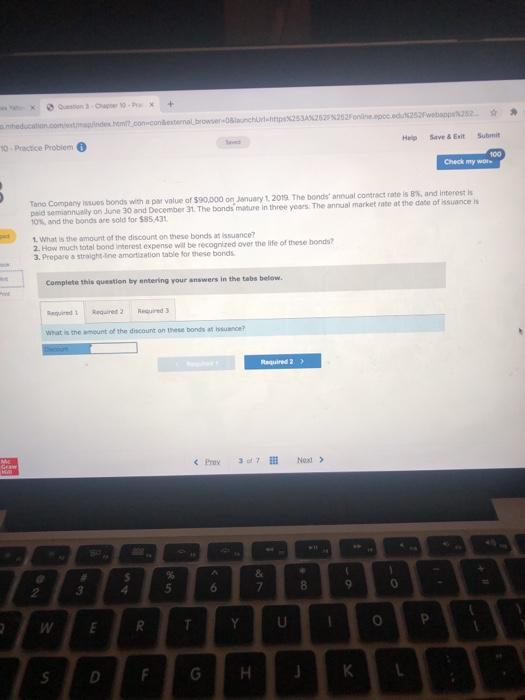

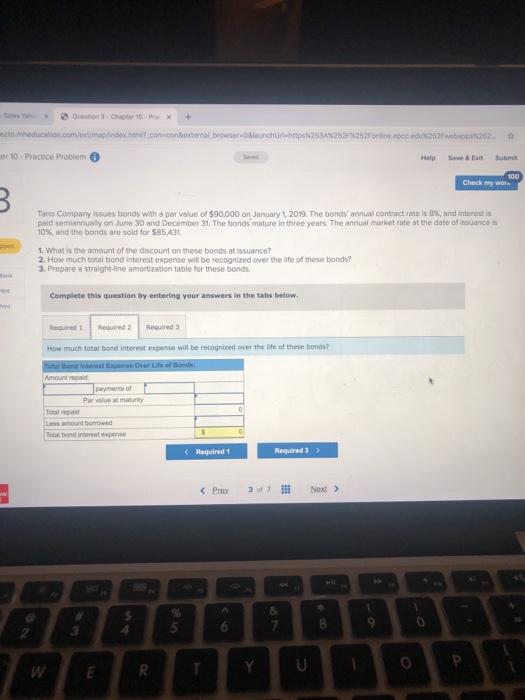

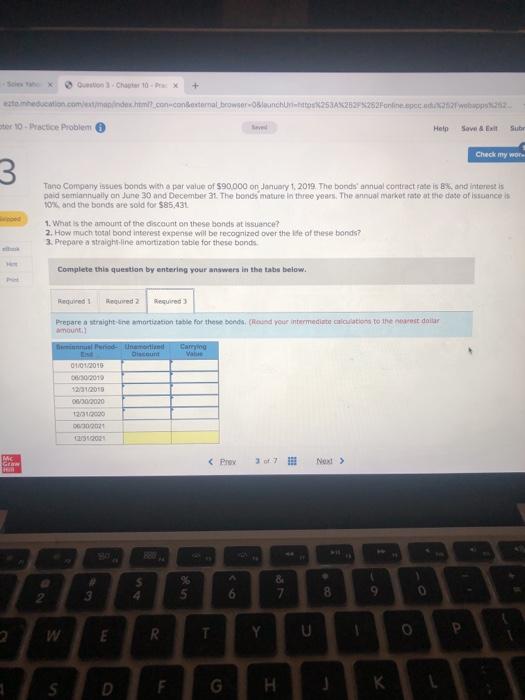

education.com.micooneternal browser-anchor. c.ro Have & Exit Submit 0 Practice Problem 100 Check my wor Tone Company bonds with a par value of $90,000 on January 1 2019. The bonds' annual contractes and interestis paid sually on June 30 and December 31. The band mature in three years. The annual market inte at the date of ances 10and the bonds are sold for 585431 1. What is the amount of the discount on these bonds at sunce? 2. How much total bond interest expense wil be recognized over the life of these bonds? 3. Prepare a straight ne amortization table for these bonds Complete this question by entering your answers in the tabs below. Rouret what is the amount of the discount on the bonde at Ragu? M GE S 4 % 5 & 7 6 8 9 O 2 E P R . Y U F S H . + 25 online web entheducation commande con contextemal blanche 2534 10. Practice Problem Sunt 100 Check my w Tono Company issues bonds with a par value of $90,000 on January 1 2019. The bonds annual contract te is 8%, and interestis paid semiannusly on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of essuance is 10% and the bonds are sold for $85.431 1. What is the amount of the discount on these boods at issuance? 2. How much total bond interest expense will be recognized over the fe of these bands? 3. Prepare a straight-line amortization table for these bonds So Complete this question by entering your answers in the tabs below. Required Recured How much total bod interest expense will be recognized over the life of these bonde? utant des Our Life of Bon Amount road pays of Pavlor Toad swobowe Dotal bod resten Required Required 3 > 0 5 15 7 0 E R Y U + CHU TH V P. theation.com/extmani.html?con.confexternal browser-anchon Set 10 - Practice Probleme 5262 Foliespodoba Hein Sove & Sube Check my wore 3 Tano Company issues bonds with a par value of $90,000 on January 1, 2019. The bonds annual contract rate is 8%, and interestis paid semiannually on June 30 and December 21 The bonds mature to three years. The annual market rate at the date of issuances 10% and the bonds are sold for $85.431 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the fit of these bonds? 3. Prepare a straight line amortization table for these bonds 11 Complete this question by entering your answers in the tabs below. Recured Required 2 Required) Prepare a straight amortization table for these bonds and your intermediate calculations to the nearest dalur mount Caming Valle Discount 01/01/2015 7302019 1231.2010 30/2020 2312000 06730902 Nic G s 4. 