Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EC2003 2019-20 project fnal.pdf - Foxt Reader Find 20.- Gu FILE HOME COMMENT VIEW FORM PROTECT SHARE T SnapShot Fit Page 103.40% bpboard - P

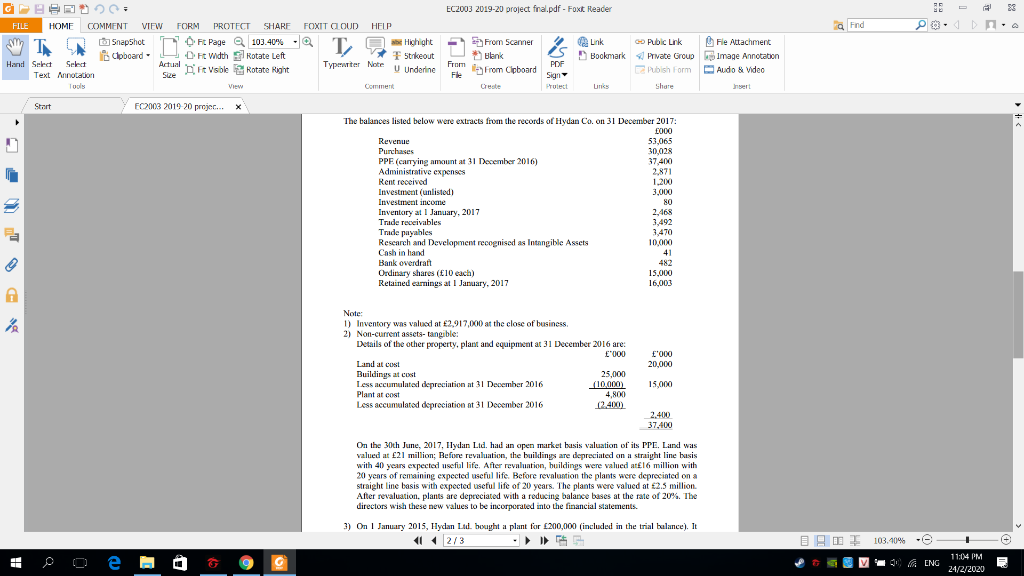

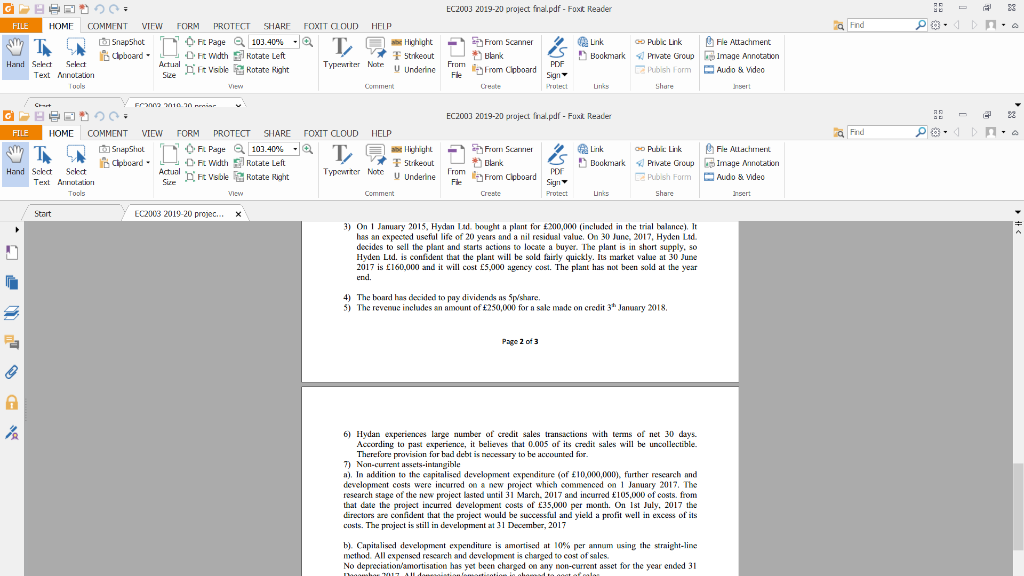

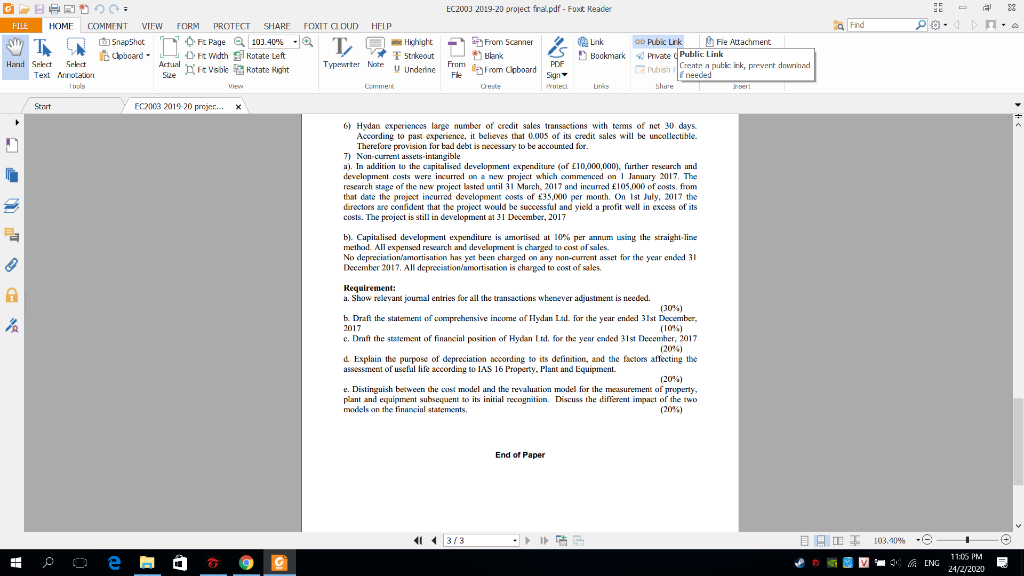

EC2003 2019-20 project fnal.pdf - Foxt Reader Find 20.- Gu FILE HOME COMMENT VIEW FORM PROTECT SHARE T SnapShot Fit Page 103.40% bpboard - P DF Width Rotate Left Hand Select Select Text Annotation See Ft Vsble Rotate Right Tools View FOXIT COUD T. . HELP O * Highight F Strikeout From Scanner Blank L ink Bookmark so Pubic Link Private Group Publish Form File Attachment Image Annotation Audo & video Typenter Note U Underline from PDF From Cipboard From File Sign Proiect Links Share Insert FC2003 2019 20 projec... x The balances listed below were extracts from the records of Hydan Co. on 31 December 2017: 2000 Revenue 53.065 Purchases 30.028 PPE (carrying amount at 31 December 2016) 37.400 Administrative expenses 2.871 Rent received 1.200 Investment (unlisted) 3,000 Investment income Inventory at 1 January, 2017 2,468 Trade receivables 3.492 Tride payables 1.470 Research and Development recognised as Intangible Assets 10,000 Cash in hand Bank overdratt Ordinary shares (10 each) 15.000 Retained earnings at 1 January, 2017 16.003 482 Note: 1) Inventory was valued at 2,917,000 at the close of business 2) Non-current assets- tangible: Details of the other property, plant and equipment at 31 December 2016 are: '000 20,000 Land at cost Buildings at cost Less accumulated depreciation at 31 December 2016 Plant at cost Less accumulated depreciation at 31 December 2016 25,000 (10.000) 4,800 (2.400) 15,000 2.400 37,400 On the 30th June, 2017, Hydan Ltd. had an open market basis valuation of its PPE. Land was valued at 21 million; Before revaluation, the buildings are depreciated on a straight line basis with 40 years expected useful life. After revnluntion, buildings were valued at16 million with 20 years of remaining expected useful life. Before revaluation the plants were depreciated on a straight line basis with expected useful life of 20 years. The plants were valued at $2.5 million After revaluation, plants are depreciated with a reducing balance bases at the rate of 20%. The directors wish these new values to be incorporated into the financial statements. 3) On 1 January 2015, Hyclan Ltd. bought a plant for 200,000 (included in the trial balance). It 2/3 D 103.10% 0 O I ta V 0 - 11:04 PM NG 24/2/2020 E EC2003 2019-20 project fnal.pdf - Foxt Reader Find 20.