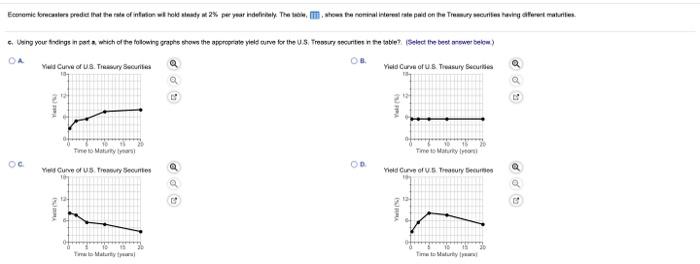

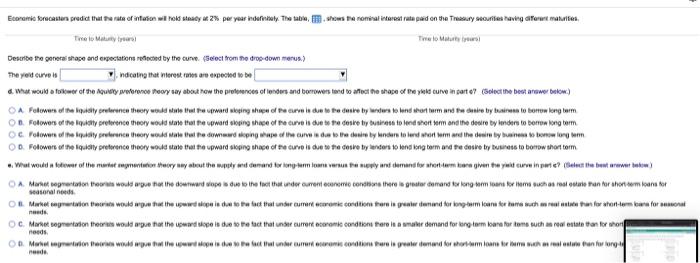

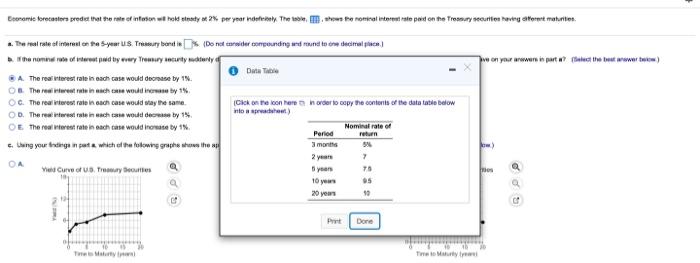

Economic forecasters predict that the rate of inflation will hold steady at 2% per year indefinitely. The table, Treasury securities having different maturities. shows the nominal interest rate paid on the a. The real rate of interest on the 5-year U.S. Treasury bond is % (Do not consider compounding and round to one decimal place.) b. If the nominal rate of interest paid by every Treasury security suddenly dropped by 1% without any change in inflationary expectations, what effect, if any. would this have on your answers in part a? (Select the best answer below.) A. The real interest rate in each case would decrease by 1%. B. The real interest rate in each case would increase by 1% C. The real interest rate in each case would stay the same. D. The real interest rate in each case would decrease by 1% Economic forecasters predict that the rate of inflation will hold steady at 2% per year indefinitely. The table. Treasury securities having different maturities. shows the nominal interest rate paid on the OD. The real interest rate in each case would decrease by 1% O E. The real interest rate in each case would increase by 1% c. Using your findings in part a, which of the following graphs shows the appropriate yield curve for the U.S. Treasury securities in the table? (Select the best answer below.) OA OB. Yield Curve of U.S. Treasury Securities a Q Yield Curve of US Treasury Securities Economie komentare predict that the rate of intent tok lasty w 2% per your definitely. The tour taroni interest rate pad on he mayor any alteret maturile Using you findings n perta, which of the following graphs shows the apropale vied curve for the US, Tromsury Securities in the table? Select the best rower Deko) OA Wild Card UST Securifica Vield Curse of us. Tasury Securi o Volt - 10 Tineto May Time to Mauro Yerve of US Troy Scouts Veld Curve of US Treature Time to Economic Forcester predict that the rate of sont roky 2% per year induly. The tube to the romanerest rata pad on the Treasury securities navegar mais The Mar Time to our Describe the general shape and expectations reflected by the cure Select from the drop-down menus) The yerde ndicating that norests are expected to be . What would tower of the guy toney say about how the presence of lenders and borrowerstand to affect the shape of the yeke curven part el (Select the best row below.) CA Fotowers of the city relate theory would real ward sloping the recole due to the desire by anderson or formand the desire by business to borrow long term On Folowers of the liquidity preference theory would was that the upward sloping the ofrecurve in the the desire by business to lend short form and the desire by to borroa long term OC Flowers of the preference theory would hele dawdoping hape of the curved to the chie by understoord word and the site bybanenowionym OD. Followers of the liquidity preference theory would state that the upward sking the recurve is due to the core by enters to lend long term and the desire tryburts to borrow short torm .. What would news of the matterson way about the way and demand for impuls versus ayant demand for more gente yait curve inte? (Belt the best wtbok O A. Morogoro hors would we that the dowwwepes due to the that under content condition there are demand for long comfort for such as real nan for short com.cans for Seasonal needs. O Maret cartone would we that the wind to crot under content condition or is geen and for tom loans for home theater for fontem reforma OC. Mare Begretation there would we that the award slope is due to the fact that under current eceranke condition there a war demand for long term kan for toms such a real estate than for who needs OR Martirion he will that I will do the fact that under com estremi continere in greater tentand for shormone trame all fan tulong end Economie trecestora predet that the rate of infeson el hok straty 2% per year hoodetely. The 10 Bestronomical internet resto paid on the Freseryetlen bevry tent matunities The related into the sout Us Treasury londie (Do not inter compounding and round to crea echipe the noi ofered by www Try it only Data BA The real terest rate in each case would decrease by 18. O The rear when he would by 1% OC. The real interest rate in ach case would say the same Click on the conneren order to copy the contents of the datatable below OD. The restere ateinachts would by 15 intot OE The real estate in each case would noase by 1% Nominal rate of Period return eng your tradeganpata which of the following graphe shows the 3 months OA