Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Risk Averse Entrepreneur. You have programmed a new messaging app, whose value q + X depends on its quality q and its market

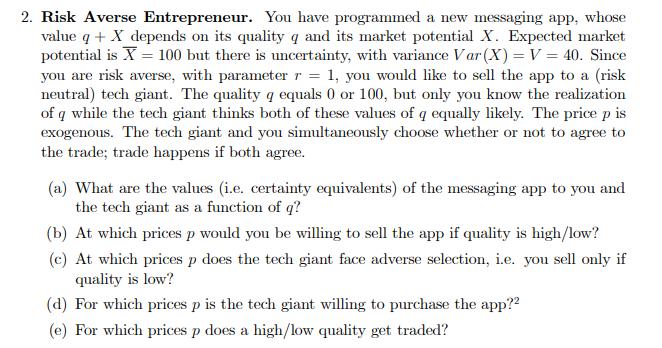

2. Risk Averse Entrepreneur. You have programmed a new messaging app, whose value q + X depends on its quality q and its market potential X. Expected market potential is X = 100 but there is uncertainty, with variance Var (X) = V = 40. Since you are risk averse, with parameter r= 1, you would like to sell the app to a (risk neutral) tech giant. The quality q equals 0 or 100, but only you know the realization of q while the tech giant thinks both of these values of q equally likely. The price p is exogenous. The tech giant and you simultaneously choose whether or not to agree to the trade; trade happens if both agree. (a) What are the values (i.e. certainty equivalents) of the messaging app to you and the tech giant as a function of q? (b) At which prices p would you be willing to sell the app if quality is high/low? (c) At which prices p does the tech giant face adverse selection, i.e. you sell only if quality is low? (d) For which prices p is the tech giant willing to purchase the app? (e) For which prices p does a high/low quality get traded?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The value of the messaging app to the entrepreneur is CEq q X The value of the messaging app to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started