Answered step by step

Verified Expert Solution

Question

1 Approved Answer

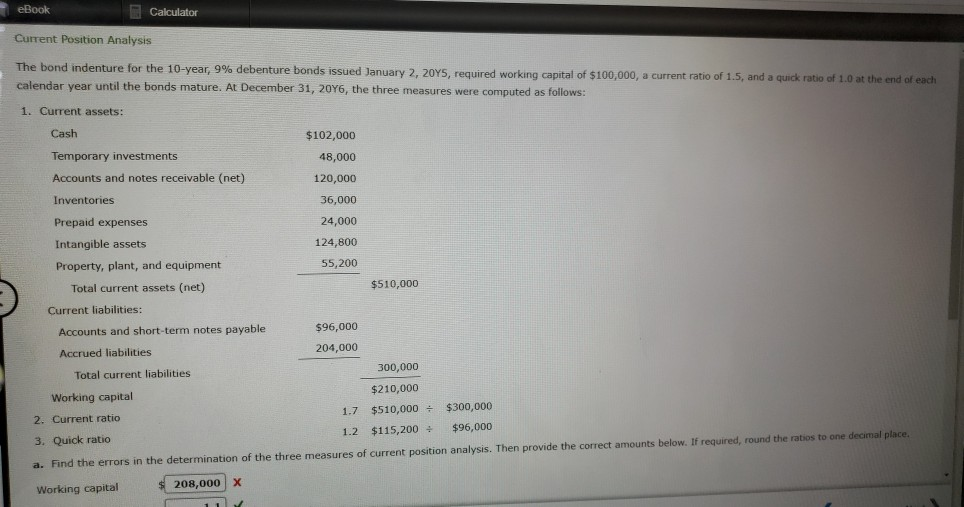

eBook Calculator Current Position Analysis The bond indenture for the 10-year, 9% debenture bonds issued January 2, 20Y5, required working capital of $100,000, a current

eBook Calculator Current Position Analysis The bond indenture for the 10-year, 9% debenture bonds issued January 2, 20Y5, required working capital of $100,000, a current ratio of 1.5, and a quick ratio of 1.0 at the end of each calendar year until the bonds mature. At December 31, 20Y6, the three measures were computed as follows: 1. Current assets: Cash $102,000 Temporary investments 48,000 Accounts and notes receivable (net) 120,000 Inventories 36,000 24,000 Prepaid expenses 124,800 Intangible assets 55,200 Property, plant, and equipment $510,000 Total current assets (net) Current liabilities: $96,000 Accounts and short-term notes payable 204,000 Accrued liabilities 300,000 Total current liabilities $210,000 Working capital $300,000 1.7 $510,000 2. Current ratio $96,000 1.2 $115,200+ 3. Quick ratio rors in the determination of the three measures of current position analysis. Then provide the correct amounts below. If required, round the ratios to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started