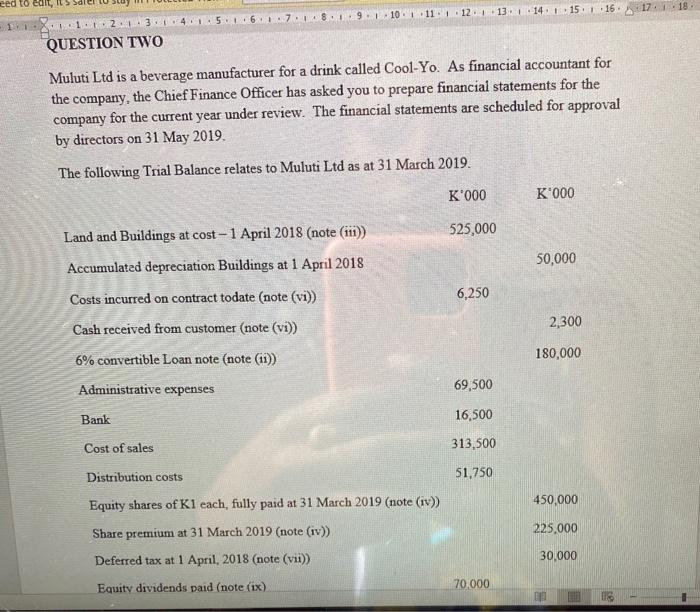

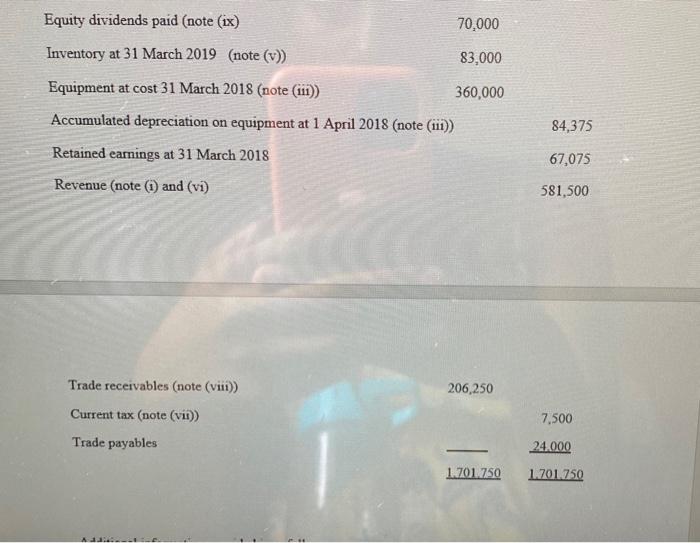

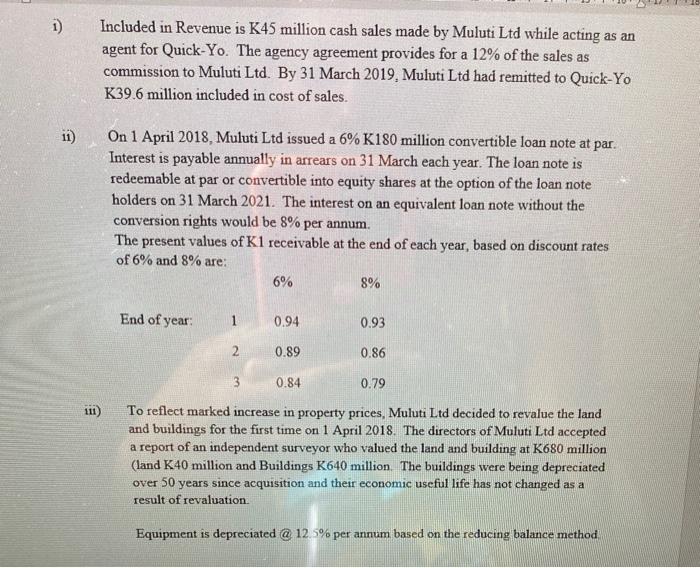

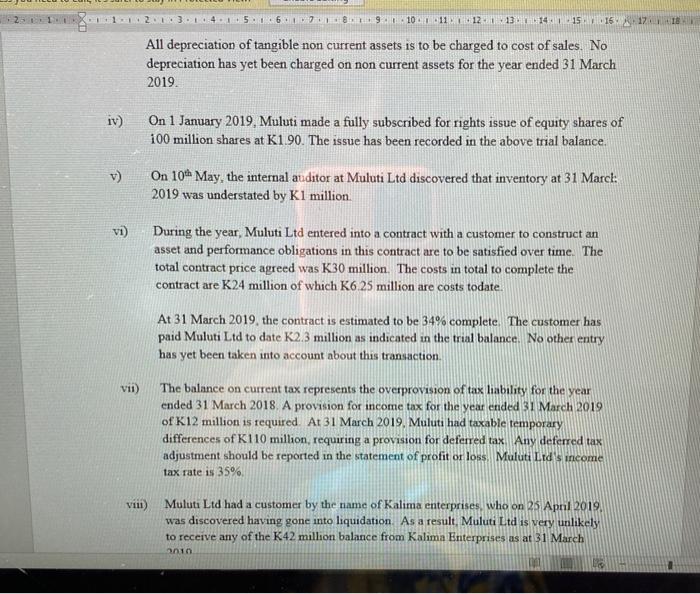

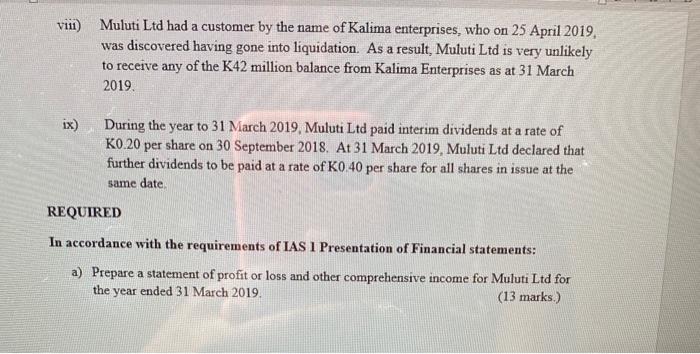

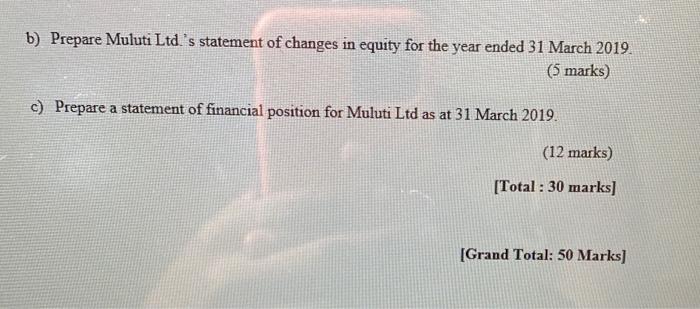

eed to edit, Il Soler 6.7.8.9. 1. 10. 1.11.12 13. 14. 15:1.16. 17.1.18 11.1.2013 QUESTION TWO Muluti Ltd is a beverage manufacturer for a drink called Cool-Yo. As financial accountant for the company, the Chief Finance Officer has asked you to prepare financial statements for the company for the current year under review. The financial statements are scheduled for approval by directors on 31 May 2019. The following Trial Balance relates to Muluti Ltd as at 31 March 2019. K'000 K'000 Land and Buildings at cost - 1 April 2018 (note (111) 525,000 50,000 6,250 Accumulated depreciation Buildings at 1 April 2018 Costs incurred on contract todate (note (vi)) Cash received from customer (note (vi)) 6% convertible Loan note (note (11)) 2,300 180,000 Administrative expenses 69,500 Bank 16,500 Cost of sales 313,500 Distribution costs 51,750 Equity shares of K1 cach, fully paid at 31 March 2019 (note (iv)) 450,000 Share premium at 31 March 2019 (note (iv)) 225.000 Deferred tax at 1 April, 2018 (note (vii)) 30,000 Equity dividends paid (note (ix) 70.000 Equity dividends paid (note (ix) 70,000 Inventory at 31 March 2019 (note (v)) 83,000 Equipment at cost 31 March 2018 (note (111) 360,000 Accumulated depreciation on equipment at 1 April 2018 (note (111)) 84,375 Retained earnings at 31 March 2018 67,075 Revenue (note (1) and (vi) 581,500 206,250 Trade receivables (note (viii)) Current tax (note (vii)) Trade payables 7,500 24.000 1.701.750 1.701.750 A. 1) Included in Revenue is K45 million cash sales made by Muluti Ltd while acting as an agent for Quick-Yo. The agency agreement provides for a 12% of the sales as commission to Muluti Ltd. By 31 March 2019. Muluti Ltd had remitted to Quick-Yo K39.6 million included in cost of sales. 11) On 1 April 2018, Muluti Ltd issued a 6% K180 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2021. The interest on an equivalent loan note without the conversion rights would be 8% per annum. The present values of K1 receivable at the end of each year, based on discount rates of 6% and 8% are: 6% 8% End of year: 1 0.94 0.93 2 0.89 0.86 3 0.84 0.79 111) To reflect marked increase in property prices, Muluti Ltd decided to revalue the land and buildings for the first time on 1 April 2018. The directors of Muluti Ltd accepted a report of an independent surveyor who valued the land and building at K680 million (land K40 million and Buildings K640 million. The buildings were being depreciated over 50 years since acquisition and their