Answered step by step

Verified Expert Solution

Question

1 Approved Answer

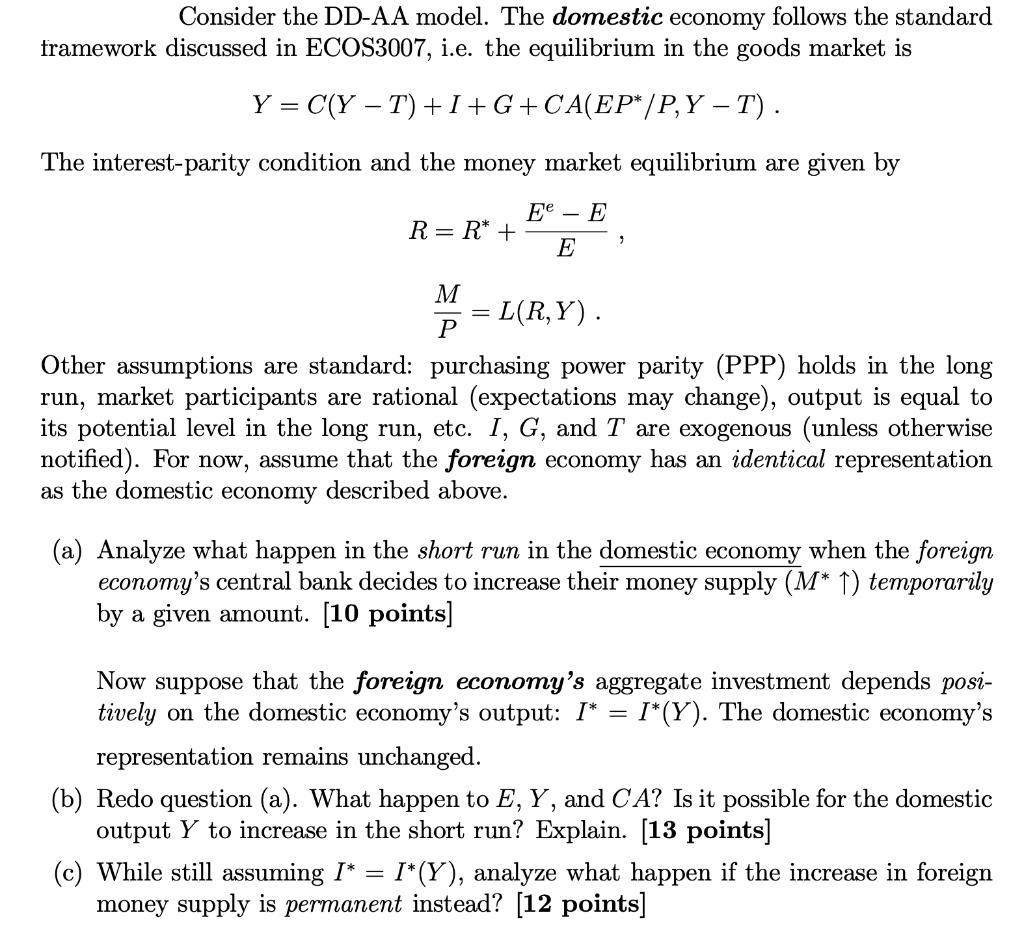

Consider the DD-AA model. The domestic economy follows the standard framework discussed in ECOS3007, i.e. the equilibrium in the goods market is Y =

Consider the DD-AA model. The domestic economy follows the standard framework discussed in ECOS3007, i.e. the equilibrium in the goods market is Y = C(YT) +I+G+CA(EP*/P,Y T). The interest-parity condition and the money market equilibrium are given by Ee E E R=R* + M P = L(R,Y) . Other assumptions are standard: purchasing power parity (PPP) holds in the long run, market participants are rational (expectations may change), output is equal to its potential level in the long run, etc. I, G, and T are exogenous (unless otherwise notified). For now, assume that the foreign homy has an identical representation as the domestic economy described above. (a) Analyze what happen in the short run in the domestic economy when the foreign economy's central bank decides to increase their money supply (M* ) temporarily by a given amount. [10 points] Now suppose that the foreign economy's aggregate investment depends posi- tively on the domestic economy's output: I* = I*(Y). The domestic economy's representation remains unchanged. (b) Redo question (a). What happen to E, Y, and CA? Is it possible for the domestic output Y to increase in the short run? Explain. [13 points] (c) While still assuming I* = I*(Y), analyze what happen if the increase in foreign money supply is permanent instead? [12 points]

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a When the foreign economys central bank decides to increase their money supply M temporarily by a g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started