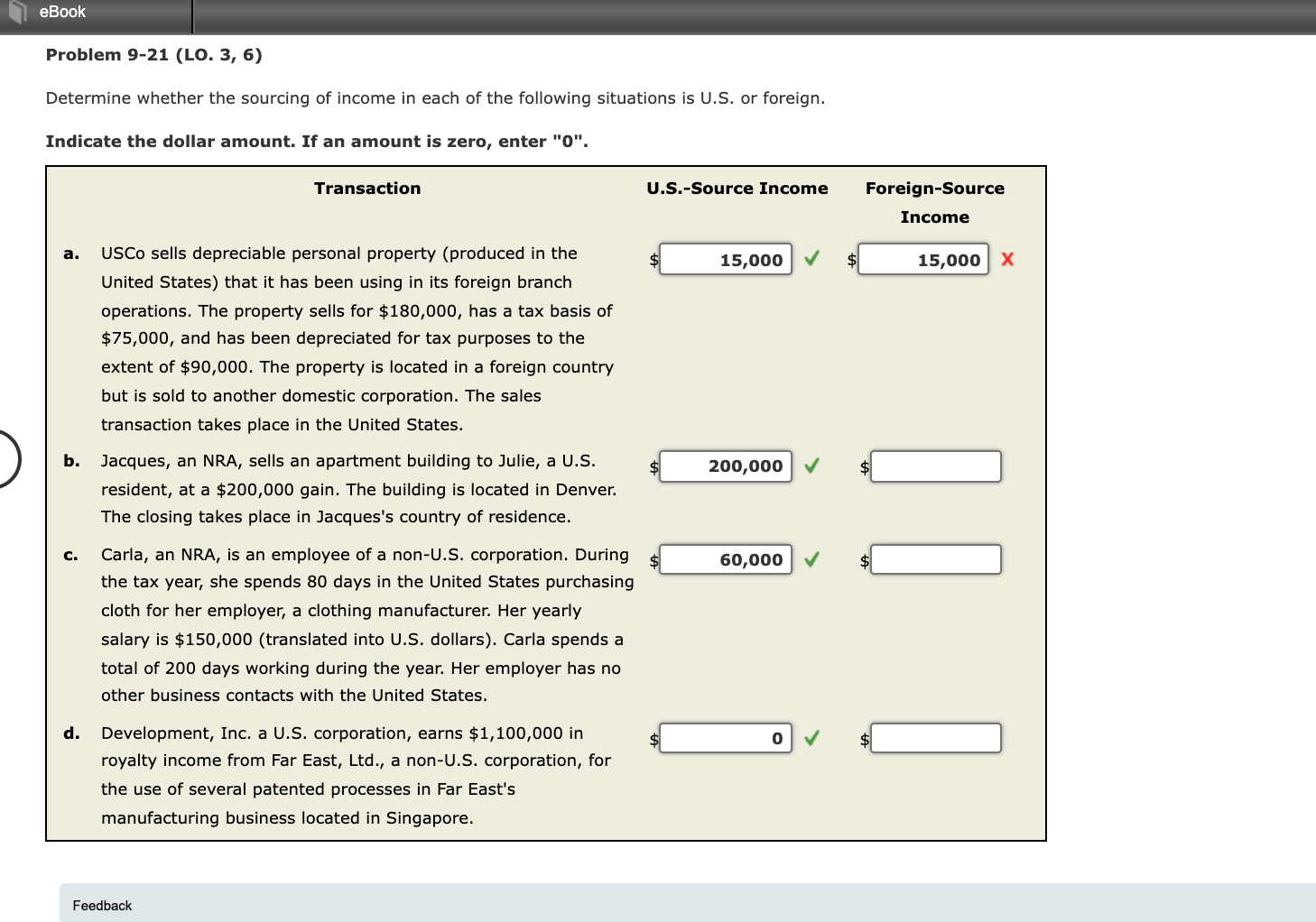

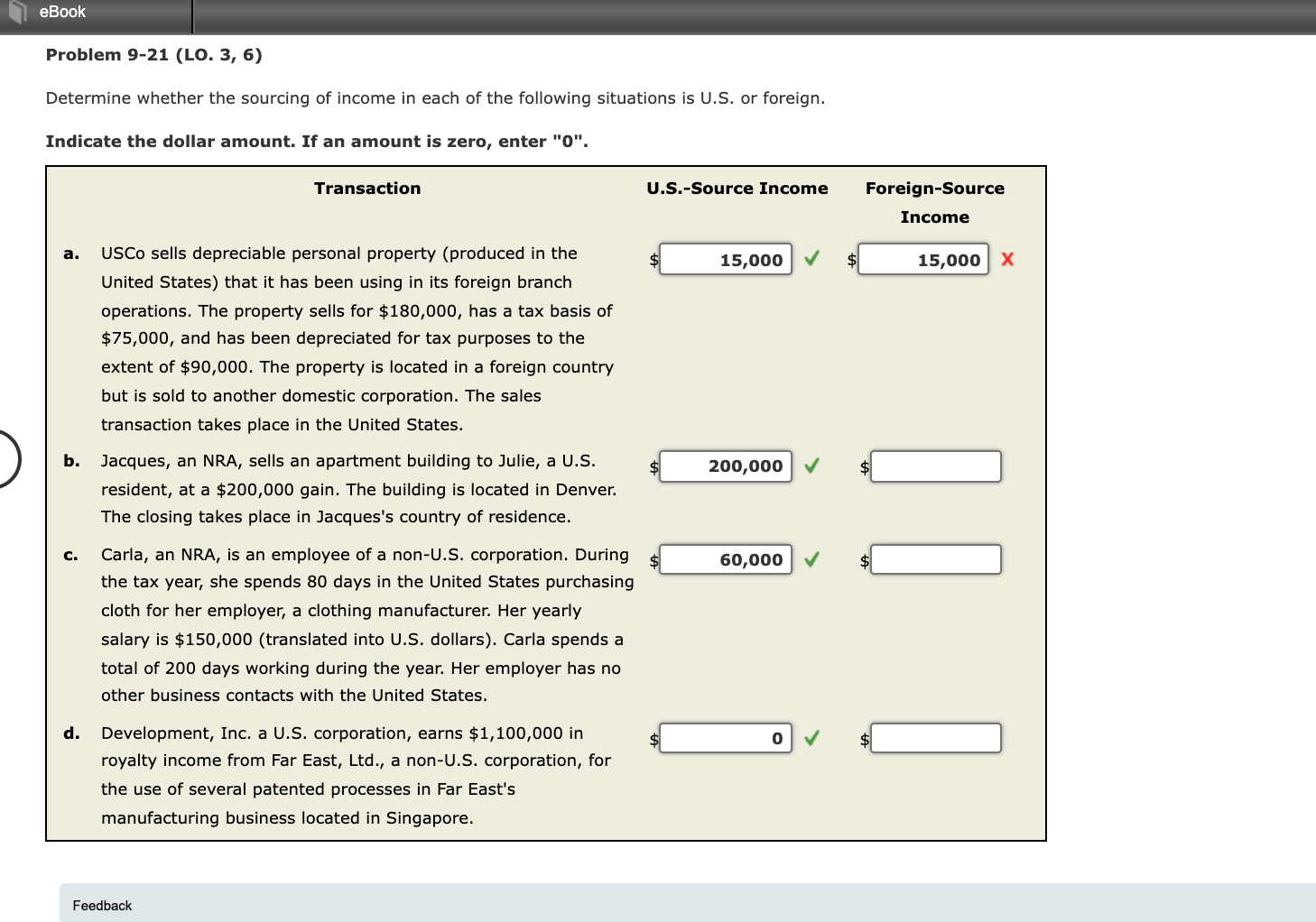

eBook Problem 9-21 (LO. 3, 6) Determine whether the sourcing of income in each of the following situations is U.S. or foreign. Indicate the dollar amount. If an amount is zero, enter "0". Transaction U.S.-Source Income Foreign-Source Income a. 15,000 15,000 x USCo sells depreciable personal property (produced in the United States) that it has been using in its foreign branch operations. The property sells for $180,000, has a tax basis of $75,000, and has been depreciated for tax purposes to the extent of $90,000. The property is located in a foreign country but is sold to another domestic corporation. The sales transaction takes place in the United States. 200,000 b. Jacques, an NRA, sells an apartment building to Julie, a U.S. resident, at a $200,000 gain. The building is located in Denver. The closing takes place in Jacques's country of residence. II C. 60,000 Carla, an NRA, is an employee of a non-U.S. corporation. During the tax year, she spends 80 days in the United States purchasing cloth for her employer, a clothing manufacturer. Her yearly salary is $150,000 (translated into U.S. dollars). Carla spends a total of 200 days working during the year. Her employer has no other business contacts with the United States. 