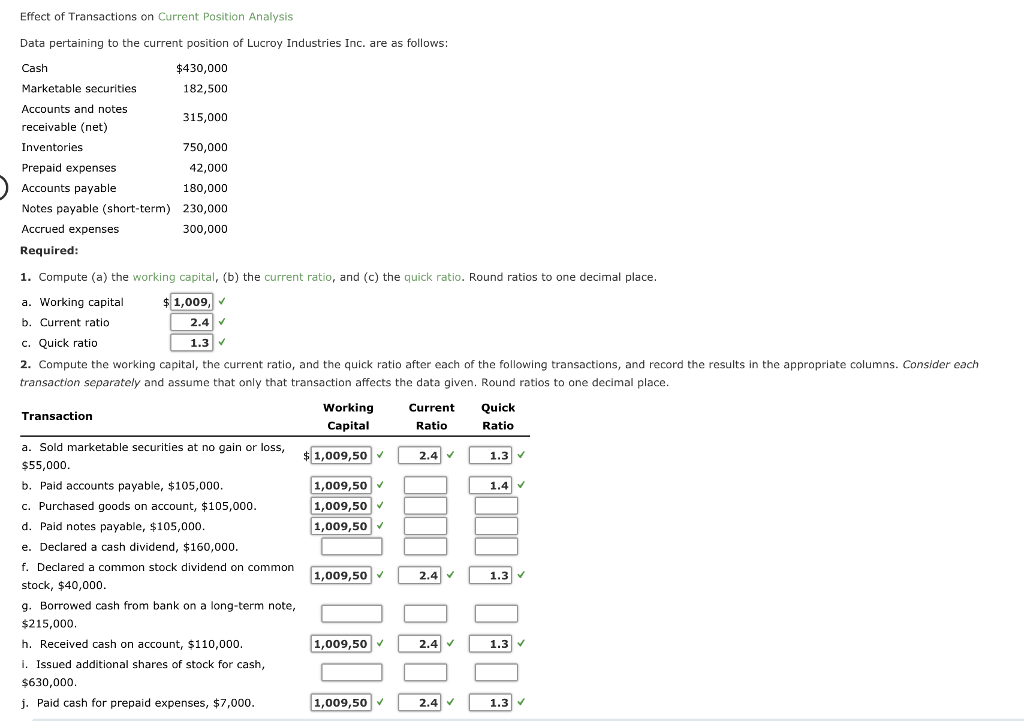

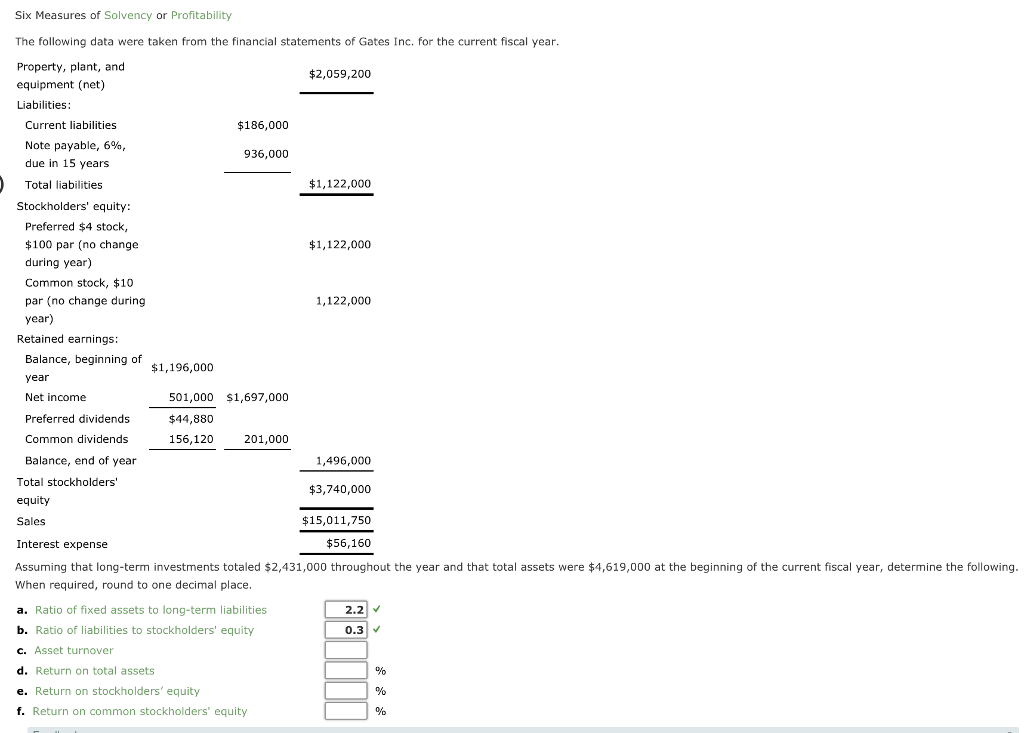

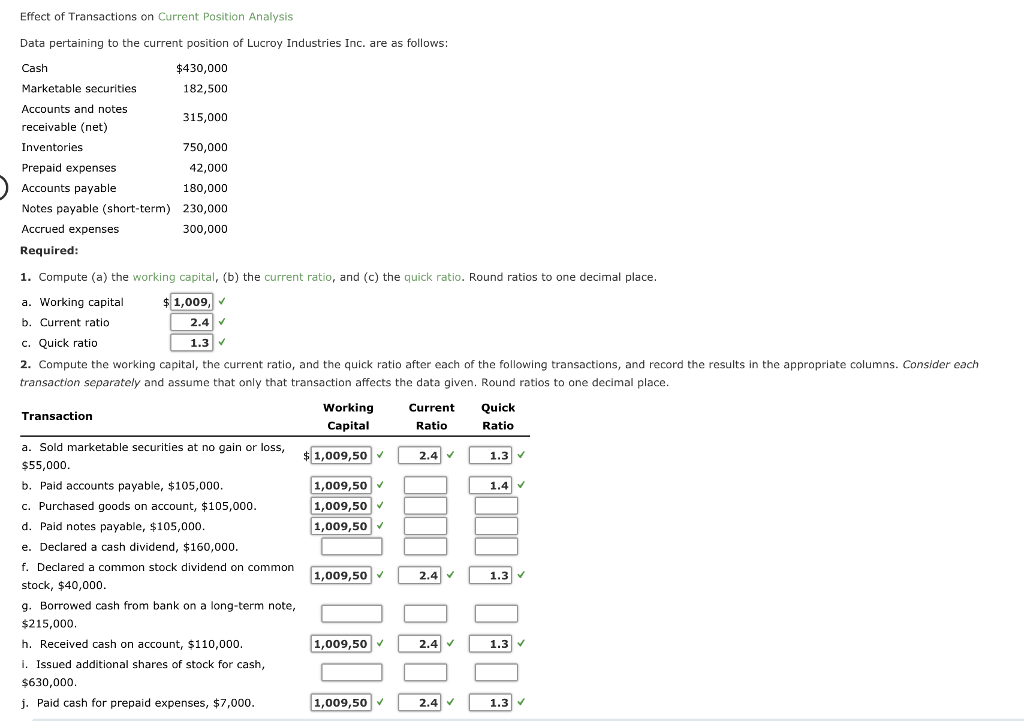

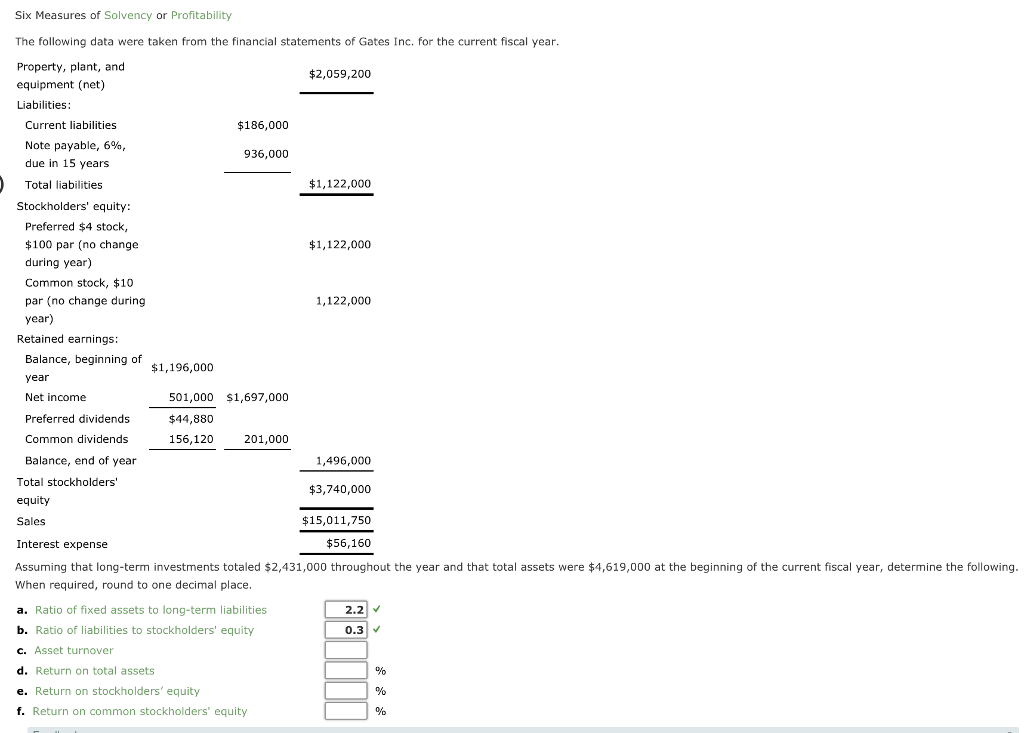

Effect of Transactions on Current Position Analysis Data pertaining to the current position of Lucroy Industries Inc. are as follows: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Accounts payable Notes payable (short-term) 230,000 Accrued expenses Required: 1. Compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. Round ratios to one decimal place a. Working capital b. Current ratio c. Quick ratio 2. Compute the working capital, the current ratio, and the quick ratio after each of the following transactions, and record the results in the appropriate columns. Consider each transaction separately and assume that only that transaction affects the data