- Gu FILE HOME COMMENT VIEW FORM PROTECT SHARE T SnapShot Fit Page 103.40% Clipboard P D F Width Rotate Left Hand Select Select Text Annotation See Ft Vsble Rotate Right Tools FOXIT COUD T. . HELP O * Highight F Strikeout From Scanner Blank L ink Bookmark File Attachment Image Annotation Audo & Video Typenter Note from Underline PDF so Pubic Link Private Group Publish Form Share From Cipboard File From Cipboard Sign Comment Proiect FDM EC2003 2019-20 project final.pdf - Foxit Reader Find 2010 GO FILE HOME COMMENT VIEW FORM PROTECT SHARE T CN SnapShot FL Page 103.406 - Clipboard - P D Fit Width Sl Rotate Left Hand Select Select Visible Sve Text Annotation Rotate Hught Tools FOXIT CLOUD T. HELP M E Highlight 1/ CVT Typewrter Note Sukeoul V Underline frorn Scammer Blank Link Bookmark Oo Public Link Private Group La Pubish Form File Allachment Image Annotation Audo & Video From From clipboard PDF Sign Comment Create Start EC2003 2019-20 projec... X 3) On 1 January 2015, Hydan ad bought a plant for $200,000 (included in the trial balance. It has an expected useful life of 20 years and a nil residual value. On 30 June, 2017. Huden Led decides to sell the plant and starts action to locate a buyer. The plant is in short supply. 50 Hyden Lid. is confident that the plant will be sold fairly quickly. Its market value at 30 June 2017 is 160,000 and it will cost 5,000 agency cost. The plant has not been sold at the year erd. 4) The board has decided to pay dividends as 5pshare, 5) The revenue includes an amount of 250,00 for sale made on credit 31 January 2018, Page 2 of 3 6) Hydan experiences large number of credit sales transactions with terms of net 30 days. According to past experience, it believes that 0.005 of its credit sales will be uncollectible. Therefore provision for bad debt is necessary to be accounted for 7) Non-cument assets intangible a). In addition to the capitalised development expenditure (of 10,000,000), further research and development costs were incurred on a new project which commenced on 1 January 2017. The research stage of the new project lasted until 31 March, 2017 and incurred 105,000 of costs, from that date the project incurred development costs of 35.000 per month. On 1st July, 2017 the directors are confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 31 December, 2017 b) Capitalised development expenditure is amortised at 10% per annum using the straight-line method. All expensed research and development is charged to cost of sales. No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 EC2003 2019-20 project fnal.pdf - Foxt Reader Find 20. - Gu FILE HOME COMMENT VIEW FORM PROTECT SHARE T SnapShot Fit Page 103.40% bpboard - P DF Width Rotate Left Hand Select Select Text Annotation See Ft Vsble Rotate Right Tools View . FOXIT COUD HELP T. O Highight * F Strikeout Typewriter Note Vurderine L From Scanner Blank From Clipboard ink Bookmark From : PDF GD Pubic Link He Attachment Private Public Link Create a public ink, prevent down nad if needed Share Sa Prulert FC2003 2019 20 projec... x 6) Hydan experiences large number of credit sales transactions with terms of net 30 days According to past experience, it believes that 0.005 of its credit sales will be uncollectible. Therefore provision for bad debt is necessary to be accounted for. 