Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Economics 2298 ASG #1 Present Value and Future Value of Annuities Spring 2024 Imagine you are a financial advisor to Valerie VanNess. Ms. VanNess

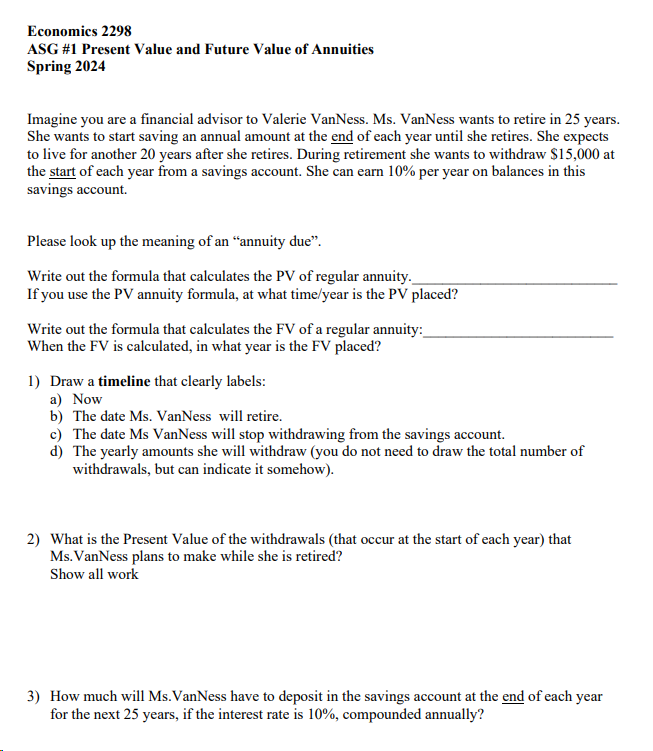

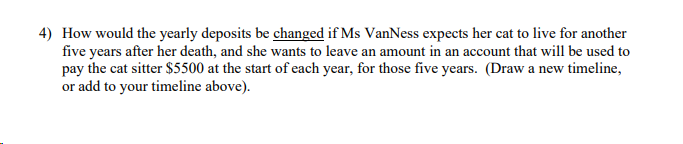

Economics 2298 ASG #1 Present Value and Future Value of Annuities Spring 2024 Imagine you are a financial advisor to Valerie VanNess. Ms. VanNess wants to retire in 25 years. She wants to start saving an annual amount at the end of each year until she retires. She expects to live for another 20 years after she retires. During retirement she wants to withdraw $15,000 at the start of each year from a savings account. She can earn 10% per year on balances in this savings account. Please look up the meaning of an "annuity due". Write out the formula that calculates the PV of regular annuity._ If you use the PV annuity formula, at what time/year is the PV placed? Write out the formula that calculates the FV of a regular annuity: When the FV is calculated, in what year is the FV placed? 1) Draw a timeline that clearly labels: a) Now b) The date Ms. VanNess will retire. c) The date Ms Van Ness will stop withdrawing from the savings account. d) The yearly amounts she will withdraw (you do not need to draw the total number of withdrawals, but can indicate it somehow). 2) What is the Present Value of the withdrawals (that occur at the start of each year) that Ms. VanNess plans to make while she is retired? Show all work 3) How much will Ms. VanNess have to deposit in the savings account at the end of each year for the next 25 years, if the interest rate is 10%, compounded annually? 4) How would the yearly deposits be changed if Ms VanNess expects her cat to live for another five years after her death, and she wants to leave an amount in an account that will be used to pay the cat sitter $5500 at the start of each year, for those five years. (Draw a new timeline, or add to your timeline above).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

An annuity due is a type of annuity in which the payments are made at the beginning of each period rather than at the end as in an ordinary annuity The formula that calculates the present value PV of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started