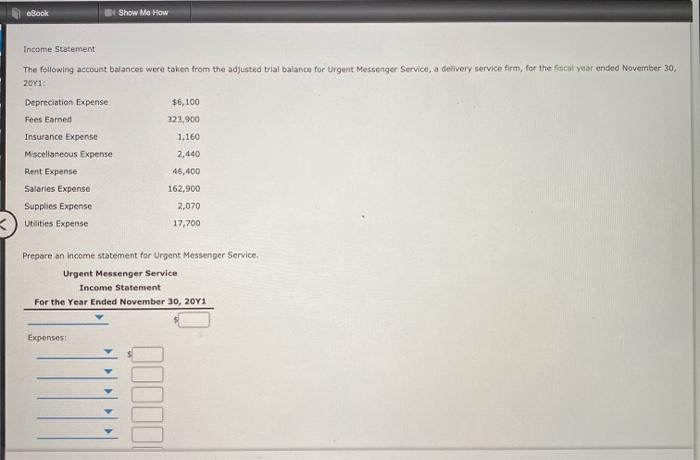

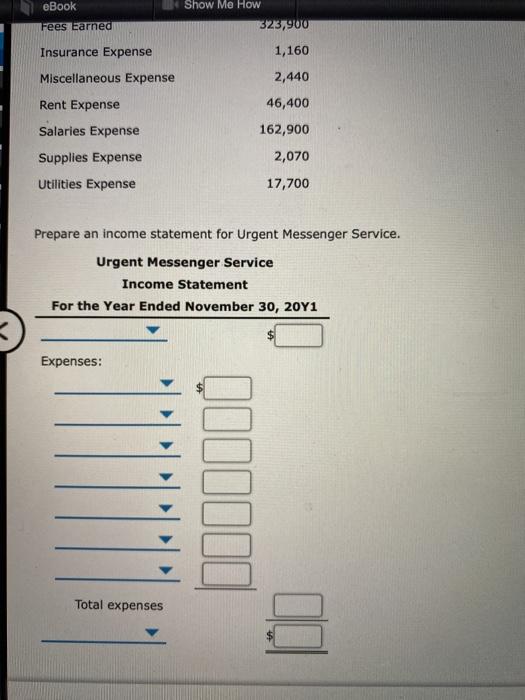

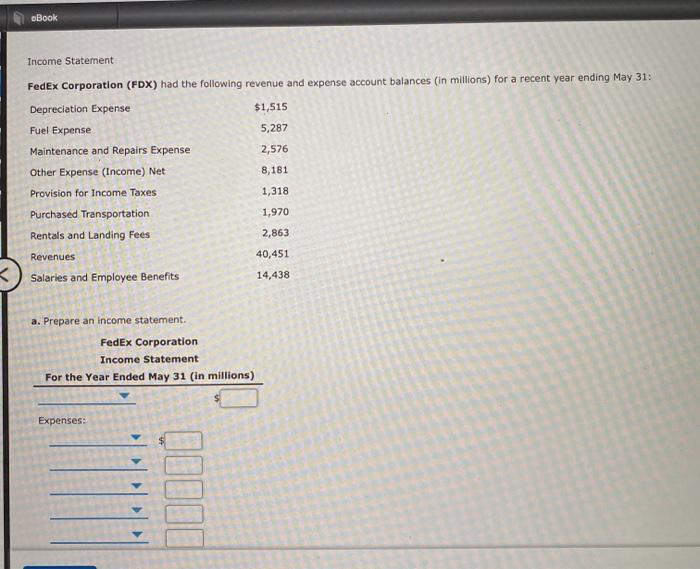

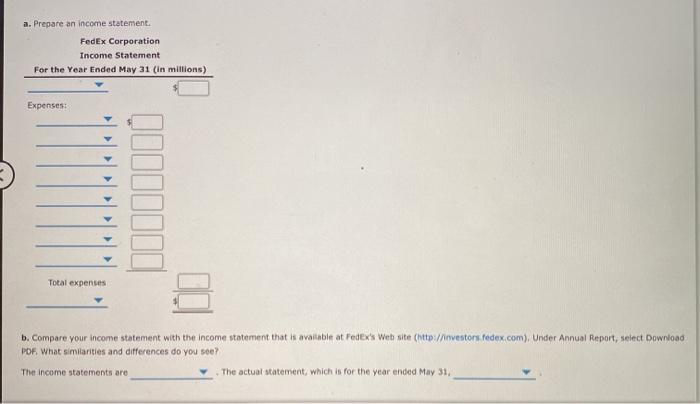

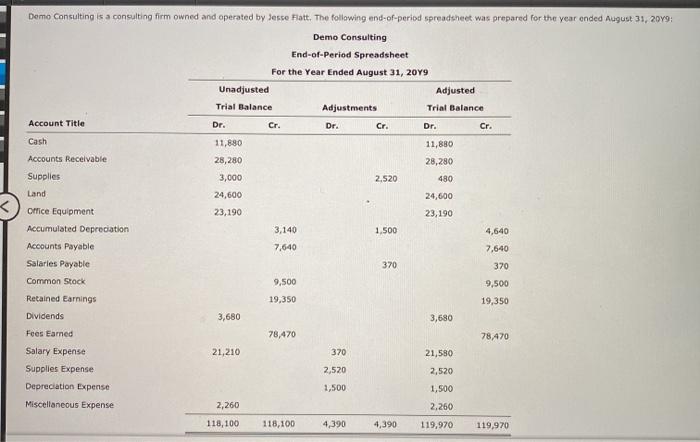

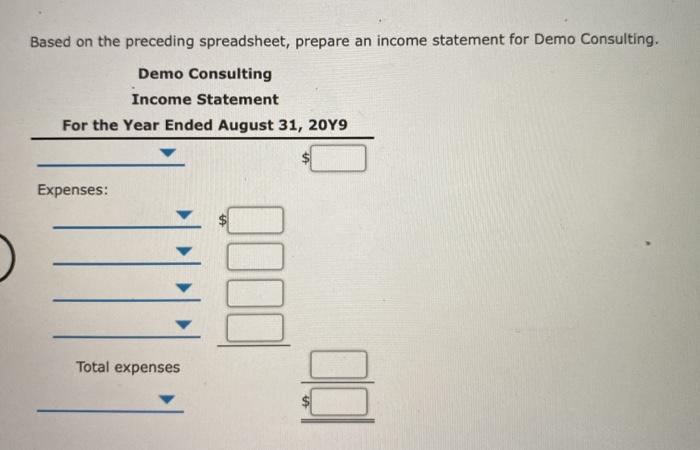

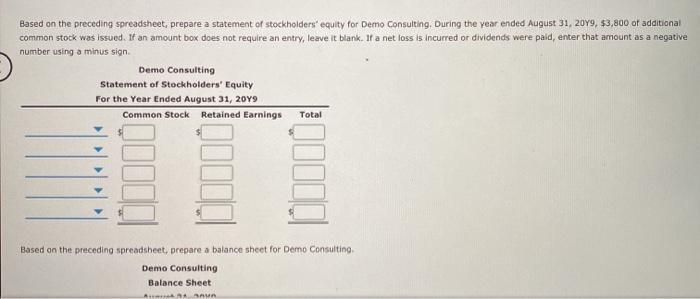

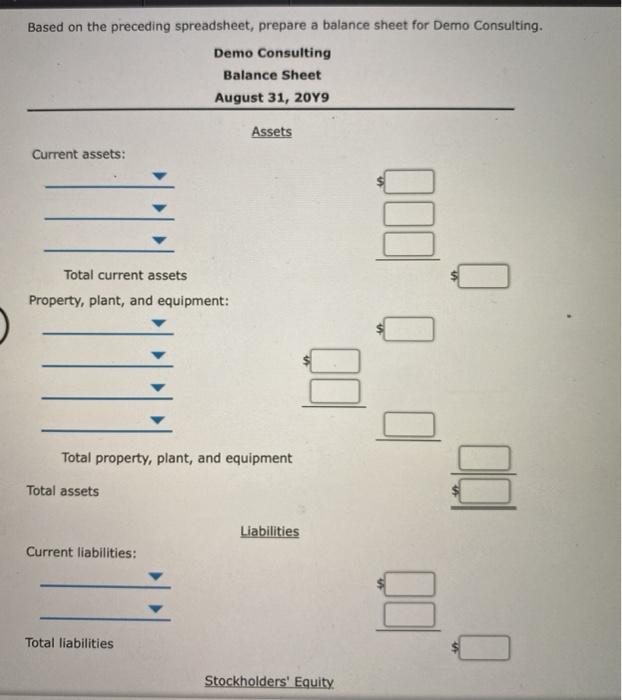

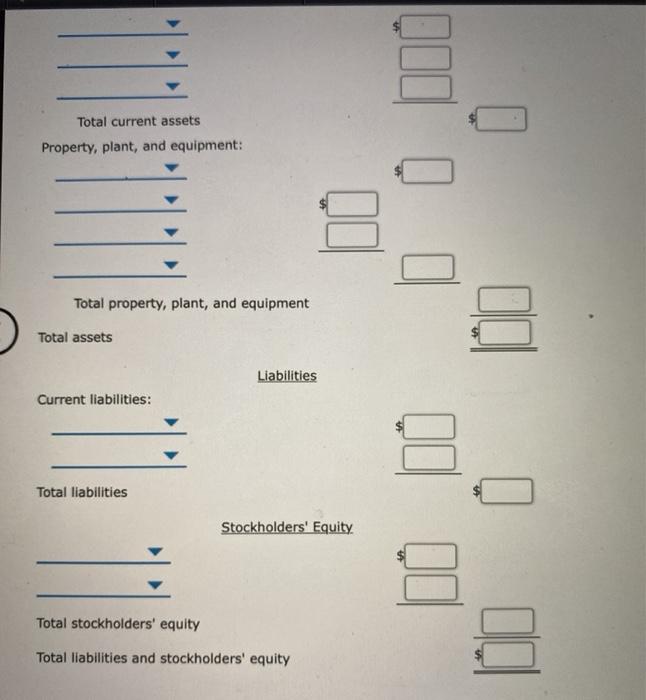

eBook Show Me How Income Statement The following account balances were taken from the adjusted trial balance for Urgent Messenger Service, a delivery service firm, for the fisicat year ended November 30, $6,100 323,900 1,160 2011 Depreciation Expense Fees Earned Insurance Expense Miscellaneous Expense Rent Expense Salaries Expense Supplies Expense Utilities Expense 2,440 46,400 162,900 2,070 17,700 Prepare an income statement for Urgent Messenger Service Urgent Messenger Service Income Statement For the Year Ended November 30, 2011 Expenses eBook Show Me How 323,900 Fees Earned 1,160 Insurance Expense Miscellaneous Expense 2,440 Rent Expense 46,400 162,900 Salaries Expense Supplies Expense 2,070 Utilities Expense 17,700 Prepare an income statement for Urgent Messenger Service. Urgent Messenger Service Income Statement For the Year Ended November 30, 20Y1 Expenses: Total expenses oBook Income Statement FedEx Corporation (FDX) had the following revenue and expense account balances (in millions) for a recent year ending May 