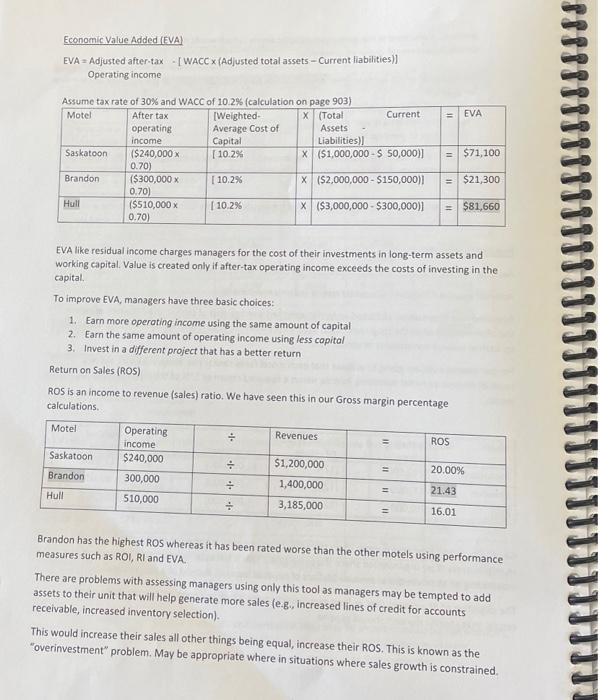

Economic Value Added [EVA] EVA= Adjusted after-tax - [ WACC x (Adjusted total assets - Current liabilities)] Operating income EVA like residual income charges managers for the cost of their investments in long-term assets and working capital. Value is created only if after-tax operating income exceeds the costs of investing in the capital. To improve EVA, managers have three basic choices: 1. Earn more operoting income using the same amount of capital 2. Earn the same amount of operating income using less copital 3. Invest in a different project that has a better return Return on Sales (ROS) ROS is an income to revenue (sales) ratio. We have seen this in our Gross margin percentage calculations. Brandon has the highest ROS whereas it has been rated worse than the other motels using performance measures such as ROI, RI and EVA. There are problems with assessing managers using only this tool as managers may be tempted to add assets to their unit that will heip generate more sales (e.g., increased lines of credit for accounts receivable, increased inventory selection). This would increase their sales all other things being equal, increase their ROS. This is known as the "overinvestment" problem. May be appropriate where in situations where sales growth is constrained Economic Value Added [EVA] EVA= Adjusted after-tax - [ WACC x (Adjusted total assets - Current liabilities)] Operating income EVA like residual income charges managers for the cost of their investments in long-term assets and working capital. Value is created only if after-tax operating income exceeds the costs of investing in the capital. To improve EVA, managers have three basic choices: 1. Earn more operoting income using the same amount of capital 2. Earn the same amount of operating income using less copital 3. Invest in a different project that has a better return Return on Sales (ROS) ROS is an income to revenue (sales) ratio. We have seen this in our Gross margin percentage calculations. Brandon has the highest ROS whereas it has been rated worse than the other motels using performance measures such as ROI, RI and EVA. There are problems with assessing managers using only this tool as managers may be tempted to add assets to their unit that will heip generate more sales (e.g., increased lines of credit for accounts receivable, increased inventory selection). This would increase their sales all other things being equal, increase their ROS. This is known as the "overinvestment" problem. May be appropriate where in situations where sales growth is constrained