0 d. Development, Inc. a U.S. corporation, earns $1,100,000 in royalty income from Far East, Ltd., a non-U.S. corporation, for the use of eral patented processes in Far East's manufacturing business located in Singapore. Feedback eBook Problem 9-21 (LO. 3, 6) Determine whether the sourcing of income in each of the following situations is U.S. or foreign. Indicate the dollar amount. If an amount is zero, enter "0". Transaction U.S.-Source Income Foreign-Source Income a. 15,000 15,000 x USCo sells depreciable personal property (produced in the United States) that it has been using in its foreign branch operations. The property sells for $180,000, has a tax basis of $75,000, and has been depreciated for tax purposes to the extent of $90,000. The property is located in a foreign country but is sold to another domestic corporation. The sales transaction takes place in the United States. 200,000 b. Jacques, an NRA, sells an apartment building to Julie, a U.S. resident, at a $200,000 gain. The building is located in Denver. The closing takes place in Jacques's country of residence. II C. 60,000 Carla, an NRA, is an employee of a non-U.S. corporation. During the tax year, she spends 80 days in the United States purchasing cloth for her employer, a clothing manufacturer. Her yearly salary is $150,000 (translated into U.S. dollars). Carla spends a total of 200 days working during the year. Her employer has no other business contacts with the United States. 0 d. Development, Inc. a U.S. corporation, earns $1,100,000 in royalty income from Far East, Ltd., a non-U.S. corporation, for the use of eral patented processes in Far East's manufacturing business located in Singapore. Feedback