3 5. 6 7 8. 0 W E R Y U 0 S. D F G H K education.com.micooneternal browser-anchor. c.ro Have & Exit Submit 0 Practice Problem 100 Check my wor Tone Company bonds with a par value of $90,000 on January 1 2019. The bonds' annual contractes and interestis paid sually on June 30 and December 31. The band mature in three years. The annual market inte at the date of ances 10and the bonds are sold for 585431 1. What is the amount of the discount on these bonds at sunce? 2. How much total bond interest expense wil be recognized over the life of these bonds? 3. Prepare a straight ne amortization table for these bonds Complete this question by entering your answers in the tabs below. Rouret what is the amount of the discount on the bonde at Ragu? M GE S 4 % 5 & 7 6 8 9 O 2 E P R . Y U F S H . + 25 online web entheducation commande con contextemal blanche 2534 10. Practice Problem Sunt 100 Check my w Tono Company issues bonds with a par value of $90,000 on January 1 2019. The bonds annual contract te is 8%, and interestis paid semiannusly on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of essuance is 10% and the bonds are sold for $85.431 1. What is the amount of the discount on these boods at issuance? 2. How much total bond interest expense will be recognized over the fe of these bands? 3. Prepare a straight-line amortization table for these bonds So Complete this question by entering your answers in the tabs below. Required Recured How much total bod interest expense will be recognized over the life of these bonde? utant des Our Life of Bon Amount road pays of Pavlor Toad swobowe Dotal bod resten Required Required 3 > 0 5 15 7 0 E R Y U + CHU TH V P. theation.com/extmani.html?con.confexternal browser-anchon Set 10 - Practice Probleme 5262 Foliespodoba Hein Sove & Sube Check my wore 3 Tano Company issues bonds with a par value of $90,000 on January 1, 2019. The bonds annual contract rate is 8%, and interestis paid semiannually on June 30 and December 21 The bonds mature to three years. The annual market rate at the date of issuances 10% and the bonds are sold for $85.431 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the fit of these bonds? 3. Prepare a straight line amortization table for these bonds 11 Complete this question by entering your answers in the tabs below. Recured Required 2 Required) Prepare a straight amortization table for these bonds and your intermediate calculations to the nearest dalur mount Caming Valle Discount 01/01/2015 7302019 1231.2010 30/2020 2312000 06730902 Nic G s 4. 3 5. 6 7 8. 0 W E R Y U 0 S. D F G H K