Question: EDIT: Can you elaborate on what is not clear? I wrote down the review questions as as took a picture of them with the table

EDIT: Can you elaborate on what is not clear? I wrote down the review questions as as took a picture of them with the table to refer to for answering the questions. It is review questions 3-9, and 14.

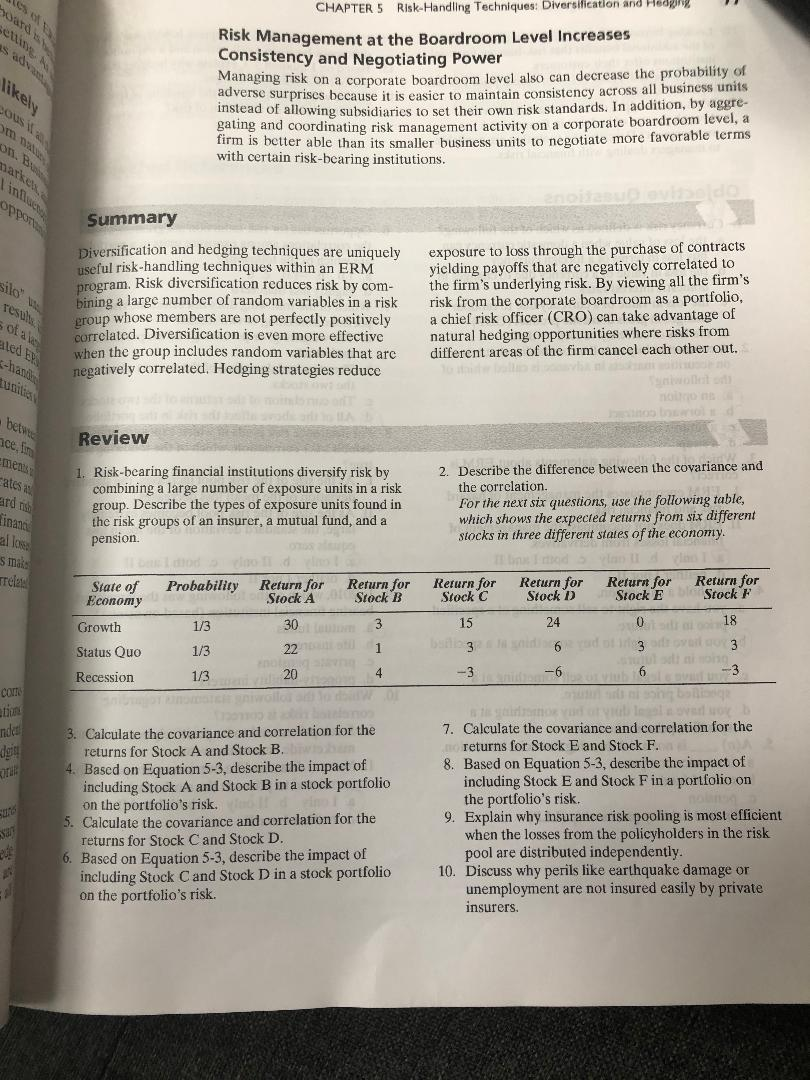

Pictures of questions and table attached.

(Review question 4) Based on the equation 5-3, describe the impact of including stock A and stock B in a stock portfolio on the portfolios risk.

**5-4 equation Var = W1^2 x SD1^2 + W2^2 x SD2^2 + 2 x W1 x W2 x SD1 x SD2 x Corr12

Review question 5) Calculate the covariance and correlation for the returns for stock C and stock D

(Review question 6) Based on the equation 5-3, describe the impact of including stock C and stock D in a stock portfolio on the portfolios risk.

(Review question 7) Calculate the covariance and correlation for the returns for stock E and stock F

Review question 8) Based on the equation 5-3, describe the impact of including stock E and stock F in a stock portfolio on the portfolios risk

Review question 9) Explain why insurance risk pooling is most efficient when the losses from the policy holders in the risk pool are distributed independently

Review question 13) what are the types of loss that are dealt with through the use of hedging in a financial risk management? Describe the tools that are available to managers dealing with financial risks

