Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Edit: Please do not use Excel as I need to learn to solve without it. thank you. Problem 4 After paying $3 million for a

Edit: Please do not use Excel as I need to learn to solve without it. thank you.

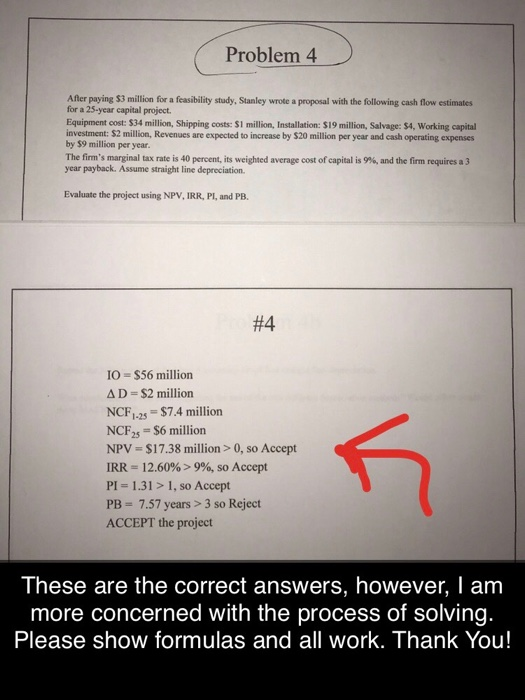

Problem 4 After paying $3 million for a feasibility study, Stanley wrote a proposal with the following cash flow estimates for a 25-year capital project. Equipment cost: $34 million, Shipping costs: $1 million, Installation: S19 million, Salvage: $4, Working capital investment: $2 million, Revenues are expected to increase by $20 million per year and cash operating expenses by $9 million per year. The firm's marginal tax rate is 40 percent, its weighted average cost of capital is 9%, and the firm requires a 3 year payback. Assume straight line depreciation. Evaluate the project using NPV, IRR, PI, and PB. #4 IO = $56 million AD=$2 million NCF-25 = $7.4 million NCF25 = $6 million NPV = $17.38 million > 0, so Accept IRR = 12.60% > 9%, so Accept PI = 1.31 > 1, so Accept PB = 7.57 years > 3 so Reject ACCEPT the project These are the correct answers, however, I am more concerned with the process of solving. Please show formulas and all work. Thank You Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started