7) Non-current assets intangible a). In addition to the capitalised development expenditure (of 10,000,000), further research and development costs were incurred in a new project which commenced on January 2017. The research stage of the new project lasted until 31 March, 2017 and incurred 105,000 of costs from that date the project incurred development oosts of 35,00 per month On 1st July, 2017 the directors are confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 31 December, 2017 b) Capitalised development expenditure in amortised at 10% per annum using the straight-line method. All expensed research and development is charged to cost of sales. No depreciation amortisation has yet heen charged on any non-current asset for the year ended il December 2017. All depreciation/amortisation is changed to cost of sales Requirement: a. Show relevant journal entries for all the transactions whenever adjustment is needed. (30%) b. Draft the statement of comprehensive income of Hydan Ltd. for the year ended 31st December, 2017 (10%) c. Duft the statement of financial position of Hyden Lid for the year ended 31st December, 2017 (20%) d. Explain the purpose of depreciation Recording to its definition, and the factors affecting the assessment of useful life according to IAS 16 Property. Plant and Equipment (20%) e. Distinguish between the cast model and the revaluation model for the measurement of property, plant and equipment subsequent to its initial recognition Discuss the different impact of the two models on the financinl statements. (20%) End of Paper 1 3/3 - 5 D O I 103.10% 0 - 0 11:06 PM EC2003 2019-20 project fnal.pdf - Foxt Reader Find 20.- Gu FILE HOME COMMENT VIEW FORM PROTECT SHARE T SnapShot Fit Page 103.40% bpboard - P DF Width Rotate Left Hand Select Select Text Annotation See Ft Vsble Rotate Right Tools View FOXIT COUD T. . HELP O * Highight F Strikeout From Scanner Blank L ink Bookmark so Pubic Link Private Group Publish Form File Attachment Image Annotation Audo & video Typenter Note U Underline from PDF From Cipboard From File Sign Proiect Links Share Insert FC2003 2019 20 projec... x The balances listed below were extracts from the records of Hydan Co. on 31 December 2017: 2000 Revenue 53.065 Purchases 30.028 PPE (carrying amount at 31 December 2016) 37.400 Administrative expenses 2.871 Rent received 1.200 Investment (unlisted) 3,000 Investment income Inventory at 1 January, 2017 2,468 Trade receivables 3.492 Tride payables 1.470 Research and Development recognised as Intangible Assets 10,000 Cash in hand Bank overdratt Ordinary shares (10 each) 15.000 Retained earnings at 1 January, 2017 16.003 482 Note: 1) Inventory was valued at 2,917,000 at the close of business 2) Non-current assets- tangible: Details of the other property, plant and equipment at 31 December 2016 are: '000 20,000 Land at cost Buildings at cost Less accumulated depreciation at 31 December 2016 Plant at cost Less accumulated