likely CHAPTER 5 Risk-Handling Techniques: Diversification and Hedge Risk Management at the Boardroom Level Increases Consistency and Negotiating Power Managing risk on a corporate boardroom level also can decrease the probability of adverse surprises because it is easier to maintain consistency across all business units instead of allowing subsidiaries to set their own risk standards. In addition, by aggre- galing and coordinating risk management activity on a corporate boardroom level, a firm is better able than its smaller business units to negotiate more favorable terms with certain risk-bearing institutions. POUS Summary Diversification and hedging techniques are uniquely useful risk-handling techniques within an ERM program, Risk diversification reduces risk hy com- bining a large number of random variables in a risk group whose members are not perfectly positively correlated. Diversification is even more effective when the group includes random variables that are negatively correlated. Hedging strategies reduce Test s of a ated by exposure to loss through the purchase of contracts yielding payoffs that are negatively correlated to the firm's underlying risk. By viewing all the firm's risk from the corporate boardroom as a portfolio, a chief risk officer (CRO) can take advantage of natural hedging opportunities where risks from different areas of the firm cancel each other out. Review - betwo Ice, in emens ates ardi inand 2. Describe the difference between the covariance and the correlation. For the next six questions, use the following table, which shows the expected returns from six different stocks in three different states of the economy. allow Smak relas 1. Risk-bearing financial institutions diversify risk by combining a large number of exposure units in a risk group. Describe the types of exposure units found in the risk groups of an insurer, a mutual fund, and a pension odd State of Probability Return for Return for Economy Stock A Stock B Growth 1/3 30 3 Status Quo 1/3 1 Recession 1/3 20 4 18 22 D3 V6 eta nder 3. Calculate the covariance and correlation for the returns for Stock A and Stock B. 4. Based on Equation 5-3, describe the impact of including Stock A and Stock B in a stock portfolio on the portfolio's risk. 5. Calculate the covariance and correlation for the returns for Stock Cand Stock D. 6. Based on Equation 5-3, describe the impact of including Stock C and Stock D in a stock portfolio on the portfolio's risk. Return for Return for Return for Return for Stock C Stock D Stock E Stock F 15 24 0 6 ador 3 svolge 3 -3 -6 -3 ban Boleslav 7. Calculate the covariance and correlation for the returns for Stock E and Stock F. 8. Based on Equation 5-3, describe the impact of including Stock E and Stock Fin a portfolio on the portfolio's risk. 9. Explain why insurance risk pooling is most efficient when the losses from the policyholders in the risk pool are distributed independently. 10. Discuss why perils like earthquake damage or unemployment are not insured easily by private insurers. likely CHAPTER 5 Risk-Handling Techniques: Diversification and Hedge Risk Management at the Boardroom Level Increases Consistency and Negotiating Power Managing risk on a corporate boardroom level also can decrease the probability of adverse surprises because it is easier to maintain consistency across all business units instead of allowing subsidiaries to set their own risk standards. In addition, by aggre- galing and coordinating risk management activity on a corporate boardroom level, a firm is better able than its smaller business units to negotiate more favorable terms with certain risk-bearing institutions. POUS Summary Diversification and hedging techniques are uniquely useful risk-handling techniques within an ERM program, Risk diversification reduces risk hy com- bining a large number of random variables in a risk group whose members are not perfectly positively correlated. Diversification is even more effective when the group includes random variables that are negatively correlated. Hedging strategies reduce Test s of a ated by exposure to loss through the purchase of contracts yielding payoffs that are negatively correlated to the firm's underlying risk. By viewing all the firm's risk from the corporate boardroom as a portfolio, a chief risk officer (CRO) can take advantage of natural hedging opportunities where risks from different areas of the firm cancel each other out. Review - betwo Ice, in emens ates ardi inand 2. Describe the difference between the covariance and the correlation. For the next six questions, use the following table, which shows the expected returns from six different stocks in three different states of the economy. allow Smak relas 1. Risk-bearing financial institutions diversify risk by combining a large number of exposure units in a risk group. Describe the types of exposure units found in the risk groups of an insurer, a mutual fund, and a pension odd State of Probability Return for Return for Economy Stock A Stock B Growth 1/3 30 3 Status Quo 1/3 1 Recession 1/3 20 4 18 22 D3 V6 eta nder 3. Calculate the covariance and correlation for the returns for Stock A and Stock B. 4. Based on Equation 5-3, describe the impact of including Stock A and Stock B in a stock portfolio on the portfolio's risk. 5. Calculate the covariance and correlation for the returns for Stock Cand Stock D. 6. Based on Equation 5-3, describe the impact of including Stock C and Stock D in a stock portfolio on the portfolio's risk. Return for Return for Return for Return for Stock C Stock D Stock E Stock F 15 24 0 6 ador 3 svolge 3 -3 -6 -3 ban Boleslav 7. Calculate the covariance and correlation for the returns for Stock E and Stock F. 8. Based on Equation 5-3, describe the impact of including Stock E and Stock Fin a portfolio on the portfolio's risk. 9. Explain why insurance risk pooling is most efficient when the losses from the policyholders in the risk pool are distributed independently. 10. Discuss why perils like earthquake damage or unemployment are not insured easily by private insurersStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts