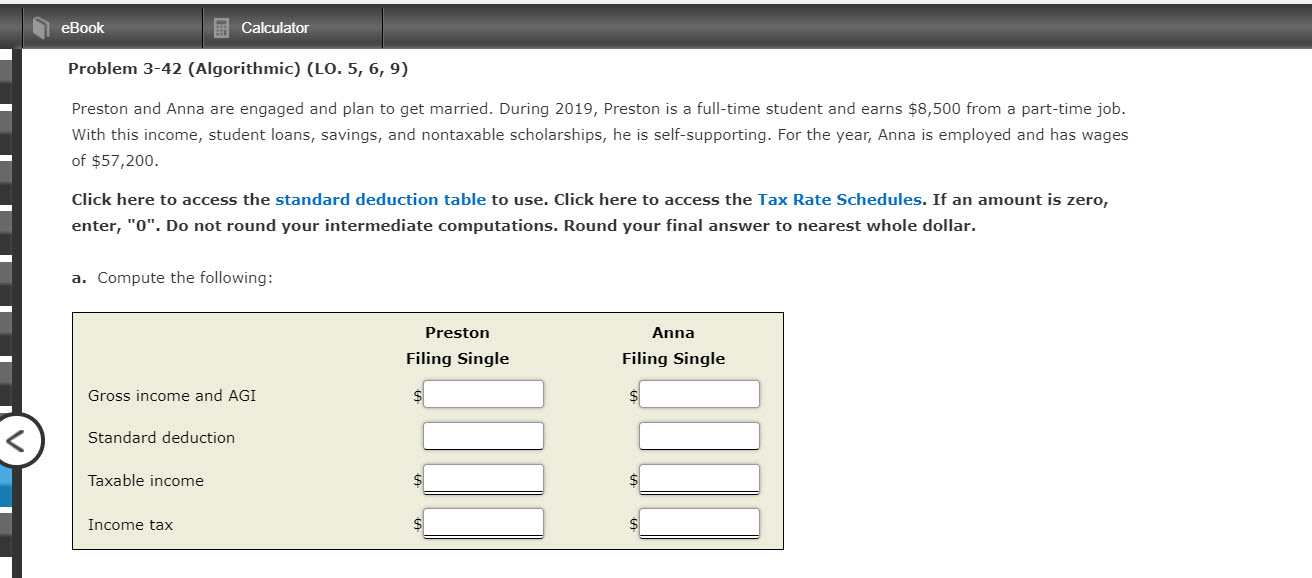

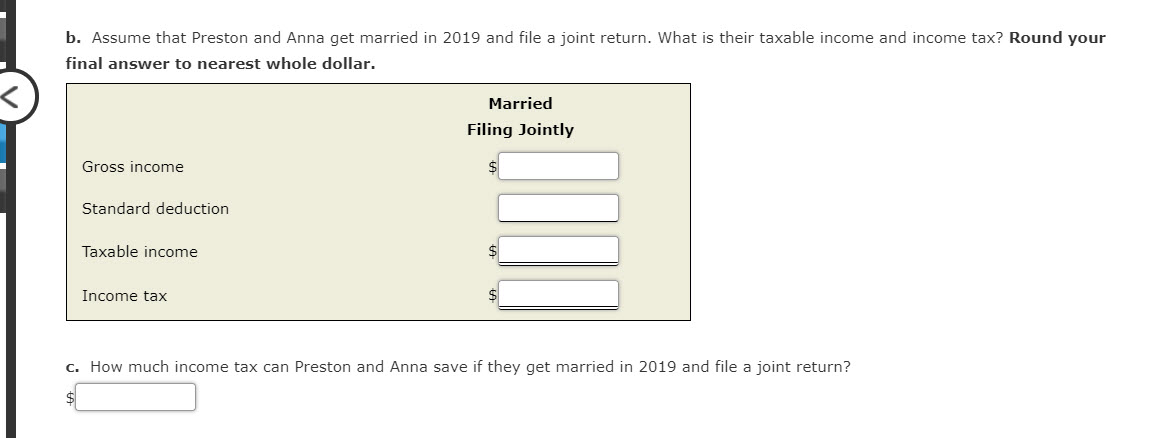

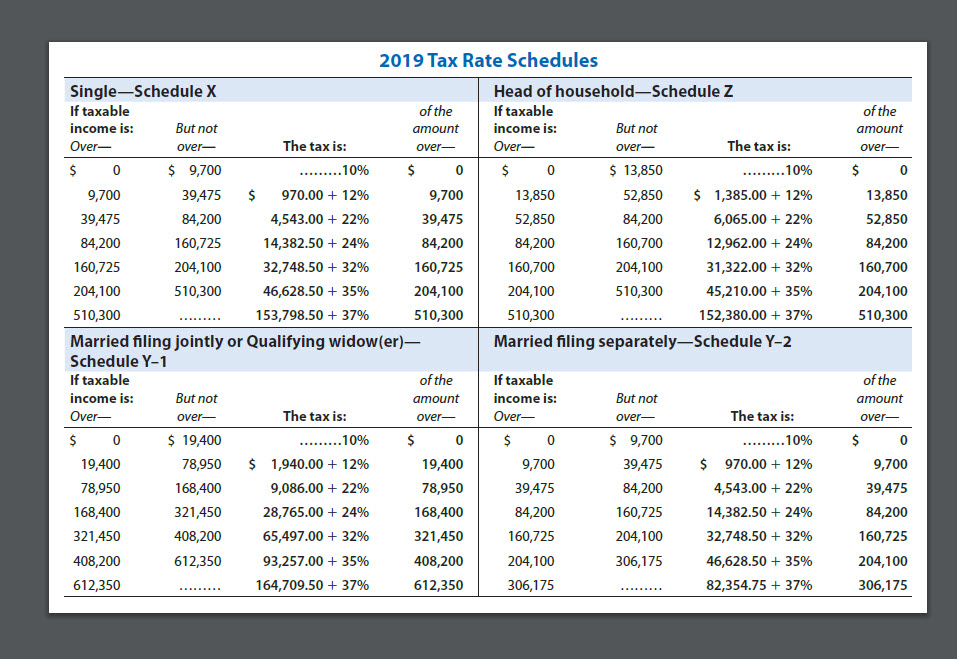

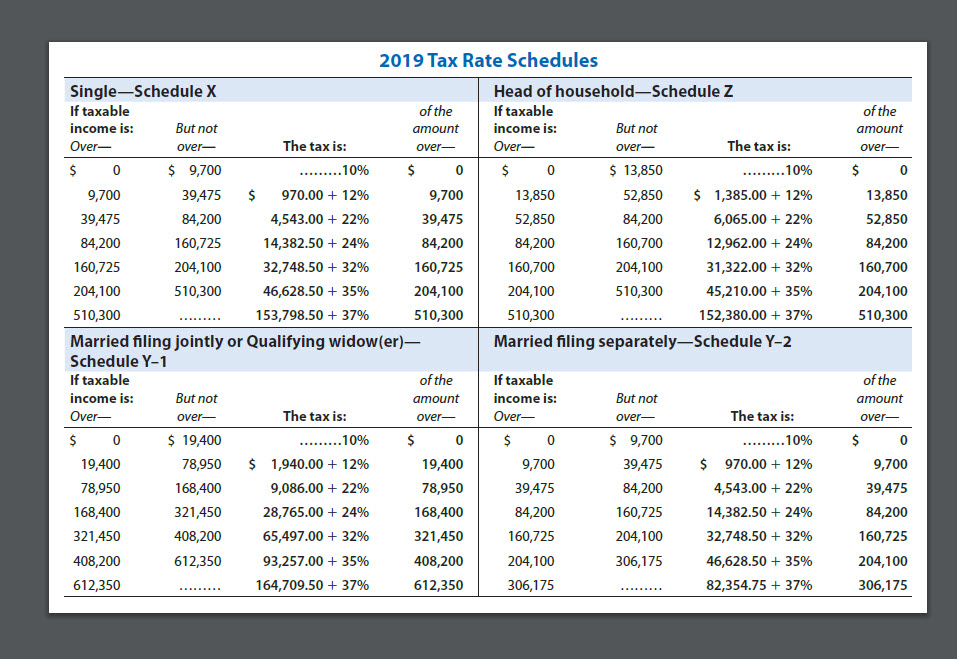

eBook Calculator Problem 3-42 (Algorithmic) (LO. 5, 6, 9) Preston and Anna are engaged and plan to get married. During 2019, Preston is a full-time student and earns $8,500 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Anna is employed and has wages of $57,200. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to nearest whole dollar. a. Compute the following: Preston Filing Single Anna Filing Single Gross income and AGI $ $ Standard deduction Taxable income A Income tax b. Assume that Preston and Anna get married in 2019 and file a joint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar. Married Filing Jointly Gross income Standard deduction Taxable income . Income tax c. How much income tax can Preston and Anna save if they get married in 2019 and file a joint return? of the amount over- 13,850 52,850 84,200 160,700 204,100 510,300 2019 Tax Rate Schedules Single Schedule X Head of household-Schedule Z If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over- Over- over- The tax is: $ 0 $ 9,700 .........10% $ 13,850 ......... 