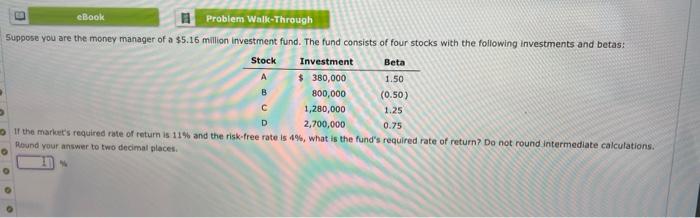

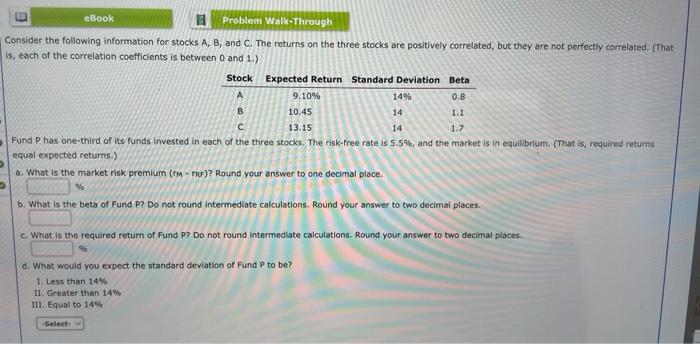

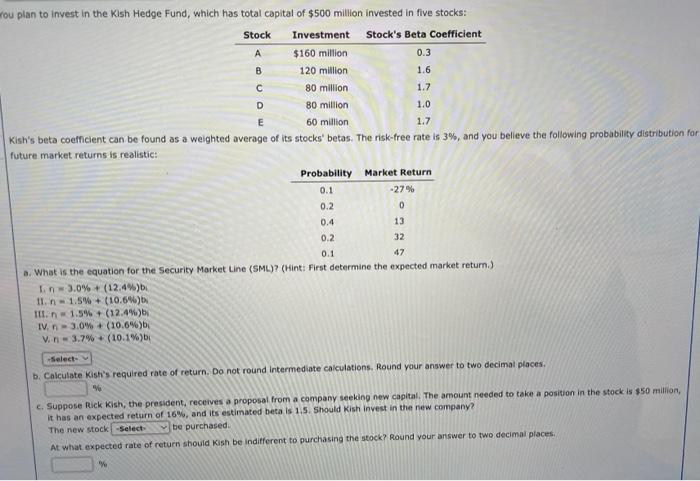

eBook Problem Walk-Through Suppose you are the money manager of a $5.16 million investment fund. The fund consists of four stocks with the following investments and betas: Investment Beta Stock A $ 380,000 800,000 B 1.50 (0.50) 1.25 1,280,000 D 2,700,000 0.75 If the market's required rate of return is 11% and the risk-free rate is 4%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. N eBook Problem Walk-Through Consider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Expected Return Standard Deviation Beta Stock A 9.10% 14% 0.8 B 10.45 14 1.1 C 13.15 14 1.7 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 5.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) a. What is the market risk premium (rm-TRF)? Round your answer to one decimal place. % b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. c. What is the required return of Fund P? Do not round Intermediate calculations. Round your answer to two decimal places. % d. What would you expect the standard deviation of Fund P to be? 1. Less than 14% II. Greater than 14%. III. Equal to 14% -Select- You plan to invest in the Kish Hedge Fund, which has total capital of $500 million invested in five stocks: Stock Stock's Beta Coefficient Investment $160 million A 0.3 B 120 million 1.6 80 million. 1.7 80 million 1.0 E 60 million 1.7 Kish's beta coefficient can be found as a weighted average of its stocks' betas. The risk-free rate is 3%, and you believe the following probability distribution for future market returns is realistic: Probability 0.1 Market Return -27% 0.2 0 0.4 13 0.2 32 0.1 47 a. What is the equation for the Security Market Line (SML)? (Hint: First determine the expected market return.). 1.3.0 % + (12.4%) b 11. n 1.5%+ (10.6%) b III. n 1.5%+ (12.4%) b IV. n-3.0 % + (10.6 %) b V. n 3.7% (10.1%) b -Select- b. Calculate Kish's required rate of return. Do not round intermediate calculations. Round your answer to two decimal places. % c. Suppose Rick Kish, the president, receives a proposal from a company seeking new capital. The amount needed to take a position in the stock is $50 million, it has an expected return of 16%, and its estimated beta is 1.5. Should Kish invest in the new company? The new stock -Select- be purchased. At what expected rate of return should Kish be indifferent to purchasing the stock? Round your answer to two decimal places.. % C D