economic useful life has not changed as a result of revaluation Equipment is depreciated @ 12.5% per annum based on the reducing balance method 2:12:3.145.0 690 10 11 12 13 14 15 16 17 All depreciation of tangible non current assets is to be charged to cost of sales. No depreciation has yet been charged on non current assets for the year ended 31 March 2019. iv) On 1 January 2019, Muluti made a fully subscribed for rights issue of equity shares of 100 million shares at K1.90. The issue has been recorded in the above trial balance. On 10th May, the internal auditor at Muluti Ltd discovered that inventory at 31 March: 2019 was understated by K1 million vi) During the year, Muluti Ltd entered into a contract with a customer to construct an asset and performance obligations in this contract are to be satisfied over time. The total contract price agreed was K30 million. The costs in total to complete the contract are K24 million of which K6.25 million are costs todate. At 31 March 2019, the contract is estimated to be 34% complete. The customer has paid Muluti Ltd to date K2.3 million as indicated in the trial balance. No other entry has yet been taken into account about this transaction VID) The balance on current tax represents the overprovision of tax liability for the year ended 31 March 2018. A provision for income tax for the year ended 31 March 2019 of K12 million is required At 31 March 2019. Muluti had taxable temporary differences of K110 million, requiring a provision for deferred tax Any deferred tax adjustment should be reported in the statement of profit or loss. Muluti Lid's income tax rate is 35% VIII) Mulut Ltd had a customer by the name of Kalima enterprises, who on 25 April 2019, was discovered having gone into liquidation. As a result, Muluti Ltd is very unlikely to receive any of the K42 million balance from Kalima Enterprises as at 31 March ni viil) Muluti Ltd had a customer by the name of Kalima enterprises, who on 25 April 2019, was discovered having gone into liquidation. As a result, Muluti Ltd is very unlikely to receive any of the K42 million balance from Kalima Enterprises as at 31 March 2019. ix) During the year to 31 March 2019, Muluti Ltd paid interim dividends at a rate of K0.20 per share on 30 September 2018. At 31 March 2019, Muluti Ltd declared that further dividends to be paid at a rate of K0.40 per share for all shares in issue at the same date REQUIRED In accordance with the requirements of IAS 1 Presentation of Financial statements: a) Prepare a statement of profit or loss and other comprehensive income for Muluti Ltd for the year ended 31 March 2019. (13 marks.) b) Prepare Muluti Ltd's statement of changes in equity for the year ended 31 March 2019. (5 marks) c) Prepare a statement of financial position for Muluti Ltd as at 31 March 2019. (12 marks) [Total: 30 marks] [Grand Total: 50 Marks] eed to edit, Il Soler 6.7.8.9. 