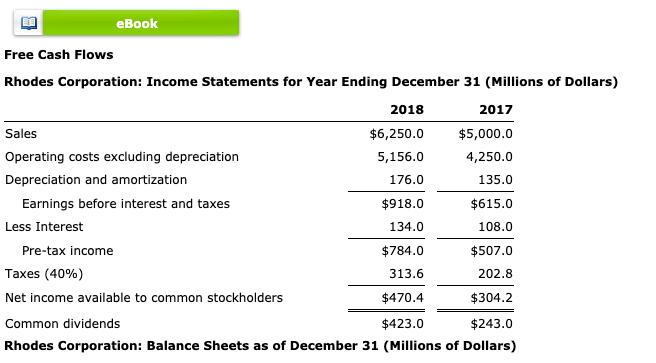

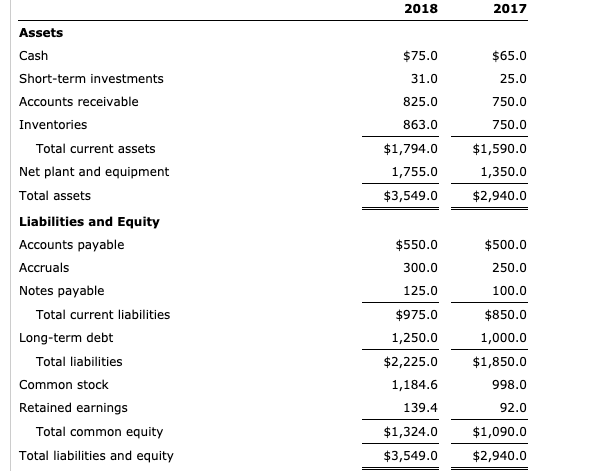

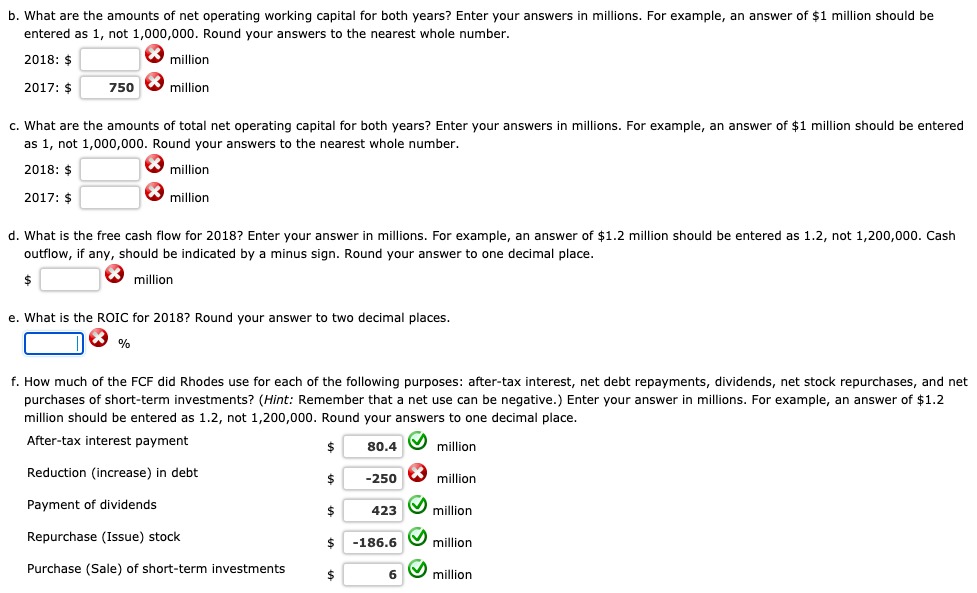

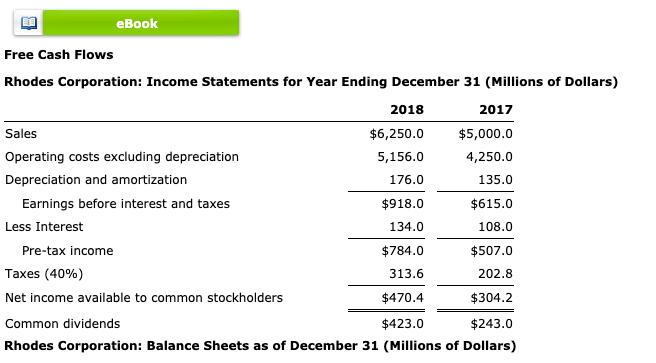

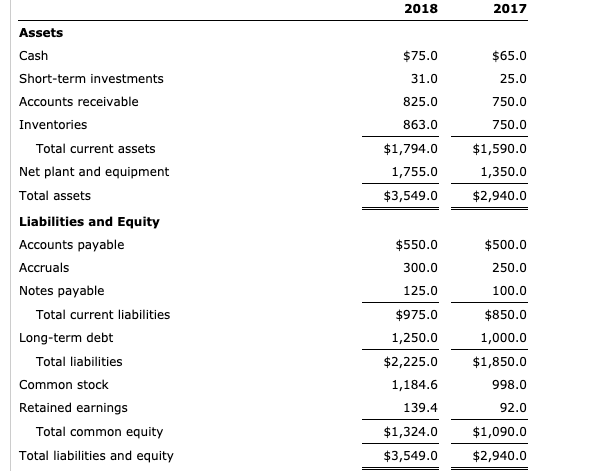

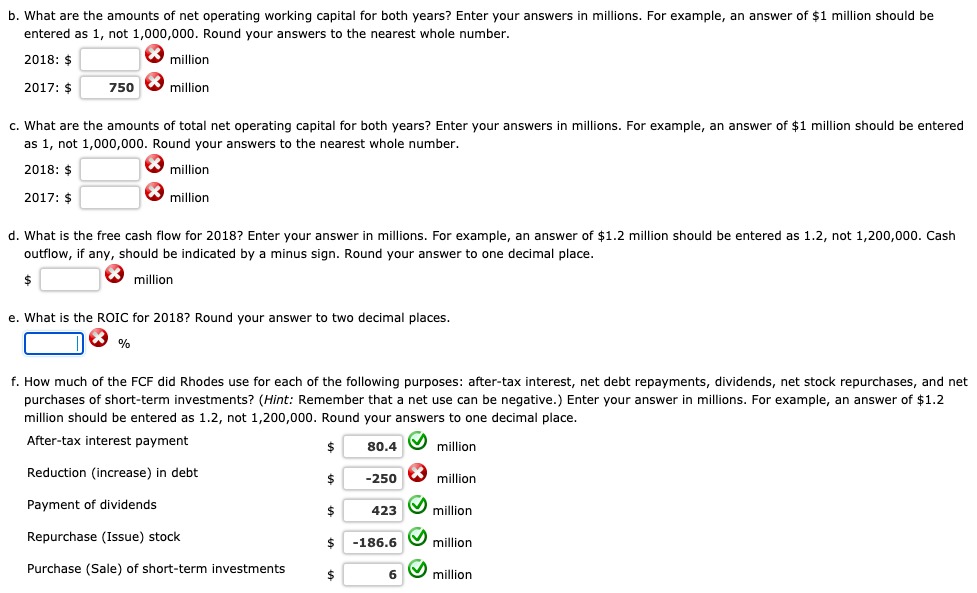

eBook Free Cash Flows Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of dollars) 2018 2017 Sales $6,250.0 $5,000.0 Operating costs excluding depreciation 5,156.0 4,250.0 Depreciation and amortization 176.0 135.0 Earnings before interest and taxes $918.0 $615.0 Less Interest 134.0 108.0 Pre-tax income $784.0 $507.0 Taxes (40%) 313.6 202.8 Net income available to common stockholders $470.4 $304.2 Common dividends $423.0 $243.0 Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2018 2017 Assets Cash $75.0 $65.0 31.0 25.0 825.0 750.0 863.0 750.0 $1,794.0 1,755.0 $3,549.0 $1,590.0 1,350.0 $2,940.0 $550.0 $500.0 Short-term investments Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity 300.0 250.0 125.0 100.0 $975.0 1,250.0 $2,225.0 1,184.6 139.4 $850.0 1,000.0 $1,850.0 998.0 92.0 $1,324.0 $3,549.0 $1,090.0 $2,940.0 b. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number. 2018: $ million 2017: $ 750 million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number. 2018: $ million 2017: $ million d. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Cash outflow, if any, should be indicated by a minus sign. Round your answer to one decimal place. $ million e. What is the ROIC for 2018? Round your answer to two decimal places. % f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answers to one decimal place. After-tax interest payment 80.4 million Reduction (increase) in debt $ -250 x million Payment of dividends $ 423 million Repurchase (Issue) stock $ -186.6 million Purchase (Sale) of short-term investments 6 million