10% 9,700 39,475 $ 970.00 + 12% 9,700 13,850 52,850 $ 1,385.00 + 12% 39,475 84,200 4,543.00 + 22% 39,475 52,850 84,200 6,065.00 + 22% 84,200 160,725 14,382.50 + 24% 84,200 84,200 160,700 12,962.00 + 24% 160,725 204,100 32,748.50 + 32% 160,725 160,700 204,100 31,322.00 + 32% 204,100 510,300 46,628.50 + 35% 204,100 204,100 510,300 45,210.00 + 35% 510,300 153,798.50 + 37% 510,300 510,300 152,380.00 + 37% Married filing jointly or Qualifying widow(er) - Married filing separatelySchedule Y-2 Schedule Y-1 If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over Over- over- The tax is: $ 0 $ 19,400 .........10% $ 0 $ 0 $ 9,700 ......... 10% 19,400 78,950 $ 1,940.00 + 12% 19,400 9,700 39,475 $ 970.00 + 12% 78,950 168,400 9,086.00 + 22% 78,950 39,475 84,200 4,543.00 + 22% 168,400 321,450 28,765.00 + 24% 168,400 84,200 160,725 14,382.50 +24% 321,450 408,200 65,497.00 + 32% 321,450 160,725 204,100 32,748.50 + 32% 408,200 612,350 93,257.00 + 35% 408,200 204,100 306,175 46,628.50 + 35% 612,350 164,709.50 + 37% 612,350 306,175 82,354.75 + 37% of the amount over- 9,700 39,475 84,200 160,725 204,100 306,175