31: Depreciation Expense $1,515 Fuel Expense 5,287 Maintenance and Repairs Expense 2,576 Other Expense (Income) Net 8,181 Provision for Income Taxes 1,318 Purchased Transportation 1,970 Rentals and Landing Fees 2,863 Revenues 40,451 Salaries and Employee Benefits 14,438 a. Prepare an income statement. FedEx Corporation Income Statement For the Year Ended May 31 (in millions) Expenses: a. Prepare an income statement. FedEx Corporation Income Statement For the Year Ended May 31 (in millions) Expenses: Total expenses b. Compare your income statement with the income statement that available at Fedexs Web site (http://investors fedex.com), Under Annual Report, select Download PDF. What similarities and differences do you see? The income statements are The actual statement, which is for the year ended May 31, Demo Consulting is a consulting firm owned and operated by Jesse Fatt. The following end-of-period spreadsheet was prepared for the year ended August 31, 2019: Demo Consulting End-of-Period Spreadsheet For the Year Ended August 31, 2019 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Cr. Dr. Cash Accounts Receivable Supplies Land 11,880 28,280 3,000 24,600 11,880 28,280 480 2.520 24,600 23,190 23,190 1.500 4,640 Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable 3,140 7,640 7,640 370 370 Common Stock 9,500 9,500 19,350 Retained Earnings 19,350 3,680 3,680 Dividends Fees Earned 78,470 