Question

Ecosneak is a sneaker merchandising company that prides itself on its environmental credentials; it considers sustainability (alongside high quality) to be central to its business

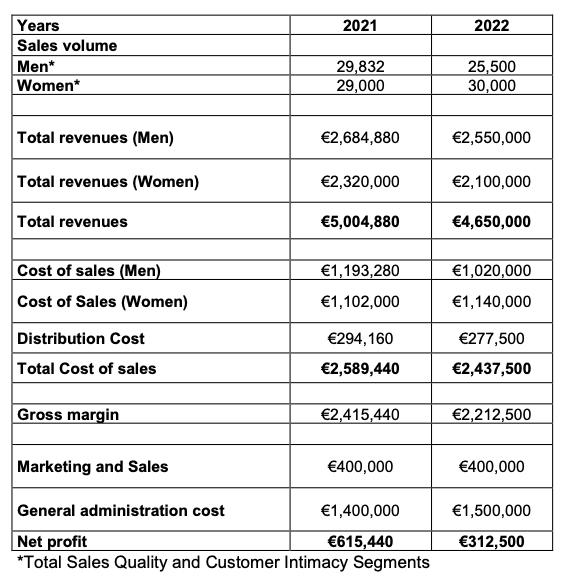

Ecosneak is a sneaker merchandising company that prides itself on its environmental credentials; it considers sustainability (alongside high quality) to be central to its business model. The company started operating three years ago in the Edinburgh market; from the start its strategy was to target the higher end of the market – the ‘quality’ and ‘customer intimacy’ segments - in both the men’s and women’s markets. Ecosneak was set up two sisters – Jenny and Jess Wilson; Jenny is responsible for purchasing and inventory management, while Jess looks after marketing; a year ago they recruited a former university friend of theirs, John Moto, to focus on financial matters and he is now a key part of the business, particularly as Stride has been facing more intense competition over the last year or so. John has consequently been asked to review the company’s financial position in 2021 and 2022 (presented in Tables 1, 2 & 3) prior to analysing the impact of a range of possible decisions on revenues and profits.

Table 1: Sales, Revenue and Cost Data for Ecosneak (2021 and 2022)

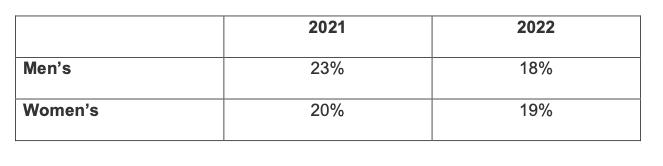

Table 2: Selling Prices and Variable Costs

Table 3: Ecosneak’s Share of Total Market (Quality + Customer Intimacy)

Investment Options

Jenny has begun to wonder whether the company can fight off this competitive threat or whether it is time to rethink its entire business strategy. One option that John would like the others to consider is whether the company should expand into the Kid’s market (targeting both quality and customer intimacy segments). However, this option has so not far seemed particularly attractive to Jenny, who feels that the company has little knowledge of the sorts of sneakers that kids might like and that Ecosneak has insufficient resources to expand without increasing borrowing.

In order to decide on the company’s strategy over the next six years, John commissioned some background research a few months ago from a consultancy company. On the basis of this he has attempted to define and quantify the possible outcomes from the following two (mutually-exclusive) options:

Focus on R&D to improve product quality

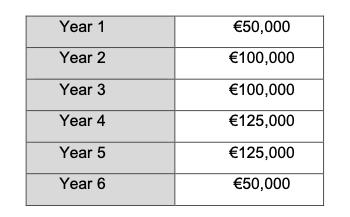

This is Jenny’s preferred option. It would require a €300,000 up-front initial expenditure in 2023. John has estimated (based largely on past experience, one would have to say) that this is expected capture increased market share in men’s and women’s market and will result in additional annual net profits for Ecosneak over the six-year period (from 2024) as follows:

Expansion into the Kid’s market

This option is favoured by John, but appears more risky, because as far as Ecosneak is concerned, the market is untested and there are a number of rival firms already operating in the segment. Nevertheless, there is potential growth in the market and it offers a route to expansion for the company. It would require investing €170,000 in 2023 in additional warehouse capacity and other fixed assets. John believes that the company could capture 10% of the kid’s market each year from 2024 (total market size currently amounts to 50,000 pairs of sneakers annually). Each pair of kid’s sneakers is estimated to generate a net profit of €10. (Assume that this will have no impact on company sales in the men’s and women’s markets which will remain at current levels, as will all other costs). The overall kid’s market will grow by 5% per year over the six-year planning period.

Q2. Investment Options

Decide whether to invest in R&D or to expand into the kid’s sneaker market.

2.1 Calculate the payback period for each option and suggest which should be chosen by Ecosneak. Make sure you explain to the management team both the shortcomings of the payback method and its strengths.

2.2 Calculate the Net Present Value (NPV) for each option. Which option would you recommend Ecosneak should choose giving your reasons. Use a cost of capital of 8% for the option of R&D investment) and 9% for expansion into the kid’s market (as it is perceived to be riskier).

2.3 Explain, in principle, the approach you would use to calculate the Internal Rate of Return (IRR) of a project/option. Illustrate this by calculating the IRR of the R&D option.

2.4 Write a brief report for Ecosneak summarising your findings and offering advice on the best investment option for them to choose. Apart from the results you have calculated, are there any other factors you might consider?

Years Sales volume Men* Women* Total revenues (Men) Total revenues (Women) Total revenues Cost of sales (Men) Cost of Sales (Women) Distribution Cost Total Cost of sales Gross margin Marketing and Sales 2021 29,832 29,000 2,684,880 2,320,000 5,004,880 1,193,280 1,102,000 294,160 2,589,440 2,415,440 400,000 General administration cost Net profit *Total Sales Quality and Customer Intimacy Segments 1,400,000 615,440 2022 25,500 30,000 2,550,000 2,100,000 4,650,000 1,020,000 1,140,000 277,500 2,437,500 2,212,500 400,000 1,500,000 312,500 Years Sales volume Men* Women* Total revenues (Men) Total revenues (Women) Total revenues Cost of sales (Men) Cost of Sales (Women) Distribution Cost Total Cost of sales Gross margin Marketing and Sales 2021 29,832 29,000 2,684,880 2,320,000 5,004,880 1,193,280 1,102,000 294,160 2,589,440 2,415,440 400,000 General administration cost Net profit *Total Sales Quality and Customer Intimacy Segments 1,400,000 615,440 2022 25,500 30,000 2,550,000 2,100,000 4,650,000 1,020,000 1,140,000 277,500 2,437,500 2,212,500 400,000 1,500,000 312,500

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Question Solution to 22 Following Table is showing the calculation of NPV of both the options Option of R D Expansion in Kids Market Particulars Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started