Answered step by step

Verified Expert Solution

Question

1 Approved Answer

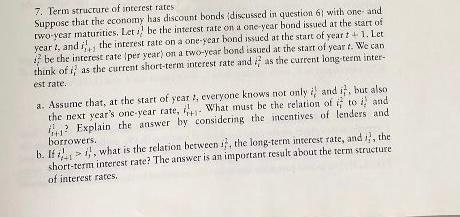

7. Term structure of interest rates Suppose that the economy has discount bonds (discussed in question 6) with one and two-year maturities. Let be

7. Term structure of interest rates Suppose that the economy has discount bonds (discussed in question 6) with one and two-year maturities. Let be the interest rate on a one-year bond issued at the start of year 1, and the interest rate on a one-year bond issued at the start of year t+1. Let be the interest rate (per year) on a two-year bond issued at the start of year t. We can think of i as the current short-term interest rate and as the current long-term inter- est rate. a. Assume that, at the start of year 1, everyone knows not only and it, but also the next year's one-year rate, What must be the relation of i to i and S45 Explain the answer by considering the incentives of lenders and borrowers. b. If , what is the relation between it, the long-term interest rate, and ), the short-term interest rate? The answer is an important result about the term structure of interest rates. Economic Fluctuations c. How would the results change if we assumed, more realistically, that there was un- certainty in yeart about the future one-year interest rate, i? the credit

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER From the given data as followed by Now we have to consider that the data as We know that a P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started