1. 10. 1.11.12 13. 14. 15:1.16. 17.1.18 11.1.2013 QUESTION TWO Muluti Ltd is a beverage manufacturer for a drink called Cool-Yo. As financial accountant for the company, the Chief Finance Officer has asked you to prepare financial statements for the company for the current year under review. The financial statements are scheduled for approval by directors on 31 May 2019. The following Trial Balance relates to Muluti Ltd as at 31 March 2019. K'000 K'000 Land and Buildings at cost - 1 April 2018 (note (111) 525,000 50,000 6,250 Accumulated depreciation Buildings at 1 April 2018 Costs incurred on contract todate (note (vi)) Cash received from customer (note (vi)) 6% convertible Loan note (note (11)) 2,300 180,000 Administrative expenses 69,500 Bank 16,500 Cost of sales 313,500 Distribution costs 51,750 Equity shares of K1 cach, fully paid at 31 March 2019 (note (iv)) 450,000 Share premium at 31 March 2019 (note (iv)) 225.000 Deferred tax at 1 April, 2018 (note (vii)) 30,000 Equity dividends paid (note (ix) 70.000 Equity dividends paid (note (ix) 70,000 Inventory at 31 March 2019 (note (v)) 83,000 Equipment at cost 31 March 2018 (note (111) 360,000 Accumulated depreciation on equipment at 1 April 2018 (note (111)) 84,375 Retained earnings at 31 March 2018 67,075 Revenue (note (1) and (vi) 581,500 206,250 Trade receivables (note (viii)) Current tax (note (vii)) Trade payables 7,500 24.000 1.701.750 1.701.750 A. 1) Included in Revenue is K45 million cash sales made by Muluti Ltd while acting as an agent for Quick-Yo. The agency agreement provides for a 12% of the sales as commission to Muluti Ltd. By 31 March 2019. Muluti Ltd had remitted to Quick-Yo K39.6 million included in cost of sales. 11) On 1 April 2018, Muluti Ltd issued a 6% K180 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2021. The interest on an equivalent loan note without the conversion rights would be 8% per annum. The present values of K1 receivable at the end of each year, based on discount rates of 6% and 8% are: 6% 8% End of year: 1 0.94 0.93 2 0.89 0.86 3 0.84 0.79 111) To reflect marked increase in property prices, Muluti Ltd decided to revalue the land and buildings for the first time on 1 April 2018. The directors of Muluti Ltd accepted a report of an independent surveyor who valued the land and building at K680 million (land K40 million and Buildings K640 million. The buildings were being depreciated over 50 years since acquisition and their economic useful life has not changed as a result of revaluation Equipment is depreciated @ 12.5% per annum based on the reducing