the project is undertaken, the company will realize an additional $14,000,000 in sales over each of the next five years. (i.e. project related sales in each year are $14,000,000) The company's operating cost (not including depreciation) will equal 45% of sales. The company's tax rate is 35 percent. Use a 3-year MACRS depreciation schedule (provided below). At t = 5, the project is expected to cease being economically viable and the equipment will be sold for $5,500,000. The project's WACC = 10 percent Assume the firm is profitable and able to use any tax credits (i.e. negative taxes). What is the project's NPV? Round to nearest whole dollar value. Year 1 33.33% Year 2 45.45% Year 3 14.81% Year 4 7.41%

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the projects NPV we need to find the present value of all cash flows both initial investment and future cash flows and then subtract the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started