Answered step by step

Verified Expert Solution

Question

1 Approved Answer

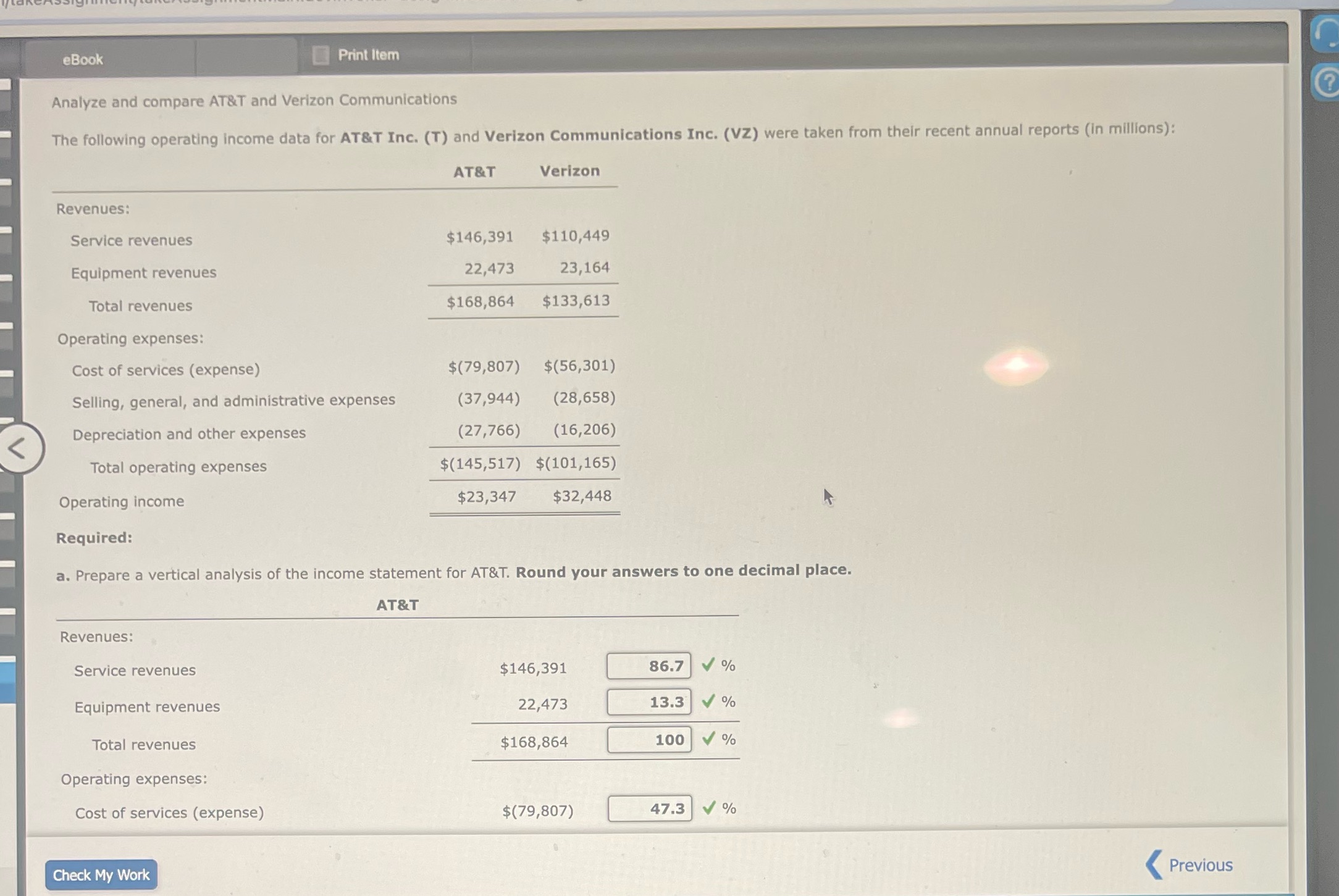

eBook Print Item Analyze and compare AT&T and Verizon Communications The following operating income data for AT&T Inc. (T) and Verizon Communications Inc. (VZ)

eBook Print Item Analyze and compare AT&T and Verizon Communications The following operating income data for AT&T Inc. (T) and Verizon Communications Inc. (VZ) were taken from their recent annual reports (in millions): Revenues: Service revenues Equipment revenues Total revenues Operating expenses: AT&T Verizon $146,391 $110,449 22,473 23,164 $168,864 $133,613 Cost of services (expense) $(79,807) $(56,301) Selling, general, and administrative expenses (37,944) (28,658) Depreciation and other expenses (27,766) (16,206) $(145,517) $(101,165) $23,347 $32,448 Total operating expenses Operating income Required: a. Prepare a vertical analysis of the income statement for AT&T. Round your answers to one decimal place. Revenues: Service revenues Equipment revenues Total revenues AT&T $146,391 86.7 % 22,473 13.3 % $168,864 100 % Operating expenses: Cost of services (expense) $(79,807) 47.3 % Check My Work Previous ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started