Edit: This question can be answered without that information. This was ALL that was given. Possible journal entries: Accumulated depreciation (Bal. Sht) Cash (Bal. Sht)

Edit: This question can be answered without that information. This was ALL that was given.

Possible journal entries:

Accumulated depreciation (Bal. Sht) Cash (Bal. Sht) Deferred rent revenue (Bal. Sht) Equipment (Bal. Sht) Lease payable (Bal. Sht) Lease receivable (Bal. Sht) Note payable (Bal. Sht) Prepaid service contract (Bal. Sht) Right-of-Use asset (Bal. Sht) Warehouse (Bal. Sht) Amortization expense (Inc. Stmt) Cost of goods sold (Inc. Stmt) Gain on sale of warehouse (Inc. Stmt) Interest expense (Inc. Stmt) Interest revenue (Inc. Stmt) Lease expense (Inc. Stmt) Lease revenue (Inc. Stmt) Misc. expenses (Inc. Stmt) Rent revenue (Inc. Stmt) Sales revenue (Inc. Stmt)

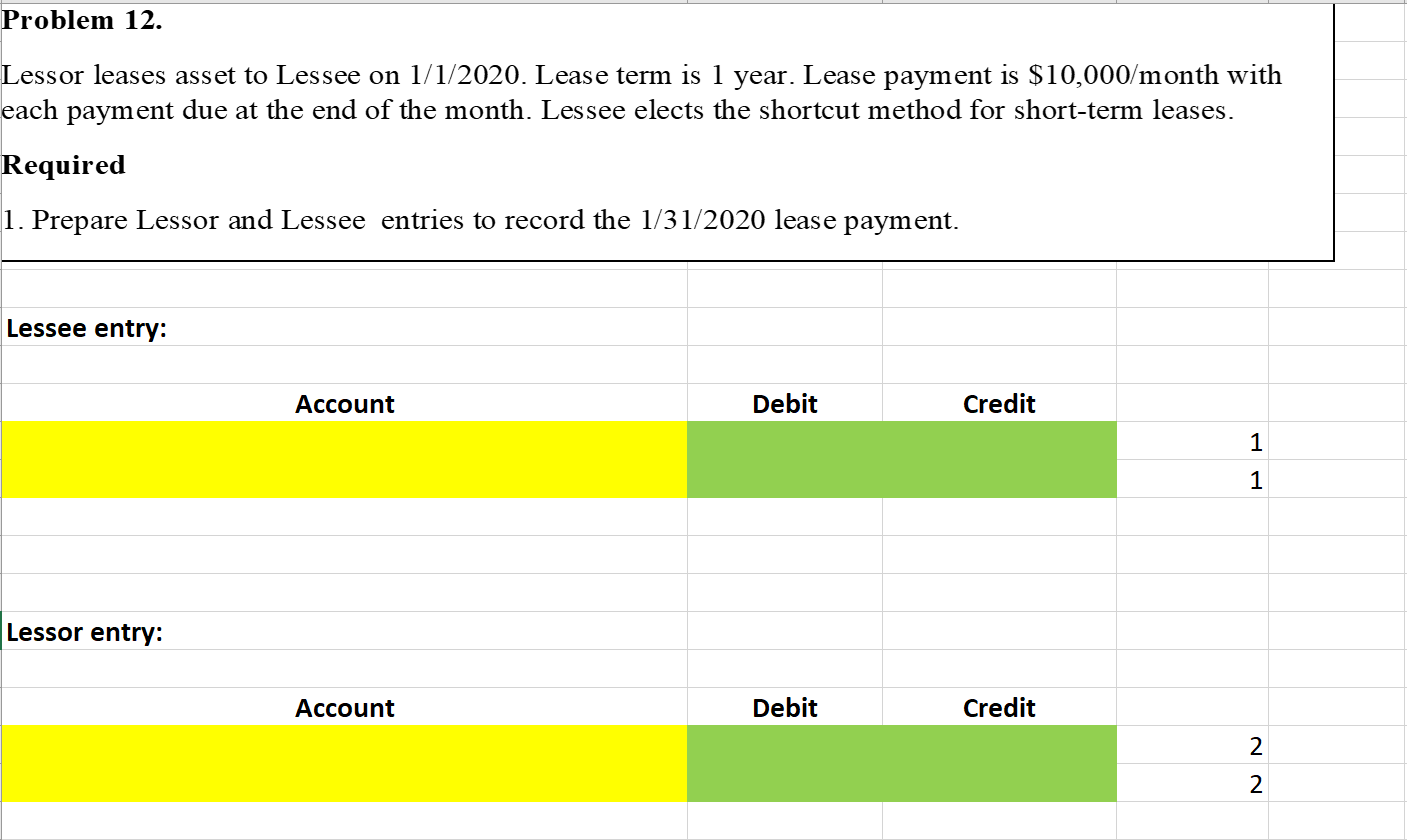

Problem 12. Lessor leases asset to Lessee on 1/1/2020. Lease term is 1 year. Lease payment is $10,000/month with each payment due at the end of the month. Lessee elects the shortcut method for short-term leases. Required 1. Prepare Lessor and Lessee entries to record the 1/31/2020 lease payment. Lessee entry: Account Debit Credit 1 1 Lessor entry: Account Debit Credit 2 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started