Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eddy Co. acquired 100% of the common stock of Fisher Co. on 1/1/20X1 for $705,600 in cash. As of that date, Fisher had the following

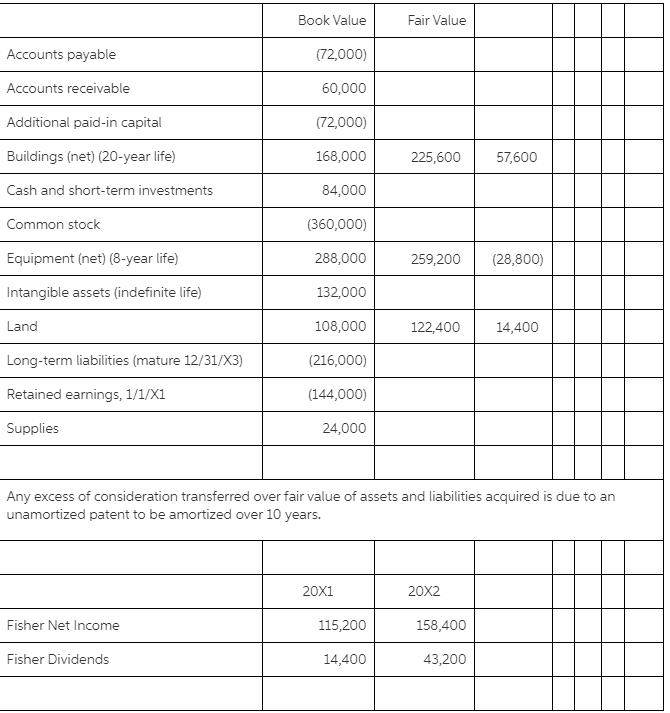

Eddy Co. acquired 100% of the common stock of Fisher Co. on 1/1/20X1 for $705,600 in cash. As of that date, Fisher had the following book values and fair values (negative means credit balance):

Answer the following questions assuming Eddy decided to use the equity method for this investment and Fisher maintains separate incorporation.

1. Prepare an allocation schedule.

2. Prepare all equity method entries and consolidation entries for 20X2!!! (keep in mind activity that happened in year X1)

Book Value Fair Value Accounts payable (72,000) Accounts receivable 60,000 Additional paid-in capital (72,000) Buildings (net) (20-year life) 168,000 225,600 57,600 Cash and short-term investments 84,000 Common stock (360,000) Equipment (net) (8-year life) 288,000 259,200 (28,800) Intangible assets (indefinite life) 132,000 Land 108,000 122,400 14,400 Long-term liabilities (mature 12/31/X3) (216,000) Retained earnings, 1/1/X1 (144,000) Supplies 24,000 Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years. 20X1 20X2 Fisher Net Income 115,200 158,400 Fisher Dividends 14,400 43,200

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Excess fair value over book value differential Asset Excess value Useful life Depreciation building ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started