depreciation at 31 December 2016 25,000 (10.000) 4,800 (2.400) 15,000 2.400 37,400 On the 30th June, 2017, Hydan Ltd. had an open market basis valuation of its PPE. Land was valued at 21 million; Before revaluation, the buildings are depreciated on a straight line basis with 40 years expected useful life. After revnluntion, buildings were valued at16 million with 20 years of remaining expected useful life. Before revaluation the plants were depreciated on a straight line basis with expected useful life of 20 years. The plants were valued at $2.5 million After revaluation, plants are depreciated with a reducing balance bases at the rate of 20%. The directors wish these new values to be incorporated into the financial statements. 3) On 1 January 2015, Hyclan Ltd. bought a plant for 200,000 (included in the trial balance). It 2/3 D 103.10% 0 O I ta V 0 - 11:04 PM NG 24/2/2020 E EC2003 2019-20 project fnal.pdf - Foxt Reader Find 20.- Gu FILE HOME COMMENT VIEW FORM PROTECT SHARE T SnapShot Fit Page 103.40% Clipboard P D F Width Rotate Left Hand Select Select Text Annotation See Ft Vsble Rotate Right Tools FOXIT COUD T. . HELP O * Highight F Strikeout From Scanner Blank L ink Bookmark File Attachment Image Annotation Audo & Video Typenter Note from Underline PDF so Pubic Link Private Group Publish Form Share From Cipboard File From Cipboard Sign Comment Proiect FDM EC2003 2019-20 project final.pdf - Foxit Reader Find 2010 GO FILE HOME COMMENT VIEW FORM PROTECT SHARE T CN SnapShot FL Page 103.406 - Clipboard - P D Fit Width Sl Rotate Left Hand Select Select Visible Sve Text Annotation Rotate Hught Tools FOXIT CLOUD T. HELP M E Highlight 1/ CVT Typewrter Note Sukeoul V Underline frorn Scammer Blank Link Bookmark Oo Public Link Private Group La Pubish Form File Allachment Image Annotation Audo & Video From From clipboard PDF Sign Comment Create Start EC2003 2019-20 projec... X 3) On 1 January 2015, Hydan ad bought a plant for $200,000 (included in the trial balance. It has an expected useful life of 20 years and a nil residual value. On 30 June, 2017. Huden Led decides to sell the plant and starts action to locate a buyer. The plant is in short supply. 50 Hyden Lid. is confident that the plant will be sold fairly quickly. Its market value at 30 June 2017 is 160,000 and it will cost 5,000 agency cost. The plant has not been sold at the year erd. 4) The board has decided to pay dividends as 5pshare, 5) The revenue includes an amount of 250,00 for sale made on credit 31 January 2018, Page 2 of 3 6) Hydan experiences large number of credit sales transactions with terms of net 30 days. According to past experience, it believes that 0.005 of its credit sales will be uncollectible. Therefore provision for bad debt is necessary to be accounted for 7) Non-cument assets intangible a). In addition to the capitalised development expenditure (of 10,000,000), further research and development costs were incurred on a new project which commenced