balance method 2:12:3.145.0 690 10 11 12 13 14 15 16 17 All depreciation of tangible non current assets is to be charged to cost of sales. No depreciation has yet been charged on non current assets for the year ended 31 March 2019. iv) On 1 January 2019, Muluti made a fully subscribed for rights issue of equity shares of 100 million shares at K1.90. The issue has been recorded in the above trial balance. On 10th May, the internal auditor at Muluti Ltd discovered that inventory at 31 March: 2019 was understated by K1 million vi) During the year, Muluti Ltd entered into a contract with a customer to construct an asset and performance obligations in this contract are to be satisfied over time. The total contract price agreed was K30 million. The costs in total to complete the contract are K24 million of which K6.25 million are costs todate. At 31 March 2019, the contract is estimated to be 34% complete. The customer has paid Muluti Ltd to date K2.3 million as indicated in the trial balance. No other entry has yet been taken into account about this transaction VID) The balance on current tax represents the overprovision of tax liability for the year ended 31 March 2018. A provision for income tax for the year ended 31 March 2019 of K12 million is required At 31 March 2019. Muluti had taxable temporary differences of K110 million, requiring a provision for deferred tax Any deferred tax adjustment should be reported in the statement of profit or loss. Muluti Lid's income tax rate is 35% VIII) Mulut Ltd had a customer by the name of Kalima enterprises, who on 25 April 2019, was discovered having gone into liquidation. As a result, Muluti Ltd is very unlikely to receive any of the K42 million balance from Kalima Enterprises as at 31 March ni viil) Muluti Ltd had a customer by the name of Kalima enterprises, who on 25 April 2019, was discovered having gone into liquidation. As a result, Muluti Ltd is very unlikely to receive any of the K42 million balance from Kalima Enterprises as at 31 March 2019. ix) During the year to 31 March 2019, Muluti Ltd paid interim dividends at a rate of K0.20 per share on 30 September 2018. At 31 March 2019, Muluti Ltd declared that further dividends to be paid at a rate of K0.40 per share for all shares in issue at the same date REQUIRED In accordance with the requirements of IAS 1 Presentation of Financial statements: a) Prepare a statement of profit or loss and other comprehensive income for Muluti Ltd for the year ended 31 March 2019. (13 marks.) b) Prepare Muluti Ltd's statement of changes in equity for the year ended 31 March 2019. (5 marks) c) Prepare a statement of financial position for Muluti Ltd as at 31 March 2019. (12 marks) [Total: 30 marks] [Grand Total: 50 Marks]