Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bob and a Negative Income Tax Assume that Bob's wage rate is WB = $10 per hour. Suppose that utility is a function of

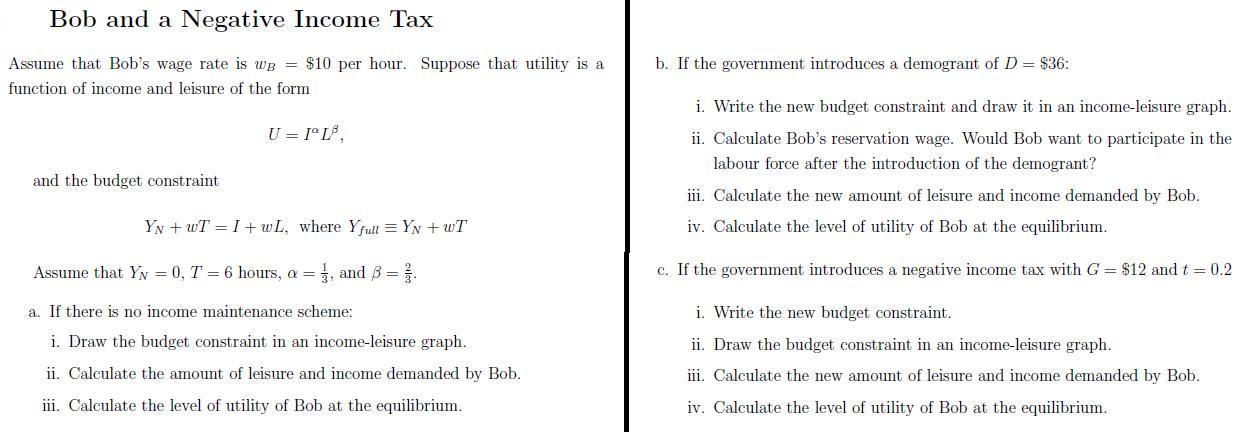

Bob and a Negative Income Tax Assume that Bob's wage rate is WB = $10 per hour. Suppose that utility is a function of income and leisure of the form and the budget constraint U = 1 1, YN +wTI+wL, where Yfull = YN + WT Assume that YN = 0, T = 6 hours, a = 1, and 3 = . a. If there is no income maintenance scheme: i. Draw the budget constraint in an income-leisure graph. ii. Calculate the amount of leisure and income demanded by Bob. iii. Calculate the level of utility of Bob at the equilibrium. b. If the government introduces a demogrant of D = $36: i. Write the new budget constraint and draw it in an income-leisure graph. ii. Calculate Bob's reservation wage. Would Bob want to participate in the labour force after the introduction of the demogrant? iii. Calculate the new amount of leisure and income demanded by Bob. iv. Calculate the level of utility of Bob at the equilibrium. c. If the government introduces a negative income tax with G = $12 and t = 0.2 i. Write the new budget constraint. ii. Draw the budget constraint in an income-leisure graph. iii. Calculate the new amount of leisure and income demanded by Bob. iv. Calculate the level of utility of Bob at the equilibrium.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a If there is no income maintenance scheme i Draw the budget constraint in an incomeleisure graph The budget constraint can be drawn as a l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started