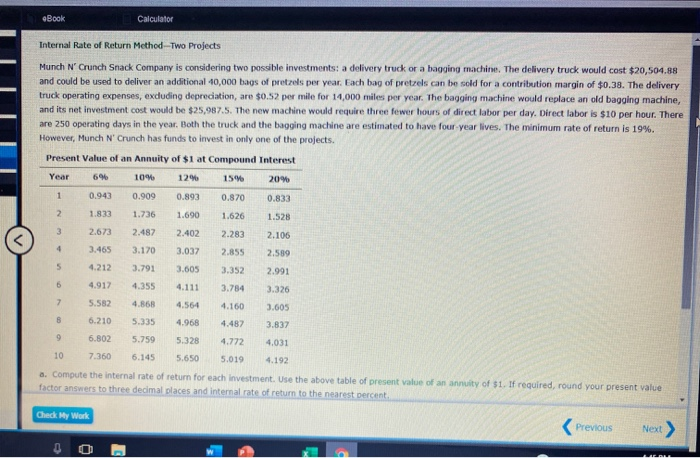

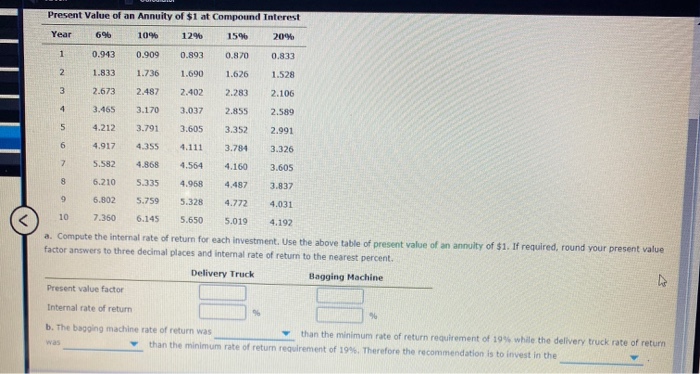

eBook Calculator Internal Rate of Return Method -Two Projects Munch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $20,504.88 and could be used to deliver an additional 10,000 bags of pretzels per year. Each bag of pretres can be sold for a contribution margin of $0.38. The delivery truck operating expenses, excluding depreciation, are $0.52 per mile for 14,000 miles per year. The bagging machine would replace an old bagging machine, and its net investment cost would be $25,987.5. The new machine would require three fewer hours of direct labor per day. Direct laboris $10 per hour. There are 250 operating days in the year. Both the truck and the bagging machine are estimated to have four year lives. The minimum rate of return is 19%. However, Munch N Crunch has funds to invest in only one of the projects Present Value of an Annuity of $1 at Compound Interest Year 696 101 129 150 209 0.943 0.909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.352 2.991 4.917 4.355 4.111 3.784 3.326 5.582 4.868 4.564 4.160 1.605 6.210 5.335 4.968 4.487 3.837 6.802 5.759 5.328 4.772 4.031 107.360 6.145 5.650 5.019 4.192 a. Compute the internal rate of return for each investment. Use the above table of present value of an annuity of 51. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest percent Check My Work Present Value of an Annuity of $1 at Compound Interest Year696 10% 12% 15% 20% 1.111 0.943 0.909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.352 2.991 4.917 4.355 3.784 3.326 5.582 4.868 4.564 4.160 3.605 6.210 5.335 4.968 4.487 3.837 6.802 5.759 5.328 4.772 4.031 107.360 6.145 5.6505.0194.192 a. Compute the internal rate of return for each investment. Use the above table of present value of an annulty of $1. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest percent. Delivery Truck Bagging Machine Present value factor Internal rate of return b. The bagging machine rate of return was than the minimum rate of return requirement of 19% while the delivery truck rate of return was than the minimum rate of return requirement of 19%. Therefore the recommendation is to invest in the