Answered step by step

Verified Expert Solution

Question

1 Approved Answer

eBook Exercise 2 7 - 1 9 ( LO . 3 ) Elizabeth made taxable gifts of $ 3 , 0 0 0 , 0

eBook

Exercise LO

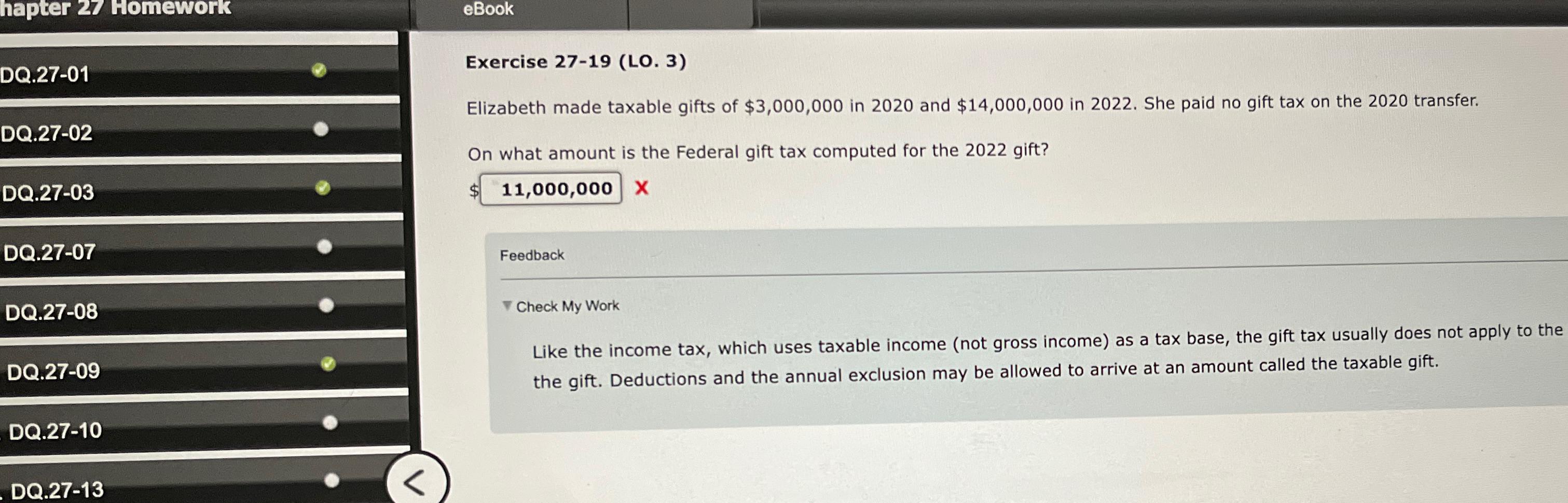

Elizabeth made taxable gifts of $ in and $ in She paid no gift tax on the transfer.

On what amount is the Federal gift tax computed for the gift?

DQ

DQ

Feedback

DQ

Check My Work

DQ

Like the income tax, which uses taxable income not gross income as a tax base, the gift tax usually does not apply to the the gift. Deductions and the annual exclusion may be allowed to arrive at an amount called the taxable gift.

DQ

DQ

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started