Well Curw of Us, Tray Shooters 10 years 20 years 70 os 19 Done Economic forecasters predict that the rate of inflation will hold steady at 2% per year indefinitely. The table, Treasury securities having different maturities. shows the nominal interest rate paid on the a. The real rate of interest on the 5-year U.S. Treasury bond is % (Do not consider compounding and round to one decimal place.) b. If the nominal rate of interest paid by every Treasury security suddenly dropped by 1% without any change in inflationary expectations, what effect, if any. would this have on your answers in part a? (Select the best answer below.) A. The real interest rate in each case would decrease by 1%. B. The real interest rate in each case would increase by 1% C. The real interest rate in each case would stay the same. D. The real interest rate in each case would decrease by 1% Economic forecasters predict that the rate of inflation will hold steady at 2% per year indefinitely. The table. Treasury securities having different maturities. shows the nominal interest rate paid on the OD. The real interest rate in each case would decrease by 1% O E. The real interest rate in each case would increase by 1% c. Using your findings in part a, which of the following graphs shows the appropriate yield curve for the U.S. Treasury securities in the table? (Select the best answer below.) OA OB. Yield Curve of U.S. Treasury Securities a Q Yield Curve of US Treasury Securities Economie komentare predict that the rate of intent tok lasty w 2% per your definitely. The tour taroni interest rate pad on he mayor any alteret maturile Using you findings n perta, which of the following graphs shows the apropale vied curve for the US, Tromsury Securities in the table? Select the best rower Deko) OA Wild Card UST Securifica Vield Curse of us. Tasury Securi o Volt - 10 Tineto May Time to Mauro Yerve of US Troy Scouts Veld Curve of US Treature Time to Economic Forcester predict that the rate of sont roky 2% per year induly. The tube to the romanerest rata pad on the Treasury securities navegar mais The Mar Time to our Describe the general shape and expectations reflected by the cure Select from the drop-down menus) The yerde ndicating that norests are expected to be . What would tower of the guy toney say about how the presence of lenders and borrowerstand to affect the shape of the yeke curven part el (Select the best row below.) CA Fotowers of the city relate theory would real ward sloping the recole due to the desire by anderson or formand the desire by business to borrow long term On Folowers of the liquidity preference theory would was that the upward sloping the ofrecurve in the the desire by business to lend short form and the desire by to borroa long term OC Flowers of the preference theory would hele dawdoping hape of the curved to the chie by understoord word and the site bybanenowionym OD. Followers of the liquidity preference theory would state that the upward sking the recurve is due to the core by enters to lend long term and the desire tryburts to borrow short torm .. What would news of the matterson way about the way and demand for impuls versus ayant demand for more gente yait curve inte? (Belt the best wtbok O A. Morogoro hors would we that the dowwwepes due to the that under content condition there are demand for long comfort for such as real nan for short com.cans for Seasonal needs. O Maret cartone would we that the wind to crot under content condition or is geen and for tom loans for home theater for fontem reforma OC. Mare Begretation there would we that the award slope is due to the fact that under current eceranke condition there a war demand for long term kan for toms such a real estate than for who needs OR Martirion he will that I will do the fact that under com estremi continere in greater tentand for shormone trame all fan tulong end Economie trecestora predet that the rate of infeson el hok straty 2% per year hoodetely. The 10 Bestronomical internet resto paid on the Freseryetlen bevry tent matunities The related into the sout Us Treasury londie (Do not inter compounding and round to crea echipe the noi ofered by www Try it only Data BA The real terest rate in each case would decrease by 18. O The rear when he would by 1% OC. The real interest rate in ach case would say the same Click on the conneren order to copy the contents of the datatable below OD. The restere ateinachts would by 15 intot OE The real estate in each case would noase by 1% Nominal rate of Period return eng your tradeganpata which of the following graphe shows the 3 months OA Well Curw of Us, Tray Shooters 10 years 20 years 70 os 19 Done