on 1 January 2017. The research stage of the new project lasted until 31 March, 2017 and incurred 105,000 of costs, from that date the project incurred development costs of 35.000 per month. On 1st July, 2017 the directors are confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 31 December, 2017 b) Capitalised development expenditure is amortised at 10% per annum using the straight-line method. All expensed research and development is charged to cost of sales. No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 EC2003 2019-20 project fnal.pdf - Foxt Reader Find 20. - Gu FILE HOME COMMENT VIEW FORM PROTECT SHARE T SnapShot Fit Page 103.40% bpboard - P DF Width Rotate Left Hand Select Select Text Annotation See Ft Vsble Rotate Right Tools View . FOXIT COUD HELP T. O Highight * F Strikeout Typewriter Note Vurderine L From Scanner Blank From Clipboard ink Bookmark From : PDF GD Pubic Link He Attachment Private Public Link Create a public ink, prevent down nad if needed Share Sa Prulert FC2003 2019 20 projec... x 6) Hydan experiences large number of credit sales transactions with terms of net 30 days According to past experience, it believes that 0.005 of its credit sales will be uncollectible. Therefore provision for bad debt is necessary to be accounted for. 7) Non-current assets intangible a). In addition to the capitalised development expenditure (of 10,000,000), further research and development costs were incurred in a new project which commenced on January 2017. The research stage of the new project lasted until 31 March, 2017 and incurred 105,000 of costs from that date the project incurred development oosts of 35,00 per month On 1st July, 2017 the directors are confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 31 December, 2017 b) Capitalised development expenditure in amortised at 10% per annum using the straight-line method. All expensed research and development is charged to cost of sales. No depreciation amortisation has yet heen charged on any non-current asset for the year ended il December 2017. All depreciation/amortisation is changed to cost of sales Requirement: a. Show relevant journal entries for all the transactions whenever adjustment is needed. (30%) b. Draft the statement of comprehensive income of Hydan Ltd. for the year ended 31st December, 2017 (10%) c. Duft the statement of financial position of Hyden Lid for the year ended 31st December, 2017 (20%) d. Explain the purpose of depreciation Recording to its definition, and the factors affecting the assessment of useful life according to IAS 16 Property. Plant and Equipment (20%) e. Distinguish between the cast model and the revaluation model for the measurement of property, plant and equipment subsequent to its initial recognition Discuss the different impact of the two models on the financinl statements. (20%) End of Paper 1 3/3 - 5 D O I 103.10% 0 - 0 11:06 PM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started