Answered step by step

Verified Expert Solution

Question

1 Approved Answer

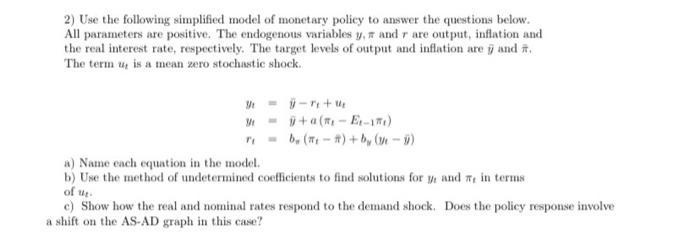

2) Use the following simplified model of monetary policy to answer the questions below. All parameters are positive. The endogenous variables y, a and

2) Use the following simplified model of monetary policy to answer the questions below. All parameters are positive. The endogenous variables y, a and r are output, inflation and the real interest rate, respectively. The target levels of output and inflation are and . The term u, is a mean zero stochastic shock. Yt -re+u +a(m-Et-1) b. (-)+by (-9) a) Name each equation in the model. b) Use the method of undetermined coefficients to find solutions for y. and #, in terms of t c) Show how the real and nominal rates respond to the demand shock. Does the policy response involve a shift on the AS-AD graph in this case? 3) For the problem above, use a graph of AS-AD to show the impact of a positive demand shock u > 0 a high b, versus a low be, assuming both are positive. 1) For the solution to the SMM in the test given by (7) and (8) a) show how the nominal rate is responds to the shock What doen it mean if the sign on the shock for the mal rate is different than that for the nominal cate? b) Use a graph of AS-AD to explain how a negative supply shock y 0 a high b, versus a low . aming both are positive. -$-+w +(-E-15)+1 4+ (-)+(-9) le expectations be static so Ert. The parameters take the values 3.0, =20025 -1.5, -0.5. The period 1 shocks are s-0 and -1, the period 0 values of output and inflation are at their respective natural rates, the period 0 real interest rate ry 6, and all succeeding shocks are ato. Find the values of the endogenous variables .. al ry for the next 5 periods Draw the resulting impulse response functions for .. and 5) For the following model let expectations be static so E Asume the monetary authority sets a fand interest rate f Show the derivation of the difference equation (9). What is the long run behavice of , assuming that a>. Show that if and compute .. or te the results about difference equations in Appendix B. Bos Find a condition for stability asuming adaptive expectations of the form E-(1-1-1+ where the parameter 10, 11 represents the gain, meaning the degree to which agents we new information to update their expectations. See Howitt (1992) for a more general model 6) For the model -+*(--) 7b (1-2) where the last equation represents a Taylor Rule, and expectations are static so E- Let the target inflation rate be aro #0 Find a condition for long run convergence of inflation by solving for a difference equation (see Appendix on difference equations?)

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The MP curve is shifted downlowering the real interest rates Explanation Low...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started