Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company purchased two new trucks for a total of $250,000 on January 1, 2018. The company paid $40,000 cash and signed a $210,000,

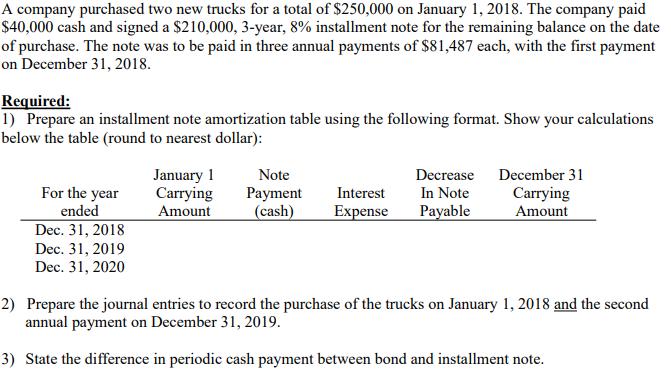

A company purchased two new trucks for a total of $250,000 on January 1, 2018. The company paid $40,000 cash and signed a $210,000, 3-year, 8% installment note for the remaining balance on the date of purchase. The note was to be paid in three annual payments of $81,487 each, with the first payment on December 31, 2018. Required: 1) Prepare an installment note amortization table using the following format. Show your calculations below the table (round to nearest dollar): For the year ended Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2020 Decrease In Note January 1 Note Carrying Payment Interest Amount (cash) Expense Payable December 31 Carrying Amount 2) Prepare the journal entries to record the purchase of the trucks on January 1, 2018 and the second annual payment on December 31, 2019. 3) State the difference in periodic cash payment between bond and installment note.

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

PART 1 INSTALLMENT NOTE AMORTISATION TABLE INTEREST AMOUNT INTEREST RATECARRYING AMOUNT ON JAN 1 DEC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started