given. Round ratios to one decimal place $430,000 182,500 315,000 750,000 42,000 180,000 300,000 $1,009, 2.4 V 1.3 Working Current Ratio Quick Ratio Transaction Capital a. Sold marketable securities at no gain or loss $55,000 b. Paid accounts payable, $105,000 c. Purchased goods on account, $105,000 d. Paid notes payable, $105,000 e. Declared a cash dividend, $160,000 f. Declared a common stock dividend on common stock, $40,000 g. Borrowed cash from bank on a long-term note $215,000 h. Received cash on account, $110,000 i. Issued additional shares of stock for cash, $630,000 j. Paid cash for prepaid expenses, $7,000 1,009,50 2.4 1.3 1,009,50 1,009,50 1,009,50 1,009,50 2.4 V 1.3 1,009,50 2.4 V 1.3 1,009,50 2.4 V 1.3 Six Measures of Solvency or Profitability The following data were taken from the financial statements of Gates Inc. for the current fiscal year Property, plant, and equipment (net) Liabilities: $2,059,200 Current liabilities Note payable, 6% due in 15 years Total liabilities $186,000 936,000 $1,122,000 Stockholders' equity Preferred $4 stock $100 par (no change during year) Common stock, $10 par (no change during year) $1,122,000 1,122,000 Retained earnings: Bal lance, beginning of $1,196,000 year Net income 501,000 s1,697,000 $44,880 156,120 Preferred dividends Common dividends 201,000 Balance, end of year Total stockholders' equity Sales Interest expense Assuming that long-term investments totaled $2,431,000 throughout the year and that total assets were $4,619,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity C. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity 1,496,000 $3,740,000 $15,011,750 $56,160 2.2 V 0.3