78,470 21,210 370 21,580 Salary Expense Supplies Expense Depreciation Expense 2,520 2,520 1,500 1,500 Miscellaneous Expense 2,260 2,260 118,100 118,100 4,390 4,390 119,970 119,970 Based on the preceding spreadsheet, prepare an income statement for Demo Consulting. Demo Consulting Income Statement For the Year Ended August 31, 2019 Expenses: Total expenses Based on the preceding spreadsheet, prepare a statement of stockholders' equity for Demo Consulting. During the year ended August 31, 2049, $3,800 of additional common stock was issued. If an amount box does not require an entry, leave it blank. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign Demo Consulting Statement of Stockholders' Equity For the Year Ended August 31, 2019 Common Stock Retained Earnings Total Based on the preceding spreadsheet, prepare a balance sheet for Demo Consulting Demo Consulting Balance Sheet AAAM Based on the preceding spreadsheet, prepare a balance sheet for Demo Consulting. Demo Consulting Balance Sheet August 31, 2019 Assets Current assets: Total current assets Property, plant, and equipment: Total property, plant, and equipment Total assets Liabilities Current liabilities: Total liabilities Stockholders' Equity Total current assets Property, plant, and equipment: Total property, plant, and equipment Total assets Liabilities Current liabilities: Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity