Answered step by step

Verified Expert Solution

Question

1 Approved Answer

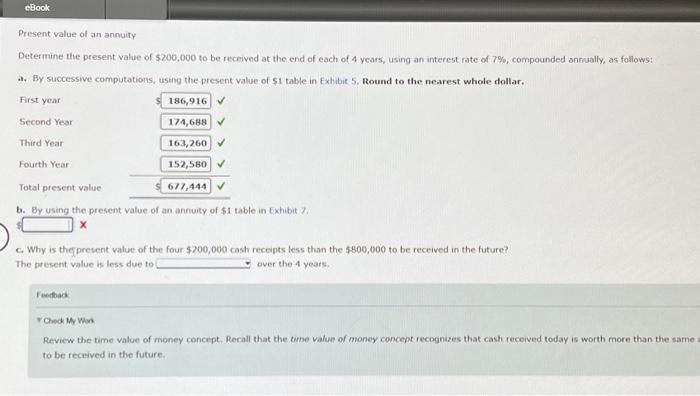

eBook Present value of an annuity Determine the present value of $200,000 to be received at the end of each of 4 years, using an

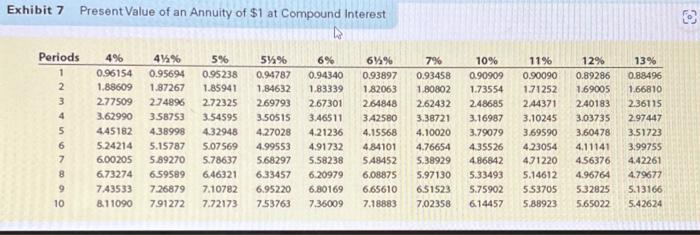

eBook Present value of an annuity Determine the present value of $200,000 to be received at the end of each of 4 years, using an interest rate of 7%, compounded annually, as follows: a. By successive computations, using the present value of $1 table in Exhibit 5. Round to the nearest whole dollar. 186,916 174,688 163,260 152,580 677,444 First year Second Year Third Year Fourth Year Total present value b. By using the present value of an annuity of $1 table in Exhibit 7. X c. Why is the present value of the four $200,000 cash receipts less than the $800,000 to be received in the future? The present value is less due to over the 4 years. Feedback Check My Work Review the time value of money concept. Recall that the time value of money concept recognizes that cash received today is worth more than the same a to be received in the future.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started