Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eduardo Arenas purchased a small retail business on January 1, 2021. The business operates as a proprietorship. The business is run out of rented

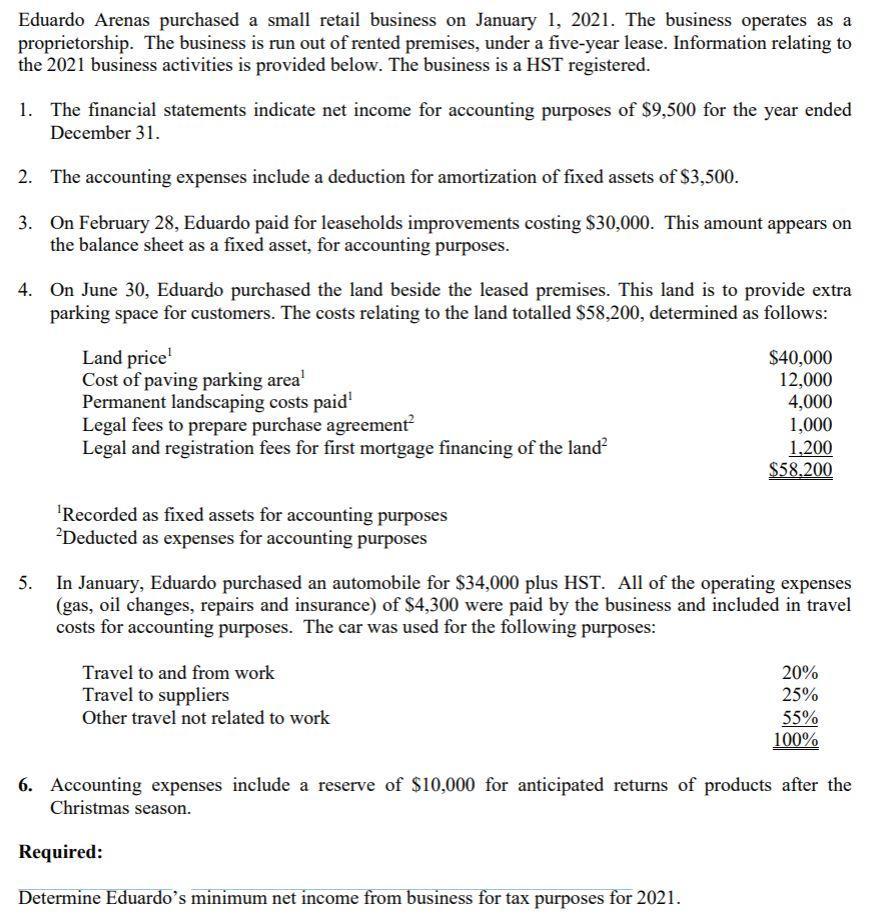

Eduardo Arenas purchased a small retail business on January 1, 2021. The business operates as a proprietorship. The business is run out of rented premises, under a five-year lease. Information relating to the 2021 business activities is provided below. The business is a HST registered. 1. The financial statements indicate net income for accounting purposes of $9,500 for the year ended December 31. 2. The accounting expenses include a deduction for amortization of fixed assets of $3,500. 3. On February 28, Eduardo paid for leaseholds improvements costing $30,000. This amount appears on the balance sheet as a fixed asset, for accounting purposes. 4. On June 30, Eduardo purchased the land beside the leased premises. This land is to provide extra parking space for customers. The costs relating to the land totalled $58,200, determined as follows: Land price' Cost of paving parking area' Permanent landscaping costs paid' Legal fees to prepare purchase agreement Legal and registration fees for first mortgage financing of the land $40,000 12,000 4,000 1,000 1,200 $58.200 'Recorded as fixed assets for accounting purposes 'Deducted as expenses for accounting purposes In January, Eduardo purchased an automobile for $34,000 plus HST. All of the operating expenses (gas, oil changes, repairs and insurance) of $4,300 were paid by the business and included in travel costs for accounting purposes. The car was used for the following purposes: 5. Travel to and from work 20% Travel to suppliers 25% Other travel not related to work 55% 100% 6. Accounting expenses include a reserve of $10,000 for anticipated returns of products after the Christmas season. Required: Determine Eduardo's minimum net income from business for tax purposes for 2021.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Net income Deducation po Fixed asset...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started