Answered step by step

Verified Expert Solution

Question

1 Approved Answer

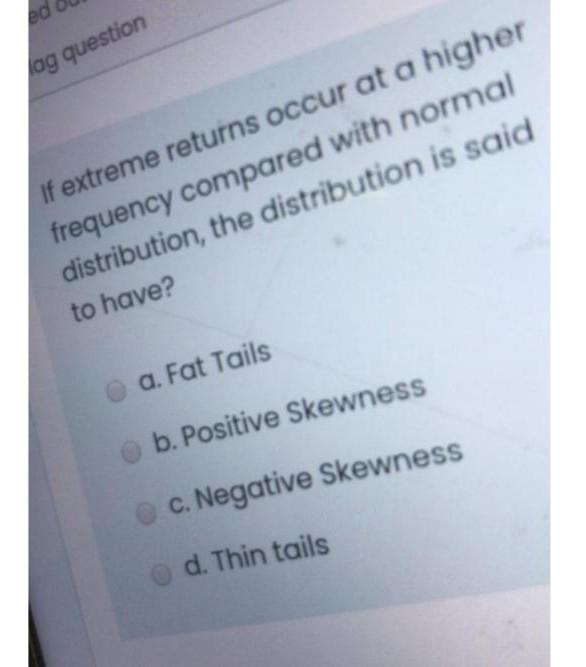

ed lag question If extreme returns occur at a higher frequency compared with normal distribution, the distribution is said to have? a. Fat Tails b.

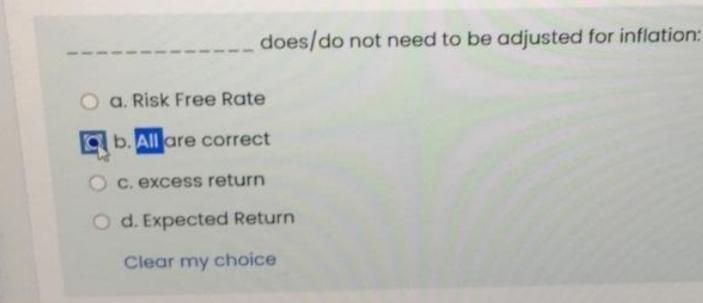

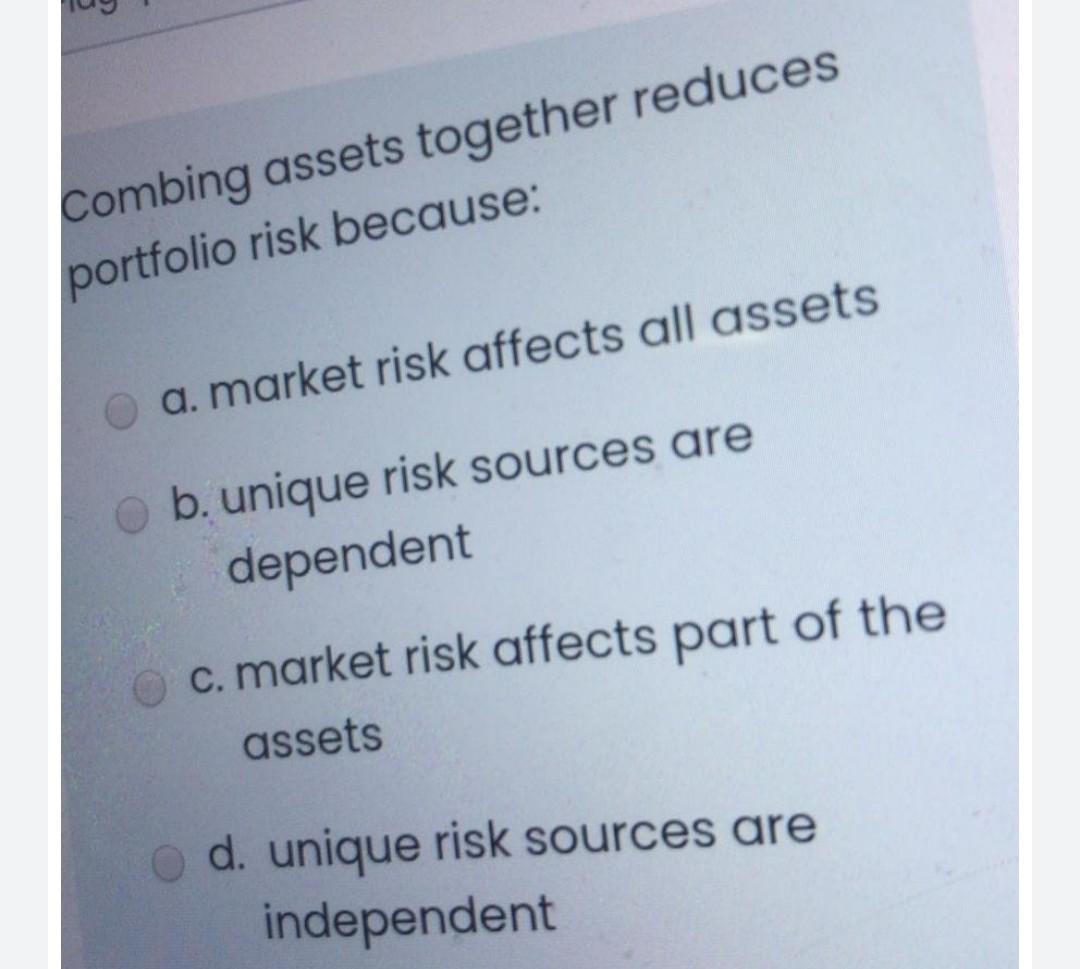

ed lag question If extreme returns occur at a higher frequency compared with normal distribution, the distribution is said to have? a. Fat Tails b. Positive Skewness c. Negative Skewness d. Thin tails does/do not need to be adjusted for inflation: a. Risk Free Rate ab. All are correct c. excess return O d. Expected Return Clear my choice Combing assets together reduces portfolio risk because: a. market risk affects all assets b. unique risk sources are dependent c. market risk affects part of the assets d. unique risk sources are independent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started