Question

eBookDirect materials$ 1 2 , 0 0 0 Direct labor cost:Department A ( 4 5 0 ?hours @ $ 1 8 ) $ 8 ,

eBookDirect materials$Direct labor cost:Department A ?hours @ $$Department B ?hours @ $$Machine hours used:Department ADepartment BUnits producedRequired:Compute the total cost of Job $Compute the perunit manufacturing cost for Job ?Round your answer to two decimal places. overhead is applied at the rate of $ ?per machine hour.Compute the total cost of Job Compute the perunit manufacturing cost for Job ?Round your answer to two decimal places.$Which method of applying overhead, plantwide or departmental, is more descriptive of the costs of Job ?Why?The method is more descriptive of the resources used by Job ?This job uses of the machinehour intensive resources ofDepartment B whichcaptured using the plantwide overhead rate.

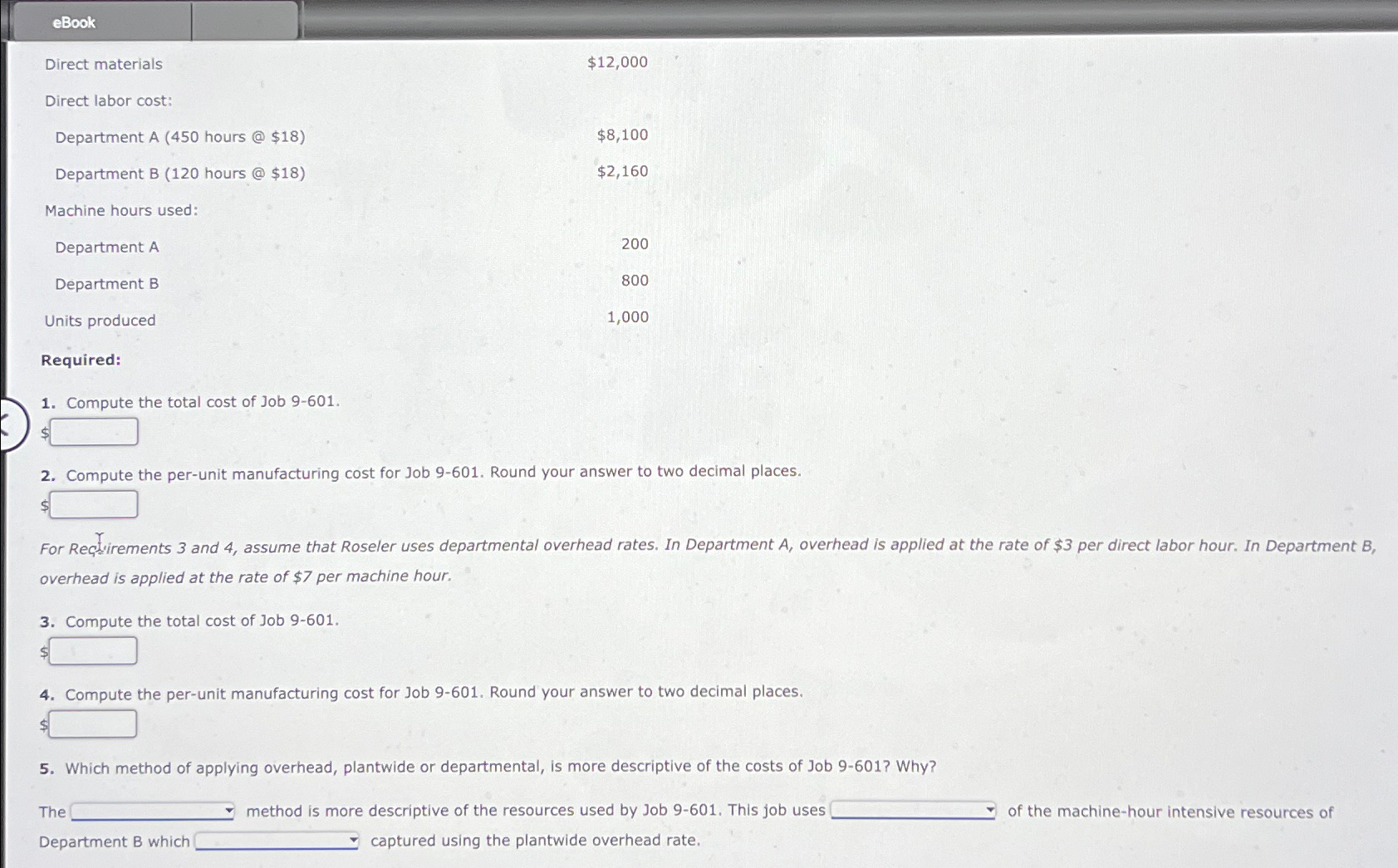

eBook Direct materials Direct labor cost: $12,000 Department A (450 hours @ $18) $8,100 Department B (120 hours @ $18) $2,160 Machine hours used: Department A Department B Units produced Required: 1. Compute the total cost of Job 9-601. 200 800 1,000 2. Compute the per-unit manufacturing cost for Job 9-601. Round your answer to two decimal places. For Requirements 3 and 4, assume that Roseler uses departmental overhead rates. In Department A, overhead is applied at the rate of $3 per direct labor hour. In Department B, overhead is applied at the rate of $7 per machine hour. 3. Compute the total cost of Job 9-601. 4. Compute the per-unit manufacturing cost for Job 9-601. Round your answer to two decimal places. 5. Which method of applying overhead, plantwide or departmental, is more descriptive of the costs of Job 9-601? Why? The method is more descriptive of the resources used by Job 9-601. This job uses Department B which captured using the plantwide overhead rate. of the machine-hour intensive resources of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started